Thursday, March 27, 2014

A Second Wind, or Will Bonds Sink the Market?

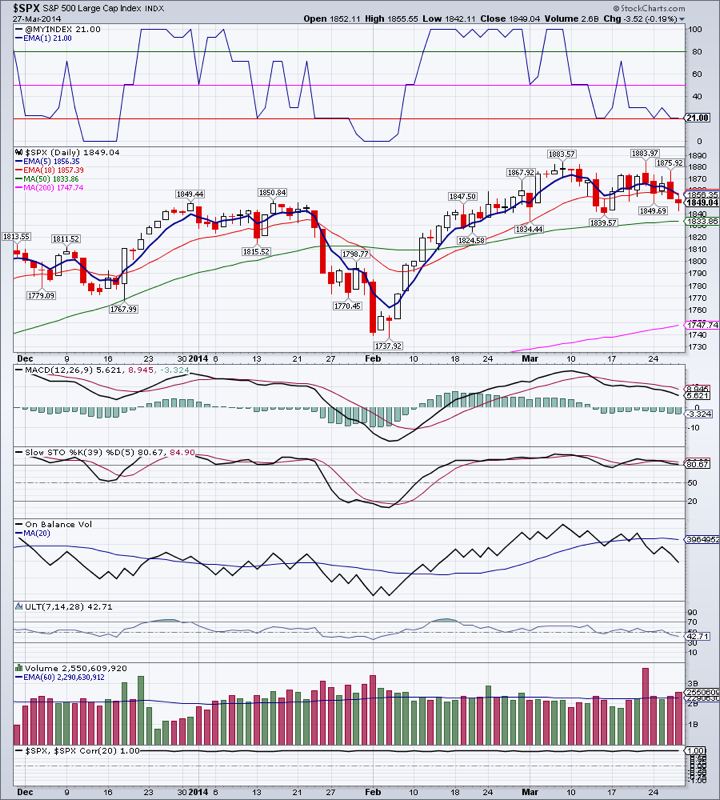

The bulls are putting up a valiant fight. $SPX attempted to rally in the morning, but ultimately failed to do so and lost 0.19 percent. It and the Dow printed what looks like a hammer candlestick - indicating decent buying pressure. Looking beyond pure momentum, we see that volume was still greater then normal and the On Balance Volume (OBV) indicator is negative. In the past OBV negativity ultimately triumphed and the market rolled over.

Market Breadth Index, the $VMBI, is hairbreadth away from confirming bearish posture. (We are currently in Bear Warning). Even a small spike in VIX to, lets say around 15.2, would likely trigger Bear Confirmation.

EEM managed to close above critical resistance at $40.42 today. We have opened a very small position. Should this rally continue, we will add to it.

TLT rallied further to $109.99 on good volume. TLT is short term overbought, so a pullback to $108-109 area is possible. This breakout in TLT is bearish for stocks since generally stocks and bonds are negatively correlated.

If we assume that GDX is more sensitive to the future direction of gold price, then we could say that gold is about to make a turnaround. (GDX gained 1.4% today on good volume). We expect gold to find support in the $1260-1290 area and rally from here.

IYR is likely to retest the 50 Day Moving average. Should that give, a fall to the $64 area is virtually guaranteed (200 DMA)

Natural Gas is rebounding, as we predicted. It may continue to do so for a while up to the 50 DMA, currently at $4.80. Should it manage to close above the 50 DMA, we will need to reevaluate our bearish stance on natural gas.

Oil may be staging a beginning of a rally. It managed to close above the 200 DMA today on a bullish candlestick and decent volume. Next resistance level is in the $102.90 area.

Open positions: GDX, IYR, TLT (added), DVY, ETV, EEM (new small position)

Hedging positions: TZA (took profits), SDOW, DGAZ (very small position)

RSS Feed

RSS Feed