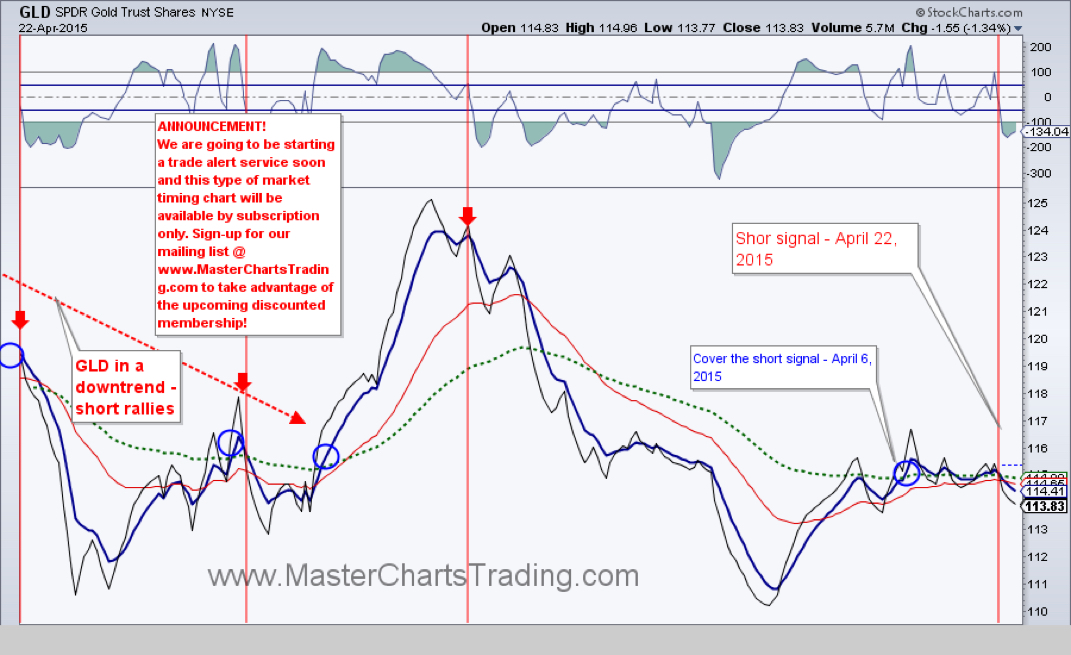

Bearish trend in gold is pulling its trump card again.

Today we saw the price of gold close decisively below its 50 day moving average on a bearish candlestick. There is now some support around $1183.50, but should that give, I am almost certain we will retest the November lows.

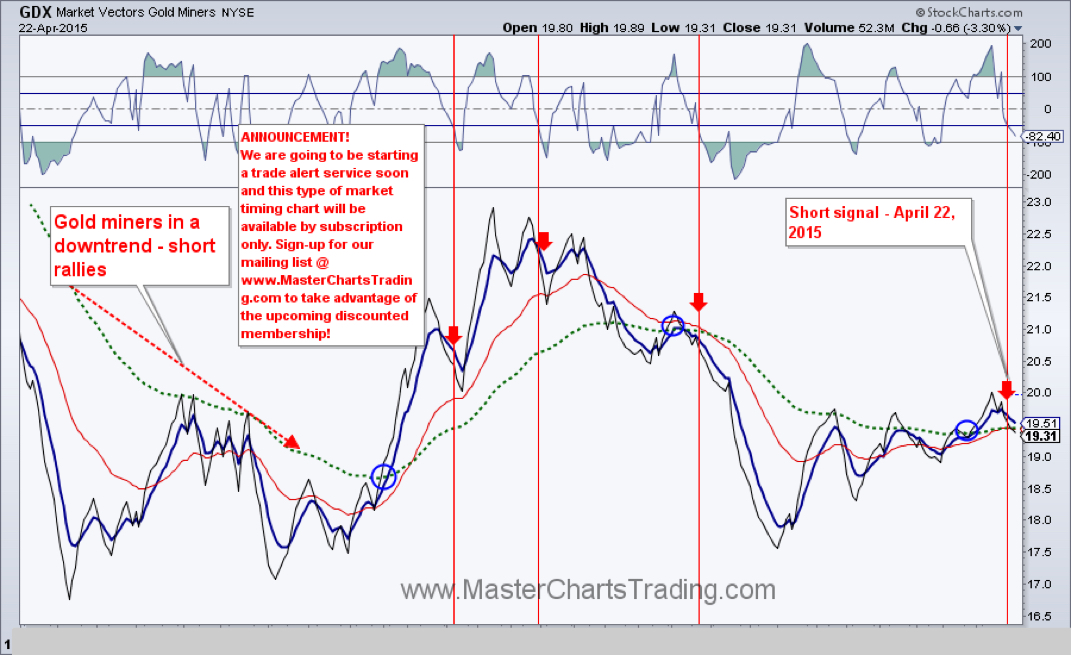

Gold miners ETF predictably followed suit and GDX now resides below all major moving averages. Looks like the resistance in the $20 area is alive and well and proving to be a serious obstacle to the gold bulls.

Gold miner's market breadth is confirming this decline as well. I wrote about the bearish divergence between the price of GDX and its underlying AD Lines in my April 4th blog entry.

Our trading system generated a short signal on both GLD, GDX and GDXJ today. We are playing this unfolding bearish continuation in the gold complex with an inverse ETF called JDST.

RSS Feed

RSS Feed