|

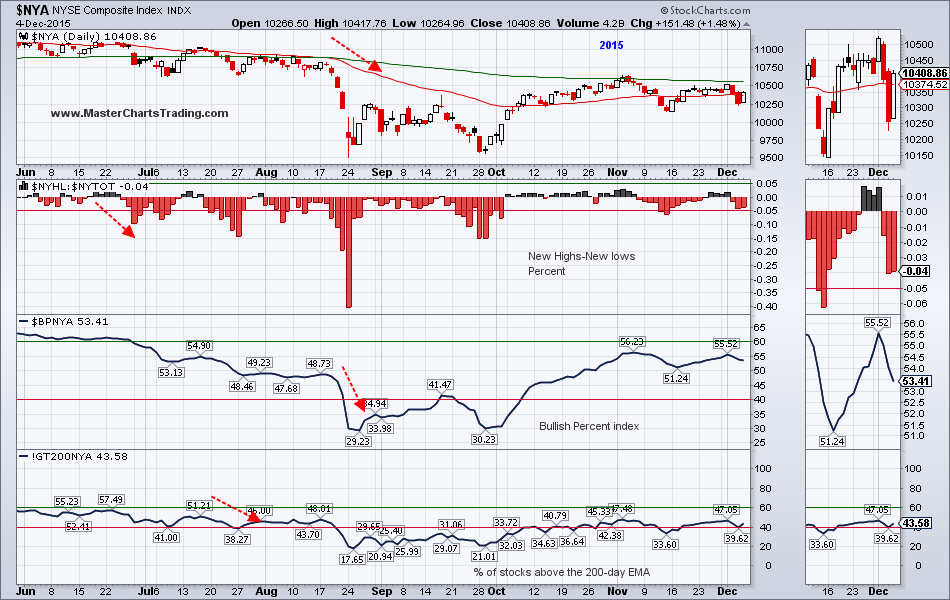

The topping process continues. Perhaps once we roll over into an outright bear market, it would be called the Commodities Crisis? This week sellers came back with gusto and no sector was spared. Energy again led to the downside, but financials was the close second with XLF loosing 5.37% for the week. As I have repeatedly mentioned since the mid-September, I believe we are in the beginning stages of the next bear market. How it will unfold is anyone’s guess, but the fact remains that we must now change and adapt to these new market conditions.

