|

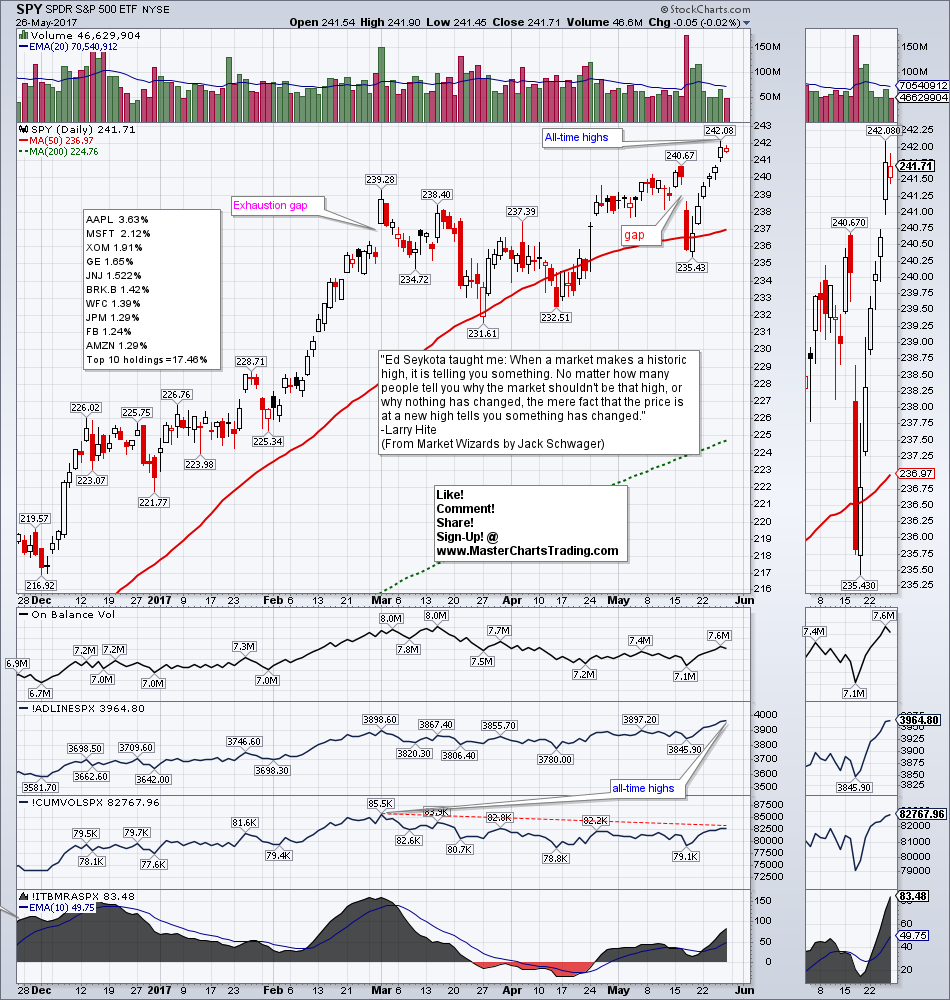

•Stocks set fresh highs on relatively thin volume | Breadth divergences still remain | Technology, Industrials, Utilities and Staples break to fresh all-time highs | Retail lags | Financials (XLF) may not yet be done correcting | S&P 500 closes above R1 Pivot | QQQ closes above R2 Pivot | Fresh highs are bullish for stocks

•Resilience in junk bonds confirms bullish posture for stocks •TLT maintains the gap from last week | AGG and LQD may be headed for a retest of all-time highs | This is concerning for the stock market •US Dollar broke support last week, but is attempting to bottom | Retest of November lows still in the cards | Major currencies trade flat for the week •Gold has another good week and could be headed for a retest of 2017 highs | Bullish divergence on GDX suggests a continuation of the move up •Oil recovers some of the losses from Thursday’s plunge | The bigger trend is down for oil | XLE has another bad week | Bearish divergences on XLE suggest further downside | XES already at 52-week lows •Peak Oil Demand may come as soon as 2020 •BlackRock and Vanguard may “push [XOM] for a climate ”stress test” gauging impact of green tech on its assets” |

Watch this video on YouTube

|

|

0 Comments

|

Archives

July 2024

|

RSS Feed

RSS Feed