Rebound continued today.

NASDAQ is still the leader, albeit on rather low volume. In fact, during this 4 day rebound OBV (on balance volume indicator) confirmed only NASDAQ as being back in the bullish phase.

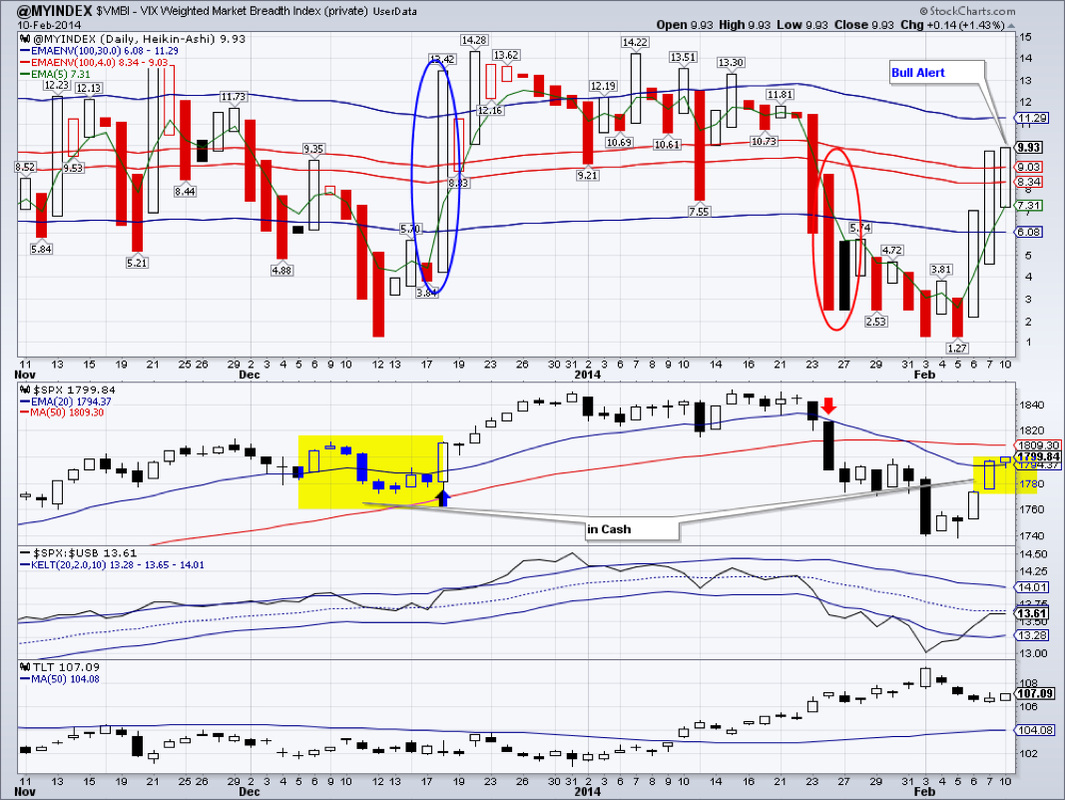

We are at an important juncture this week. Ideally we would like to see a decisive close above 1809 for $SPX (its 50 DMA) this week. This event would likely cause our market breadth index to flip into bull mode. It is currently in a bull alert mode.

A nagging concern remains the long duration treasuries. TLT firmed further today. A close below 106.25 (200 DMA) may cause a bond sell-off, and by extension, a rally in stock markets. While a close above 109.34 would be very bullish for TLTs and bearish for the markets.

IYR might be breaking out of the cup and handle formation to the upside. A measured move to around $70 would be very possible if cup and handle pans out.

A similar cup and handle breakout may be unfolding in GDX. If true, then a move to around $28.5 is possible. GDX is tied to the price of gold and its no surprise that $GOLD has been gaining steadily lately. A decisive close above $1279.80 could easily trigger a run to the next resistance level at $1361.80.

We are long: TLT, GDX, IYR

RSS Feed

RSS Feed