Monday, February 24, 2014

Broad markets are bullish.

Russell 3000 - a very broad market index - closed today at an all-time high, while SPX posted an intraday all-time high. Small caps came within a hairbreadth of all-time highs. Dow is still lagging. All indices are over-bought. But, as Arthur Hill of StockCharts.com likes to say in his video updates: “Overbought, but by no means weak!”

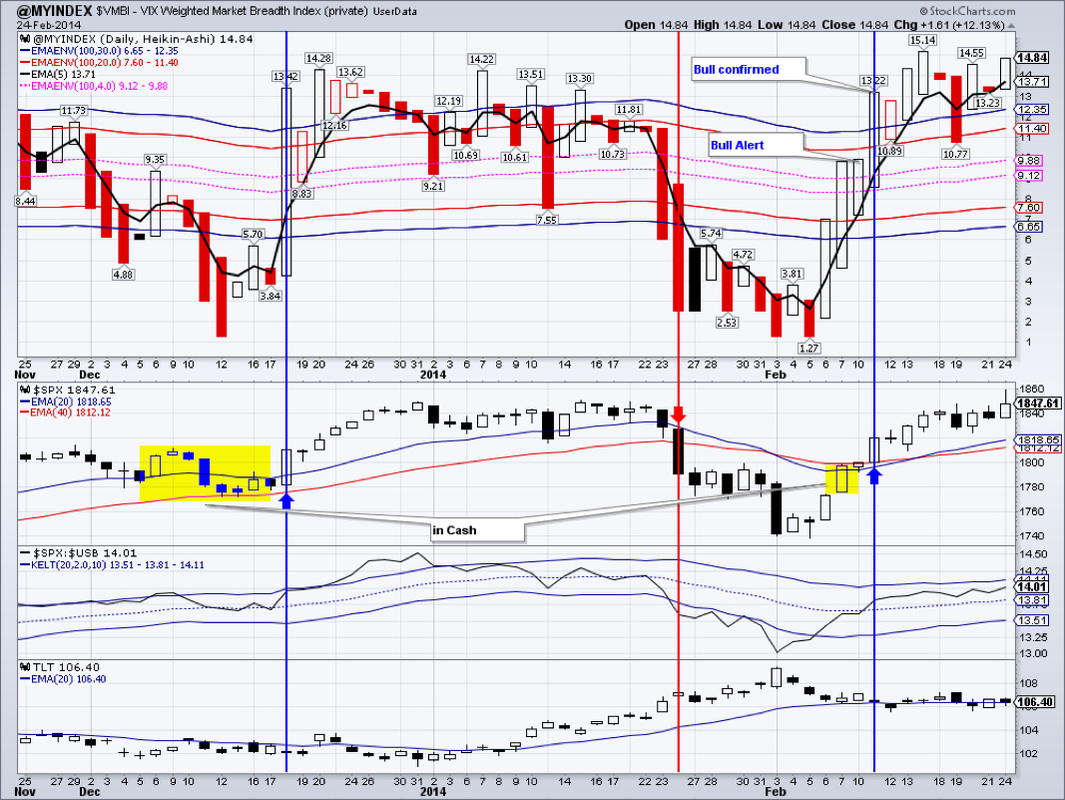

Market breadth, as measured by our proprietary index, the $VMBI, is strongly bullish. We see no weakness in the general markets yet on the daily charts.

TLT continued its meandering to just below the 20 day eMA. Most likely the next leg of this meandering would be down to around 102, as both momentum and volumes are failing.

IYR is running into resistance. After an 11+% move from mid December, its no surprise a pause of some sort is warranted.

Commodities are getting a strong bid. DBC is forging ahead powered by oil, its refined products, silver and gold. Natural gas posted a strong daily loss, though. Could this be the beginning of a natural gas correction?

GDX closed above resistance today at $26.70. This resistance was back from October 28 relief rally peak. Interestingly, $GOLD is still about 2% away from clearing the same peak.

EEM managed to close above the 40 eMA for the second day in a row. Mind you, the 20 day eMA is still BELOW the 40 day eMA. Volume patterns and momentum are bullish. More upside is likely, but China weighs on this ETF.

We are long: ETV, DVY, GDX, IYR, DEM

RSS Feed

RSS Feed