Wednesday, March 12, 2014

A Bear Alert, Almost + Gold Breakout

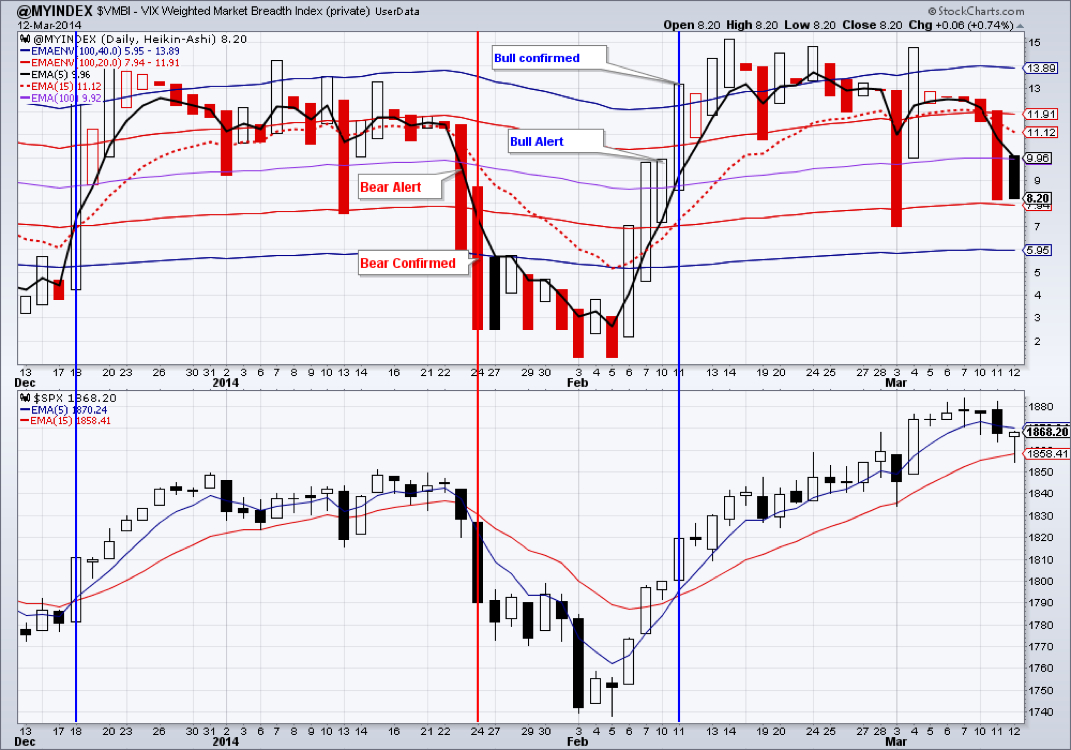

Markets sold off in am, but recovered by the close. If there was no pm recovery, we were ready to issue a bear alert. Our Market Breadth Index ($VMBI) is getting close to flipping into bear territory. We are not there yet and may still see new highs soon, should the conditions improve.

EEM held support at $38.45. We will need to wait until Friday close to see if changes in allocation to emerging markets are needed.

TLT gained 0.7 percent. Despite the recent sell-off in treasuries we continue seeing strength in the bond funds. On Balance Volume indicator for TLT has been making higher highs and higher lows since the beginning of the year - with no signs of weakness. If the markets roll-over here we could see prices of TLT increase dramatically.

Gold was the story of the day! It closed above October resistance at $1367.20 on excellent volume. This confirms the underlying strength in the gold market. GDX followed suit and we added to our open GDX position. Next resistance for GDX is at $28.37 - its September peak.

IYR may have found support in the $67 area. Should it close above $69.33, a test of last May peak at $74.11 is possible.

Oil continued its downward direction closing below the 50 day moving average today. A re-test of January low at $91.24 is very likely

Natural gas may have begun its second leg of breakdown. We already opened a very small position in DGAZ today. Should it close below $4.441, we will add to DGAZ position.

Open positions: GDX (added to position), IYR, TLT, EEM, DVY, ETV, DGAZ (new)

RSS Feed

RSS Feed