Indices opened lower today, attempted to rally, but failed miserably, as a result - lots of shooting stars printed on today's daily charts.

NASDAQ made a new high yesterday and today's candle wasn't particularly bad, but other indices, like $SPX and $NYSE look short-term bearish, should a confirmation of shooting star happen on Thursday.

From the beginning of February, $SPX rallied almost 5.5%, so some sort of a pause is normal. What is troubling is the fact that we ran into resistance without making a new high. If indices roll over now, a dreaded Head and Shoulders pattern might unfold.

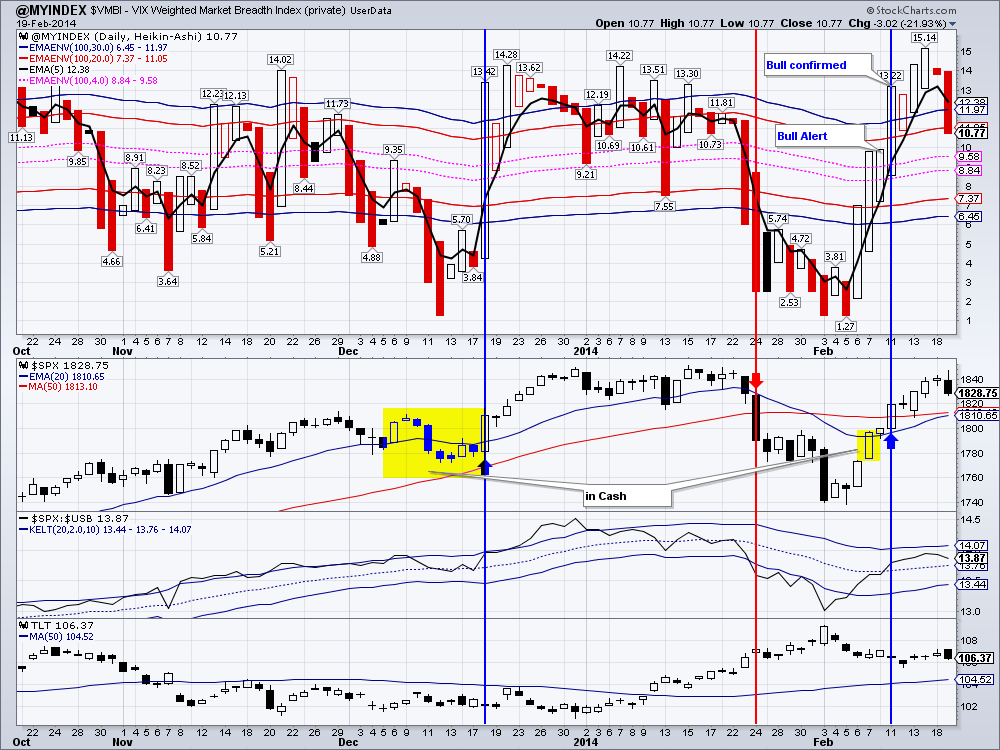

Our market breadth index, the $VMBI, is still in the bullish territory, indicating higher chances of a continuing rally. However $VIX spiked today so we are not adding to any open long positions at this time.

Interestingly, TLT did not fare much better and closed below its 20 day eMA. Could it be that money is rotating out of stocks AND bonds? If yes where is it going? Possible answer may be the commodities.

DBC - the Commodities Tracking Fund - had closed above its 200 DMA for the second day today. Many industrial commodities are gaining - most notably silver, natural gas and crude oil.

$GOLD printed a shooting star yesterday on its daily chart and today seems to have confirmed it. Gold and GDX prices are likely to go sideways or head down in the short-term.

Emerging markets are looking precarious again. If this continues, we are likely to rotate out of them, based on this Friday close.

We are long: GDX, IYR, DEM, DVY, ETV

RSS Feed

RSS Feed