|

|

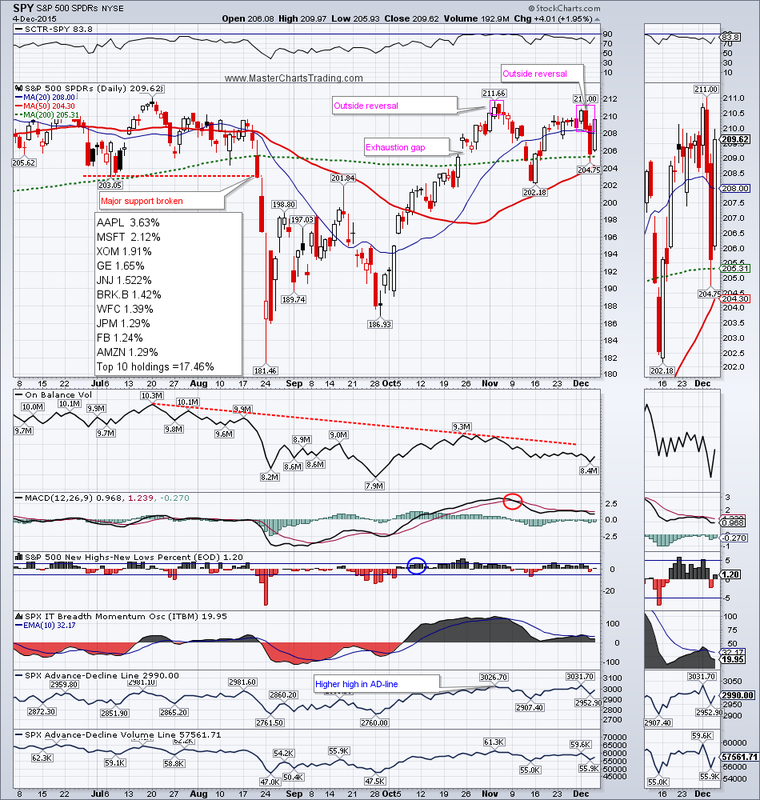

CHART OF SPY

CHART OF IWM

STOCKS ARE HIGHLY CORRELATED

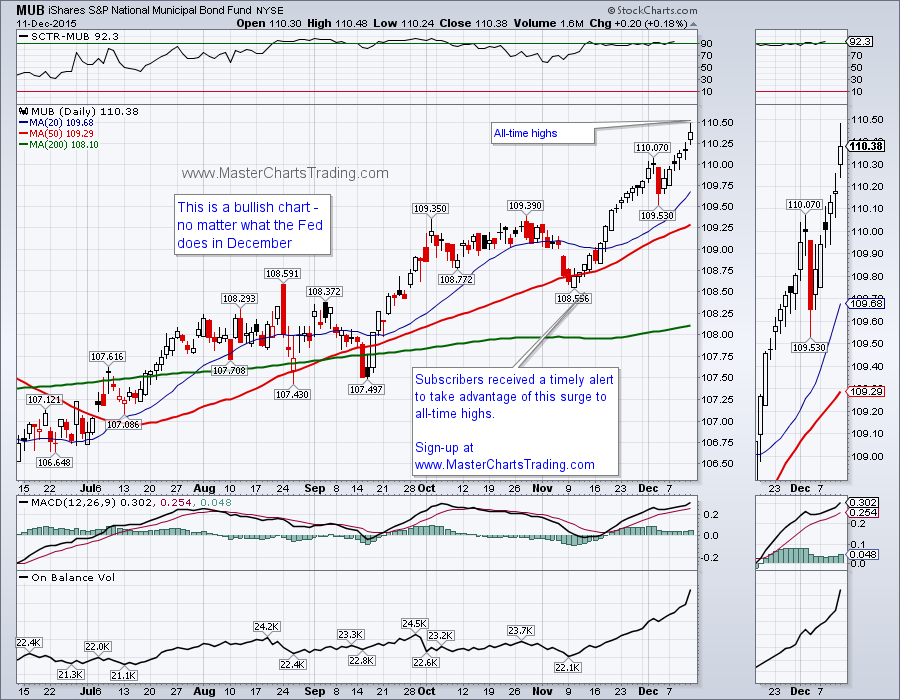

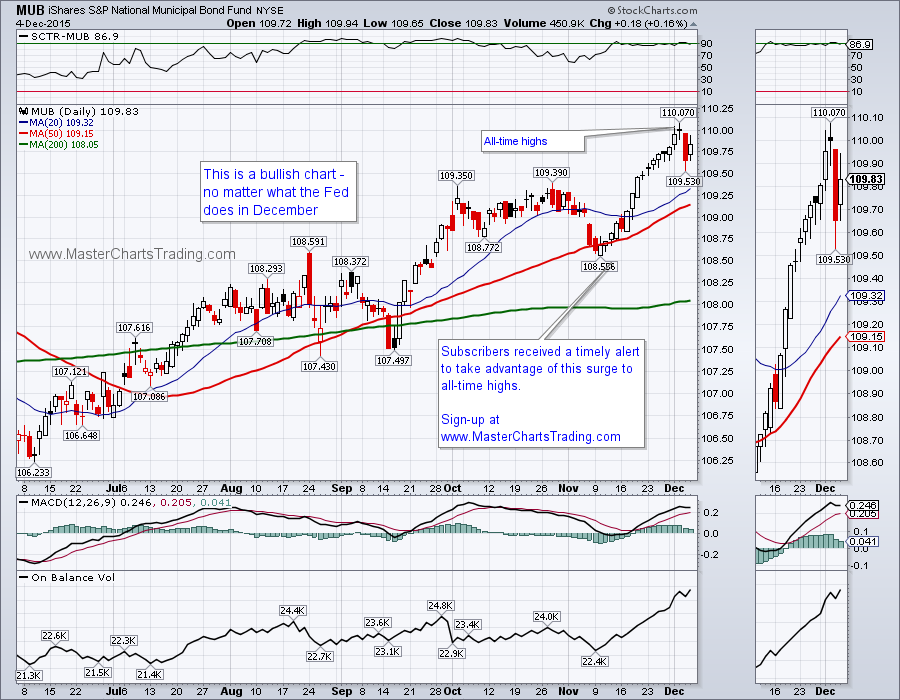

