Wednesday, March 19, 2014

Nobody Likes the Fed Statement

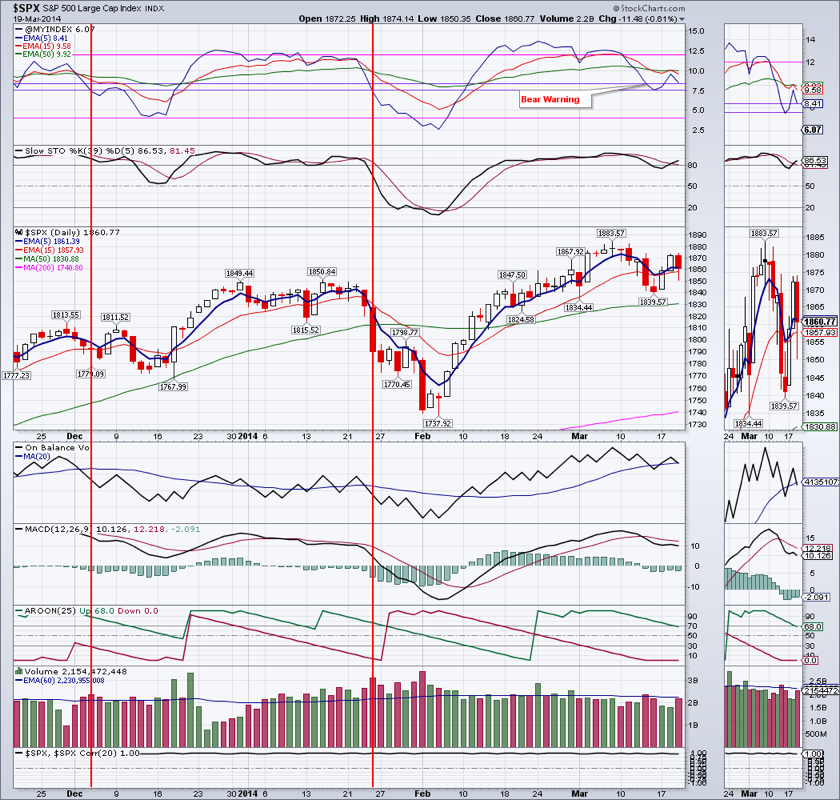

It seems like nobody liked what Janet Yellen, the new Federal Reserve chief, had to say yesterday. Almost all the major stock, bonds, gold, real estate and commodity ETFs lost ground. The Big Board lost 0.79 percent on slightly below average volume. Is this a continuation of the decline that started March 7?

Market Breadth Index, the $VMBI, is still in Bear Warning, but getting very close to Bearish confirmation territory. Coupled with the fact that the stock indices are still in the overbought territory, we could easily see a retest of the 50 DMAs and possibly even of the February lows.

TLT got walloped as well. However, selling in Treasuries was on above average volume. A close below the current support at $105.36 would be bearish for TLT and a retest of December low would be likely.

IYR got creamed with a 1.77% loss on large volume. More importantly, it closed below the March 10 low. We are likely going to see prices at least in the $66 and possibly in the $64 area, before a support is found.

EEM again could not hold on to its 3 day gains with an over 2% loss. A close below $38.03 would indicate a retest of the February low. Should that give, another significant leg down is likely.

Oil seems to be stabilizing, but more likely resting before the next leg down to the $95 area.

Natural Gas might be doing the same thing as oil. We still think that prices in the $4 area are likely very soon. It is getting oversold a bit, so a rebound to around $4.75 is possible before the next leg down.

We are long: GDX, IYR, TLT, DVY, ETV

Hedging: DGAZ, SDOW, TZA

RSS Feed

RSS Feed