February 11, Tuesday.

Markets continued up.

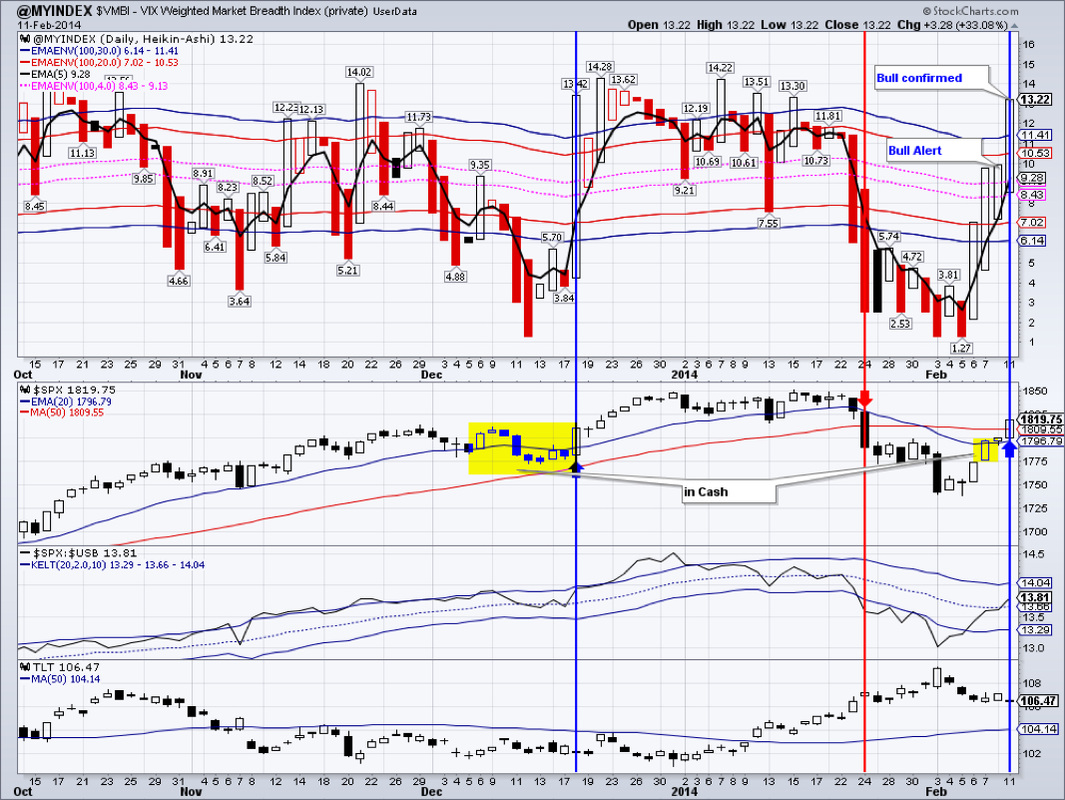

Our proprietary market breadth index, the $VMBI, has confirmed a switch to the Bull Phase on the daily charts. This most likely will take markets to new highs. NASDAQ continued to show relative strength, while biotech’s IBB already closed at new highs.

$GOLD closed above $1279.80 on excellent volume, confirming the recent bull move. Next target would be the 200 DMA at around $1312.

GDX is already above its 200 DMA and next target and area of high resistance is at $26.66. However, I believe that bigger resistance lies in the $28.37 area - a peak from September 18.

TLT dropped initially on Mrs. Yellen’s comments, but firmed and closed the day just above the 200 DMA with a hammer candlestick. This remains a concern for the stock bulls. Should TLT rally, the current rebound would be called into question. TLT still looks bullish on weekly charts, as long as it closes Friday above $106.44.

The beaten down EEM seems to have made a turnaround. A gap down from January 24 appears to have been filled with a bullish candle and a close above the 20 day eMA. The indicators: MO and OBV are confirming strength in this move.

We are long: TLT, GDX, IYR, DVY, DEM

RSS Feed

RSS Feed