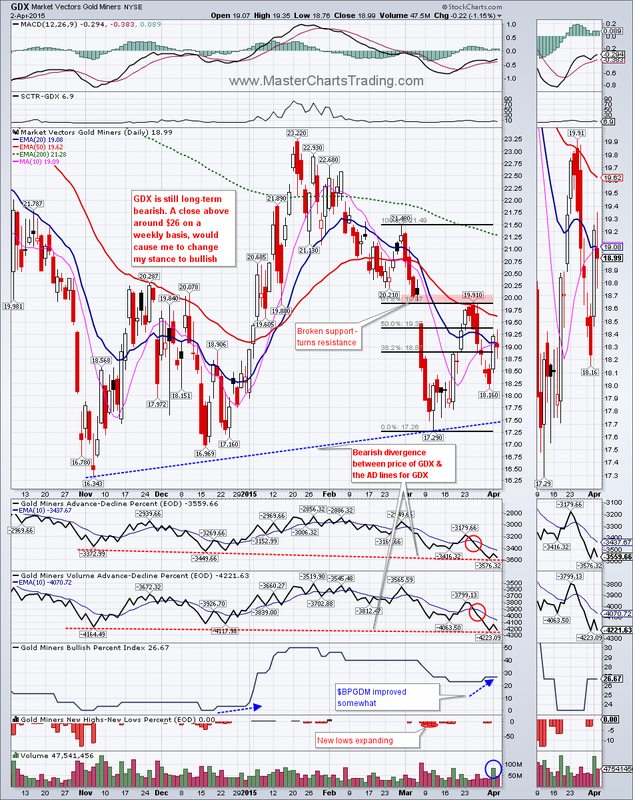

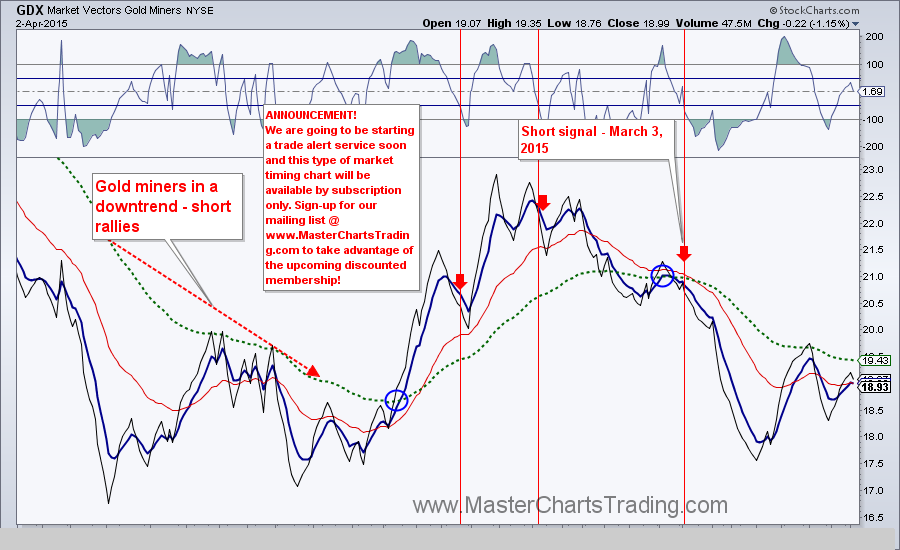

As many of the regular readers of this blog may have noticed, I have been bearish on the gold and gold mining stocks for a long time now. Currently gold and gold miners are in the middle of a good rebound, also known as a bear-market rally. How long will this rally continue no one knows.

However today I wanted to call my reader's attention to a bearish divergence between the price of gold miners ETF (GDX) and its underlying Advance-Decline Lines.

On the chart below you can see GDX making a series of higher lows in November, December and the latest one in March. From a bullish perspective it looks like a series of higher lows. Since GDX has been in a bear market for many years, a series of higher lows is a welcome sign for the bulls.

If you look below the graph of GDX there are two more lines drawn on the chart there. That of the AD-Line and of AD-Volume line. You can see that both the AD Line and the AD Volume lines are making a series of lower lows - exactly the opposite of what GDX is doing. I view this as a bearish divergence.

Coupled with the fact that GDX is long-term bearish and now this divergence is taking place, I would say that this current rally in GDX will ultimately result in a breakdown, possibly to new lows.

Gold and gold miners charts are located here

I also talk about the same bearish divergence at 10:37 mark in my latest video here

RSS Feed

RSS Feed