|

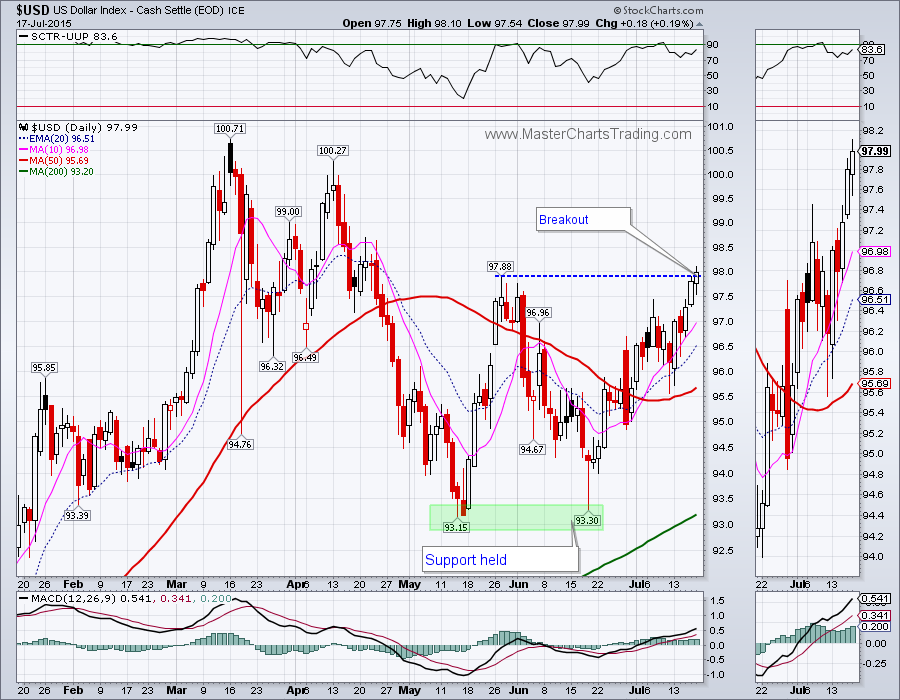

The markets again managed to surprise many observers this week. $SPX turned around from a close below the 200-day moving average and gained 2.41%, while QQQ closed at all time highs. The resilience of this bull market is undeniable and investors are exhibiting appetite for risk.

|

|

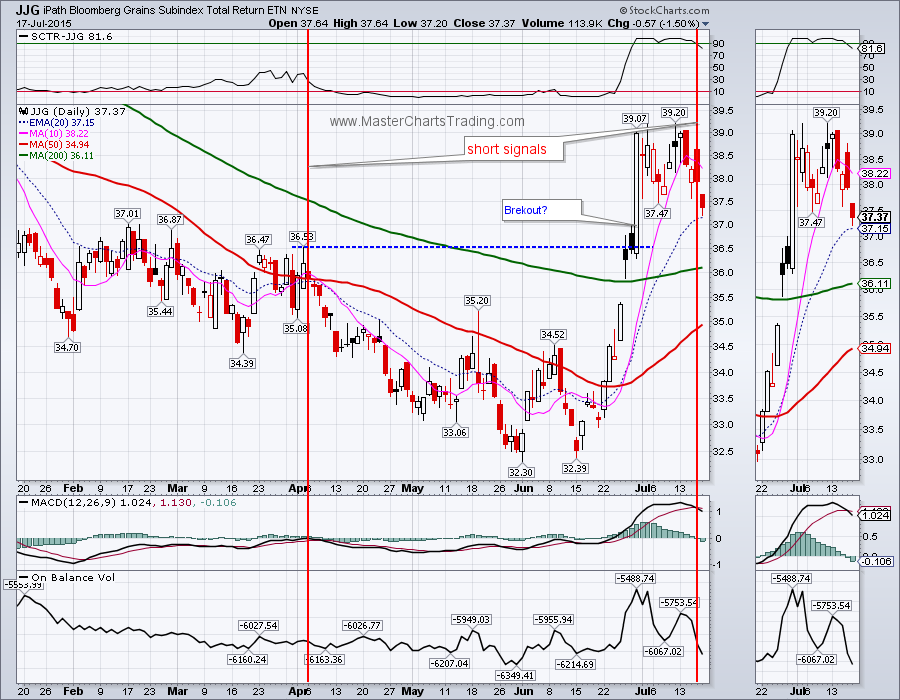

GDX is not that oversold according to MACD, but it does appear that the gold miners are approaching some sort of a selling climax (the Bullish Percent Index ($BPGDM) is at only 3.33%) so I would not rule out a short covering rally of some sort in the near term. Again, GDX is a bearish security, so I am not even going to try to pick bottoms, I would rather wait for a rebound to go short again. If/when GDX becomes bullish; I will reverse my thinking and start looking for buying opportunities.

live GDX chart

Best Regards and have another great trading week!

** Special Announcement**

We are close to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed