Thursday, April 24, 2014

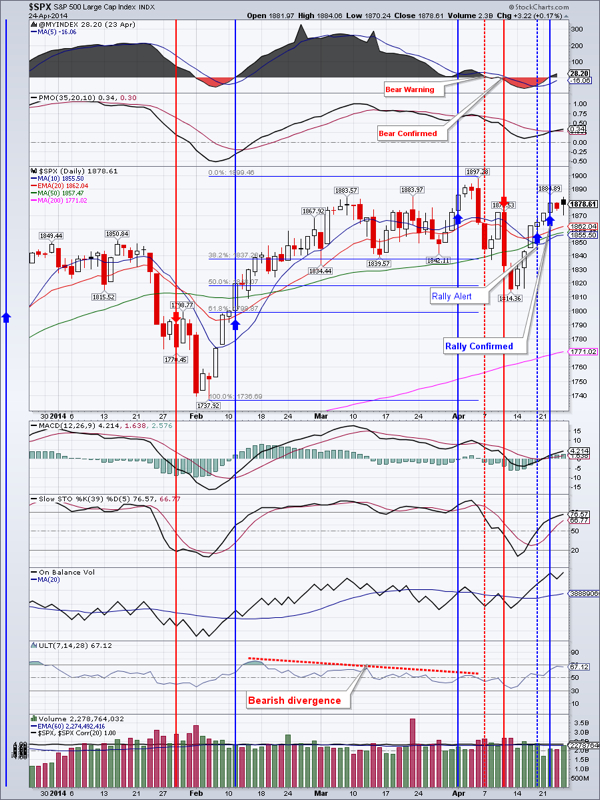

Bullish Unless Proven Otherwise.

Markets stalled somewhat at resistance. QQQ managed to gain almost a percent on the heels of Apple earnings report. IWM lagged - this is a concern. Should the markets roll over here, it would be a rather bearish development.

Market breadth is still bullish and expanding.

$SPX is very close to making new all-time highs. First support is at 1862.04

QQQ is gaining steadily on the 50 day moving average (DMA). First support is $86.01

IWM should now hold $112.51 or risk falling through to the 200 DMA

TLT continued gaining and is coming up to resistance at $111.51. If previous experience is any indication, first of the month would witness a drop in prices (after the dividend is paid out)

EEM has officially rolled over. It probably will head down to the $39-40. We will reassess once it gets there.

Gold reaffirmed support in the $1270 area with a second hammer candlestick in a row. There is still plenty of overhead resistance at $1302 and then at $1319 and $1331.40. My best guess is that we may revisit the December lows before heading higher.

GDX had an inside day and gave up most of the gains from yesterday. Resistance is at $24.59. There is now decent support around $23

IYR just keeps going higher propelled by low interest rates. First support is at $68.58

Oil may have found support at the 50 DMA, but the current candlestick pattern is starting to look like a bear flag. Should the bear flag pan out oil could drop around $99

Natural gas is hitting up against resistance in the $4.80 area. It needs to close above $4.79 to continue the rally.

Open positions: IYR, TLT, EEM, DIA, QQQ, TNA, UGAZ

Bottom line: stock should push through this resistance

RSS Feed

RSS Feed