Wednesday April 23, 2014

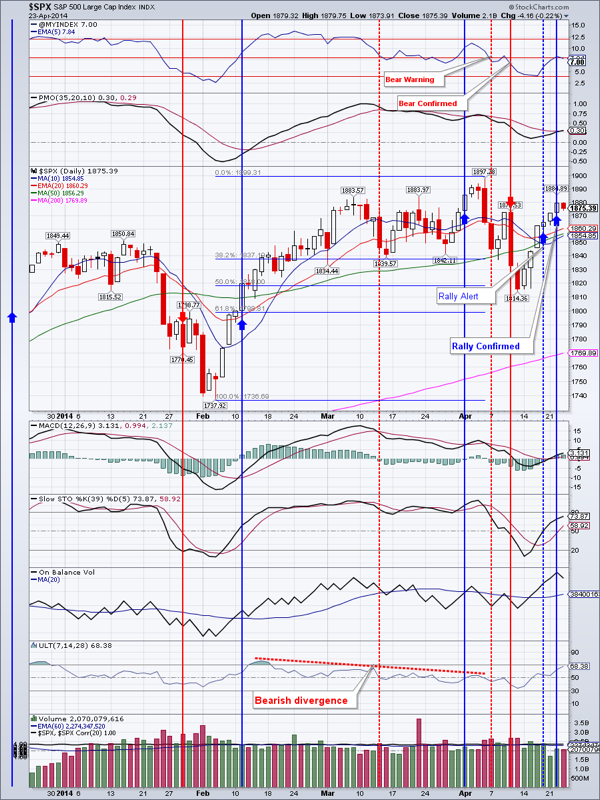

A Pause at a Critical Juncture.

Indices took a breather today with small losses and Inside days (entire today’s range within yesterday’s range). Only the NASDAQ fell through yesterday’s range and closed within the gap-up area from yesterday. NASDAQ is coming up on resistance at 4185.19 and should work through it. Unless $SPX fails here at April 4th highs, I can see it making new all-time highs soon.

Market breadth is bullish. The Swenlin oscillator is rising and positive. The McClellan Oscillator is positive. Our in-house Market Breadth Index is rising, which indicates broadening participation in this advance that started April 11.

Bonds continue to rattle investor’s nerves by putting on a strong show. There is however a divergence between TLT’S Ultimate Oscillator and TLT itself. The oscillator was overbought and above 75 on March 3rd, while TLT was at $108.90. Then on March 27 TLT made a higher high at $110.11, but the oscillator topped out at 67. Now the latest higher high on April 15th was at $111.51, yet the oscillator only made it as high as 65. We already took profits on TLT, but still hold a sizable bond allocation.

Gold may have found support in the $1275 area. There is strong resistance in the $1310 area.

GDX bounced up to the 200 day moving average and closed the gap-down from April 15th. Could this be a double bottom? I am neutral on GDX and gold for now. We were going to add to our open DUST position, but held off because there was no close below March 27 low. Our tiny DUST position got stopped-out.

EEM is still in the process of rolling over to the downside. It’s possible that it will retest the April 15th lows, but possibly even the $40-39 area before heading higher.

IYR had an inside day. First support is at $68.51

Oil may have found support at the 50 day moving average. However volume pattern suggest more downside is likely.

Natural gas is continuing to trace out a bullish flag. Today was the second day in a row that it closed above the 50 DMA. We have an open UGAZ position.

Open positions: IYR, TLT, EEM, DIA, QQQ, TNA, UGAZ

Bottom line: Stocks are coming up on resistance, but should push through it.

RSS Feed

RSS Feed