CHART OF MUB

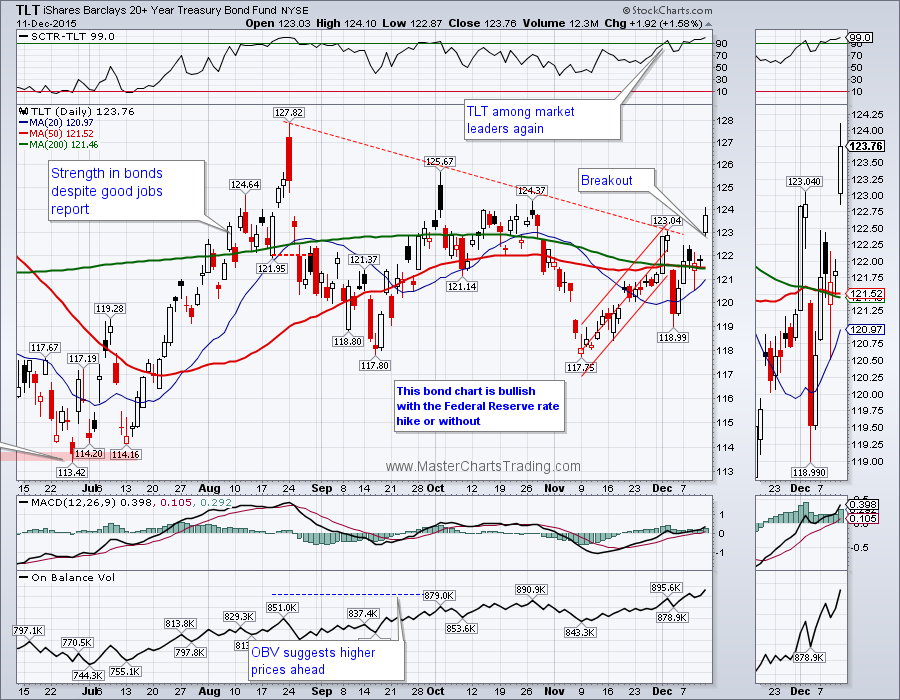

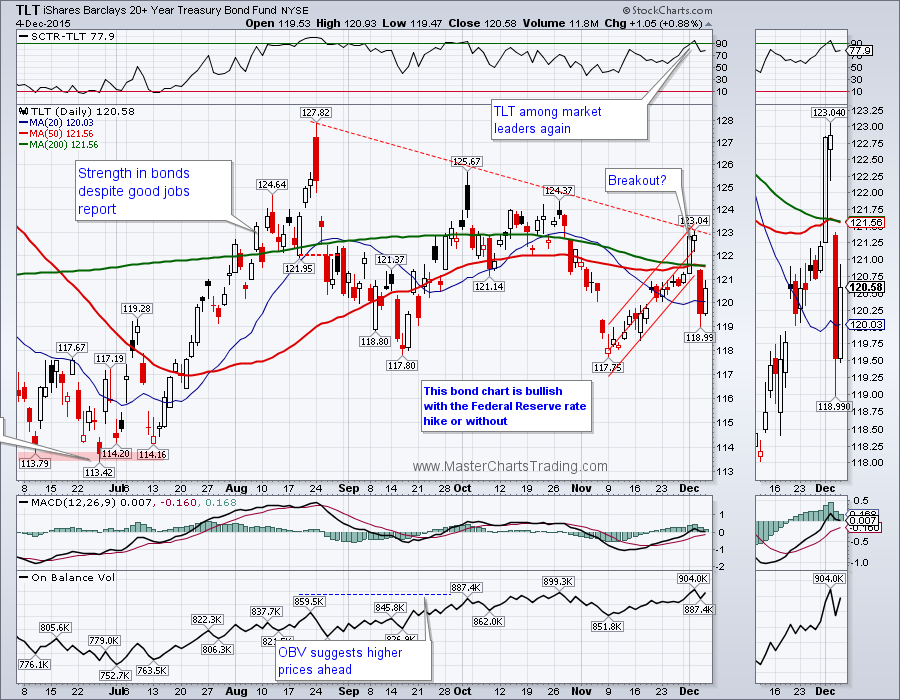

CHART OF TLT

CHART OF $USD

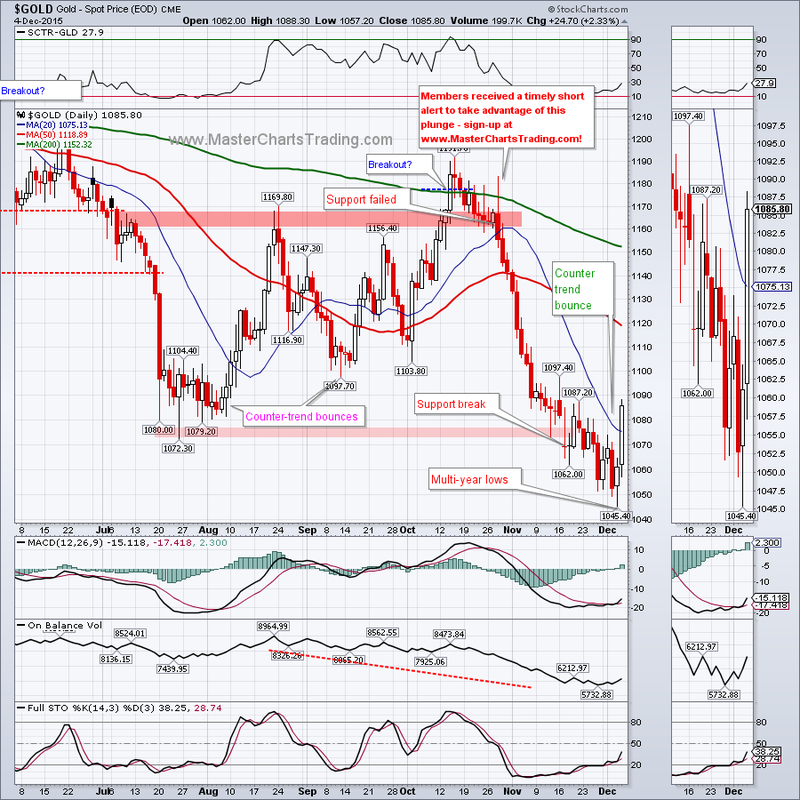

GOLD CHART

CHART OF GDX

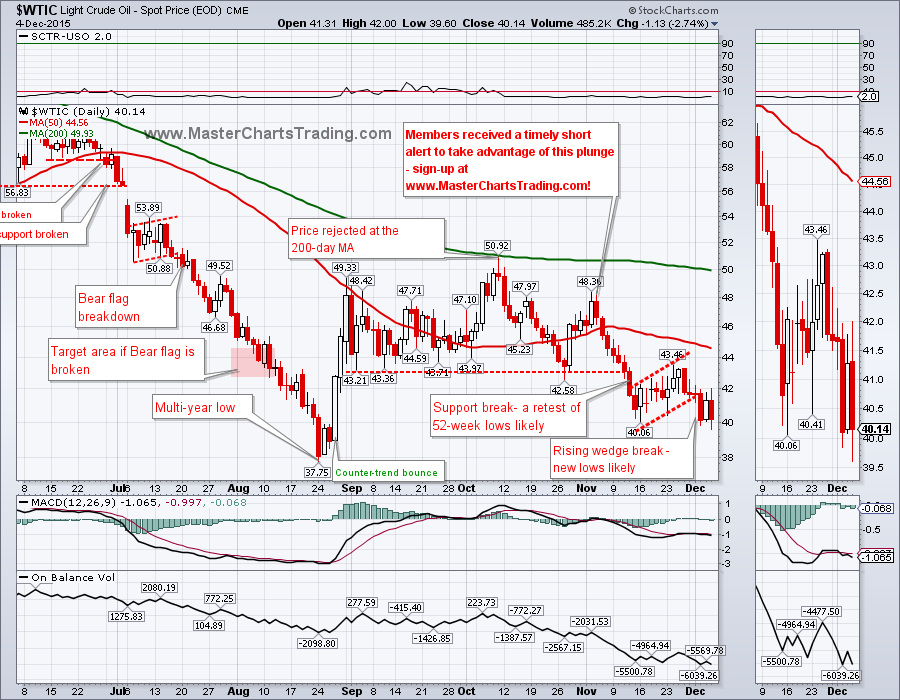

Oil is strongly bearish – it hit multi-year lows on Friday. I don’t see any signs of a bottoming action in $WTIC just yet. We could easily hit upper $20s in the near future as OPEC continues to flood the market with cheap oil.

OIL CHART

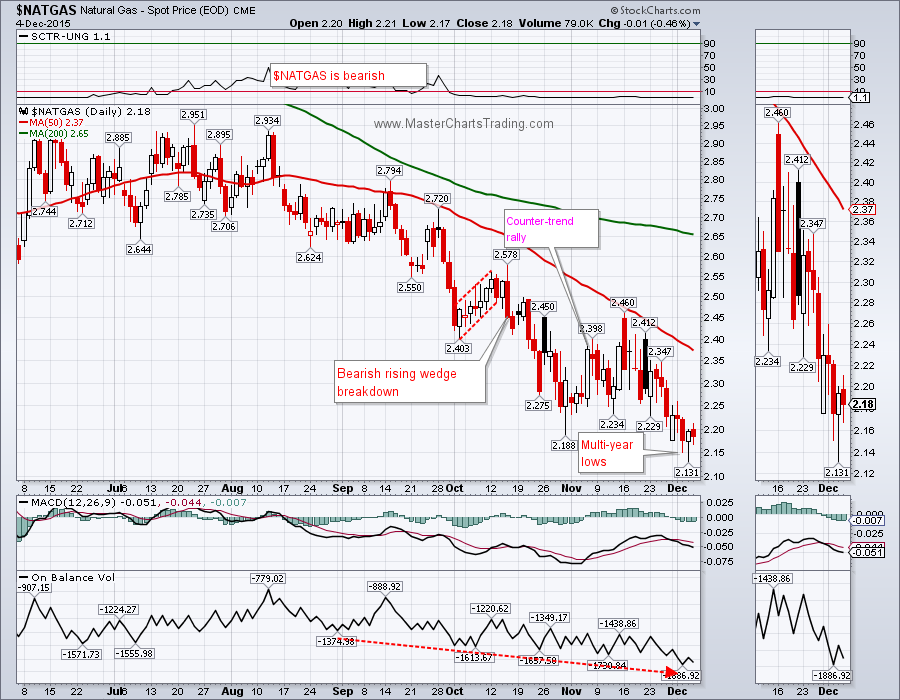

CHART OF NATGAS

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed