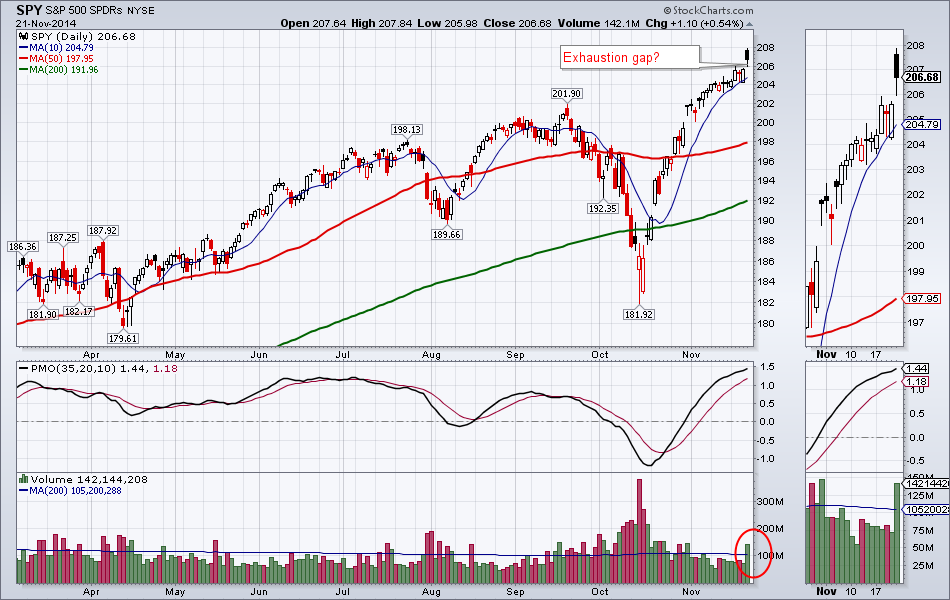

The S&P 500 and other large cap indices continued to make new all-time highs and surprise many analysts (including myself).

In my view Friday’s action could look like an exhaustion gap. The S&P 500 gapped up at the open and then continued down all day to close near the day’s lows, all this on above average volume. Could it be the beginning of a long-awaited pull back? Only time will tell.

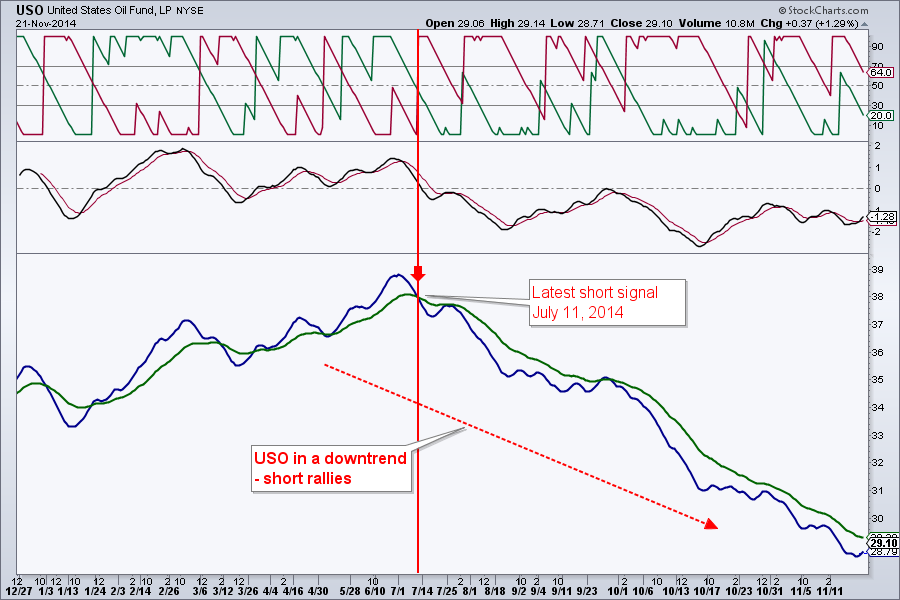

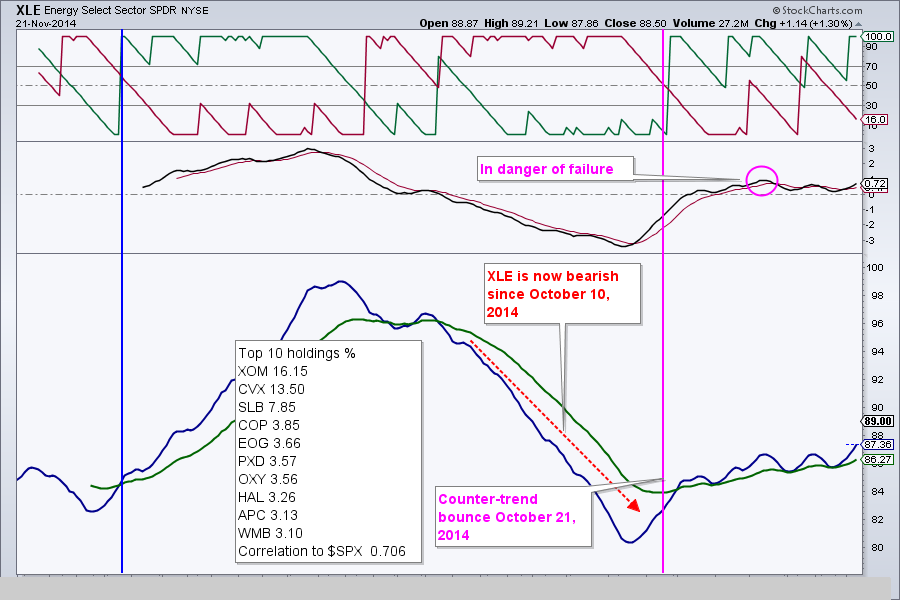

Oil related equities are holding up OK and continuing up. Should USO flip into buy signal, XLE is likely to benefit.

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer: we have open positions in SPY (took profits), TZA, AGG, TLT, GDX, and XLE (took profits)

RSS Feed

RSS Feed