|

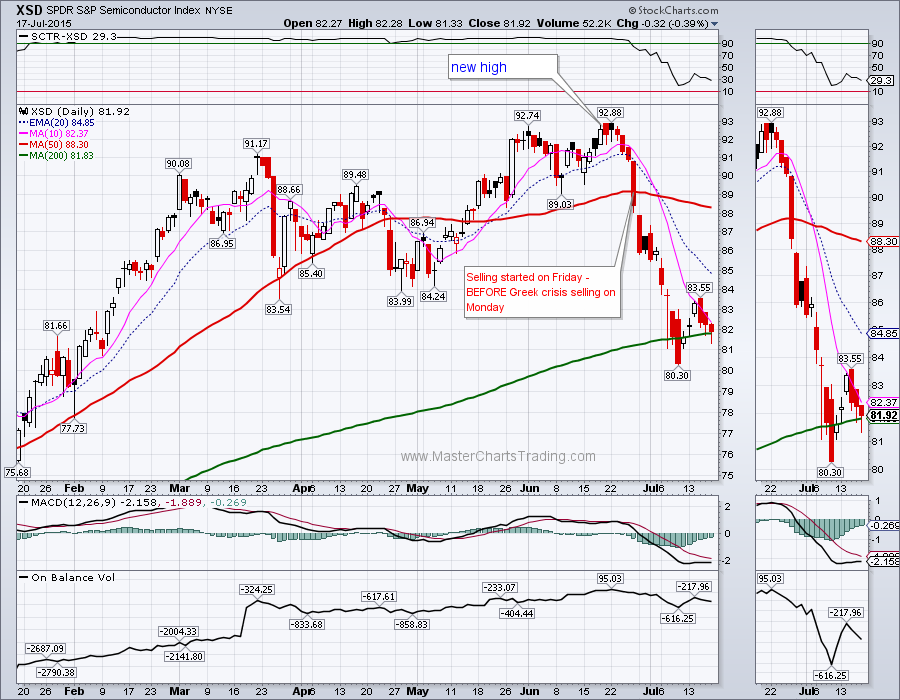

Just as many investors thought a breakout in the NASDAQ was for real, we got a wave after wave of selling throughout the week. Friday culminated with rather ominous looking candles on many indices and ETFs. $SPX lost over 2%, while QQQ fared better and closed at its breakout level.

Market breadth was narrow on the last week’s advance. I was really hoping for the divergences to be worked off this week, but it did not happen. The AD-Lines and the On Balance volume for both $SPX and QQQ did not confirm new highs. Summer month are traditionally weak for stocks, perhaps more downside is coming? Live $SPX and QQQ charts |

|

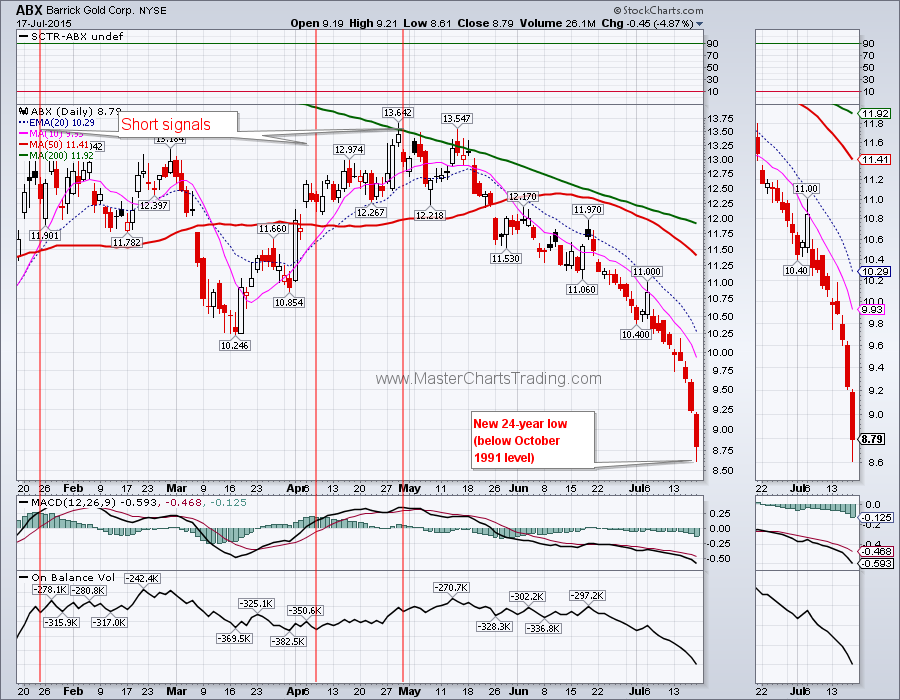

Gold Chart

... Having said that, GDX is very oversold on numerous parameters. Momentum oscillators, such as MACD, are at a level where previous rebounds took place. We had a gap down on Monday, which needs filling. Most importantly, however, is the fact that the Bullish Percent index for GDX was at zero today. That’s right, there is now not a single stock within GDX that is on a Point & Figure chart buy signal! During the previous lows in GDX this was one of the more reliable indicators of a bottoming action.

Live GDX chart with market breadth

Live GDXJ Chart

Best Regards and have another great trading week!

** Special Announcement**

We are close to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed