|

We saw some strong volatility this week as the Greek drama seems to have reached a fewer pitch. Monday’s drop in the stock markets around the world did some technical damage to the charts. When all was said and done over this short trading week, $SPX lost a little over 1% and closed above the prior low from early June - not so terrible of a performance.

|

|

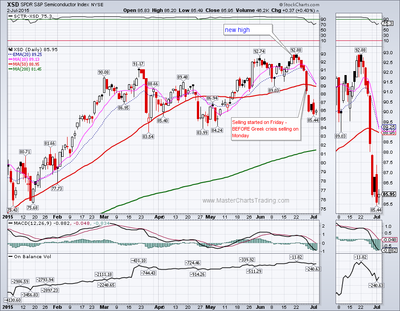

Looks like selling was more pronounced in the technology sectors. The semiconductors sector ETF – XSD, saw some heavy selling last Friday – before the Monday selling related to the Greek crisis. The New Highs-New Lows indicator for QQQ also did drop below the -5% threshold. I want to see this indicator pop above +5%, to turn more bullish. QQQ also has bearish divergences in its AD Line and in the OBV.

Small caps seemed to be weathering this downturn the best until today (Thursday, July 2). IWM closed the week off with over 2.5% loss and on a rather bearish looking candle. I think IWM will retest its 1st support in the $122 area. Market breadth for IWM is better then that for $SPX or QQQ because there are very few if any divergences and the New Highs-New Lows indicator did not drop below -5%.

Live Charts for $SPX, QQQ and IWM

Live Chart for XSD

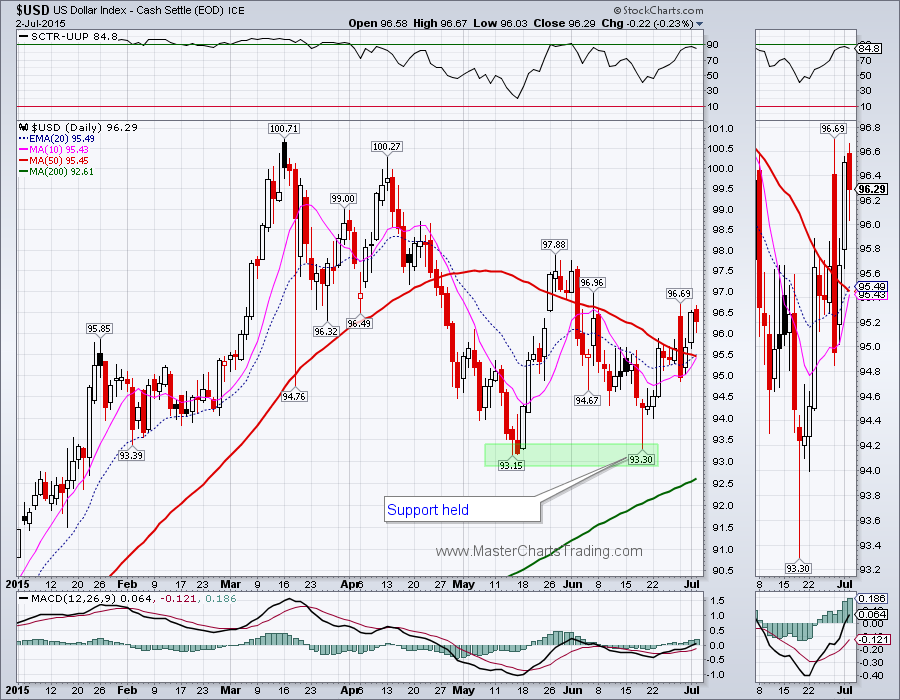

$USD chart

Gold charts

Thursday’s action is somewhat promising for GDX bulls. The two candlesticks taken together, those from Wednesday and Thursday constitute an Inside Day. This means the entire price action on Thursday was contained within the trading range from Wednesday. Should the range break to the upside, we may see sustained rally to around $18.50. Alternatively, should the range break to the downside, we could easily see prices in the $16.90 area or lower.

Gold Miners (GDX Chart)

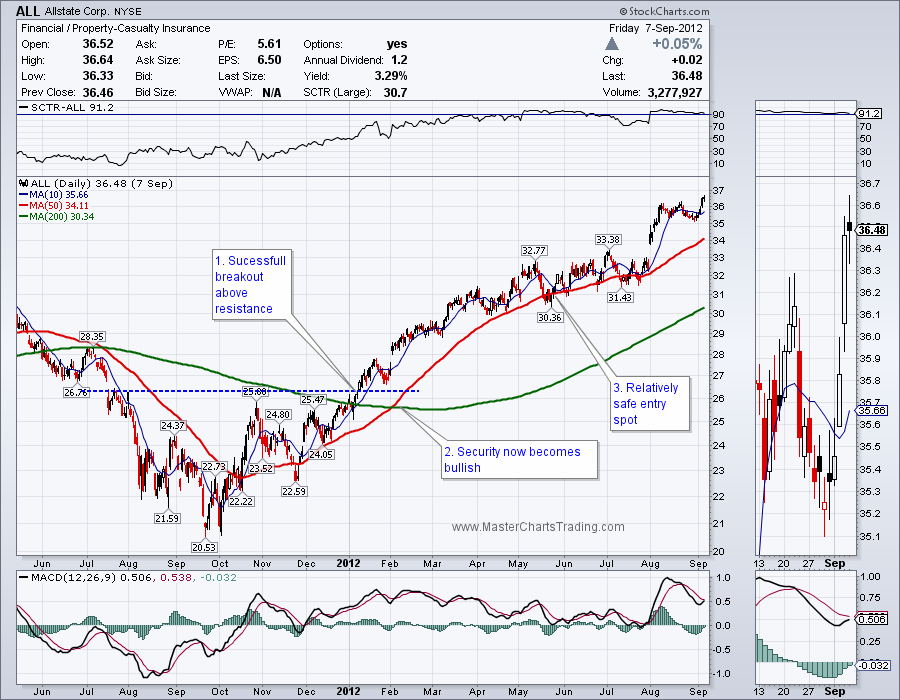

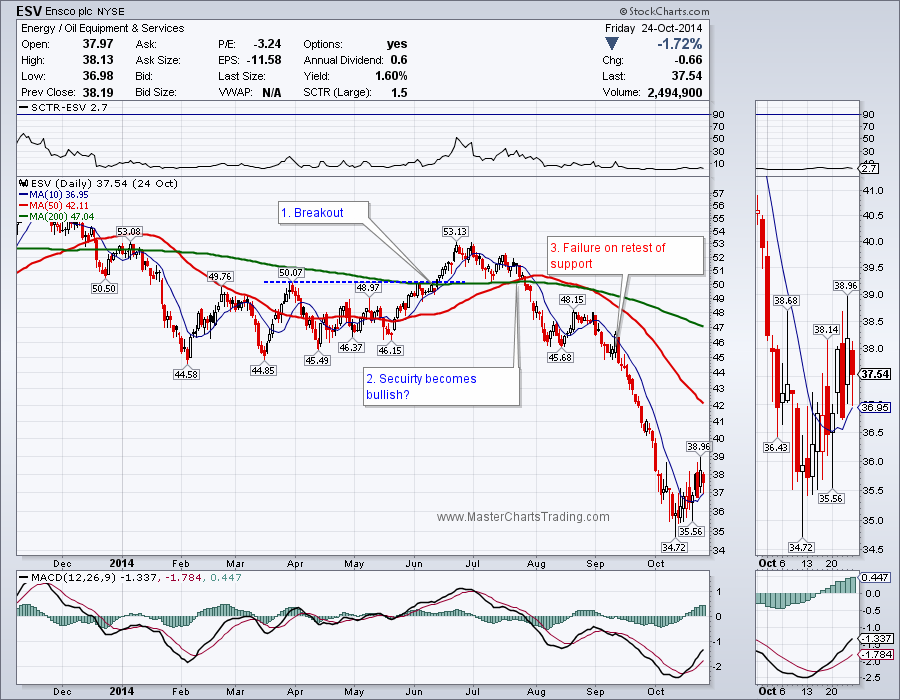

Charts for the stocks in the video exclusive are here for ALL and ESV

Best Regards and have another great trading week!

** Special Announcement**

We are close to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed