|

Friday, April 3, 2015 Weekly Market Recap.

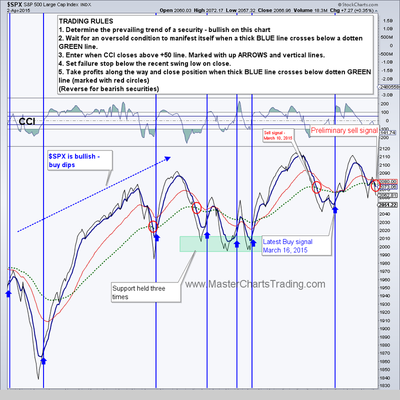

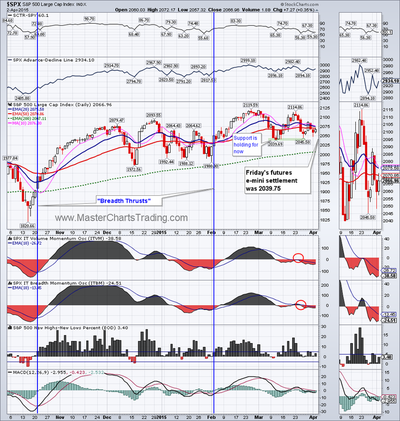

Markets were mixed this week. S&P 500 managed to gain a fraction of a percent, while the NASDAQ 100 lost a fraction of a percent. For now the support from early March is holding for the major averages. Friday’s jobs report surprised many analysts and the market participants with its weakness. Markets were closed because of the Good Friday holidays today, but futures were traded for a very brief session today. E-mini settled at 2039.75, which is exactly around the March 11th low. I am guessing $SPX will gap down on Monday. Our trading system generated a sell signal as early as March 26 in $SPX, but I kept the position open hoping for a strong rebound. It never came. On Thursday, I went ahead and cut my equity exposure. Charts for $SPX & QQQ here |

Watch this video on the YouTube

|

Chinese stocks may be one of the recipients of money rotating out of the US equities. ASHR – China 300 Fund is one of the current market leaders. How long this outperformance may continue is anybody’s guess. For now, I will treat any future substantial pullback in this China fund as a buying opportunity (once my buy trigger is hit). ASHR charts here

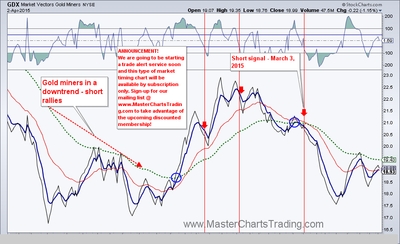

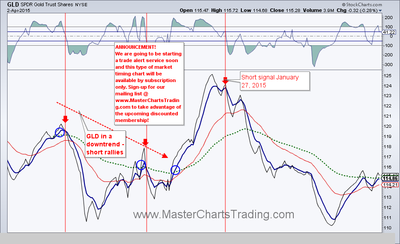

GDX – the gold miners ETF, is following gold in its footsteps, albeit in a more volatile fashion. GDX bounced from the resistance level around $20, but did manage to close the gap from the early March. Again, no short signal for now. Unless you are doing mini-swings on the 10 minute charts, which we may offer once our trade alert service starts soon.

Gold charts are located here

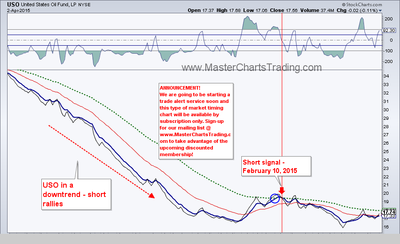

Finally, natural gas (NATGAS) broke a trend line defining the pennant formation. As with oil, any substantial rebound from here may present as a nice shorting opportunity, once the short trigger is hit.

Commodities charts located here

Best Regards and have another great trading week!

** Special Announcement**

We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: TLT, SPY (cut exposure), IYR, XLU, ERY, LULU

New position:

Closed position:

RSS Feed

RSS Feed