Indices plowed right through their yesterday’s weakness, led by small caps and NASDAQ. This is a bullish development. We probably will see new highs in $SPX and $RUT soon.

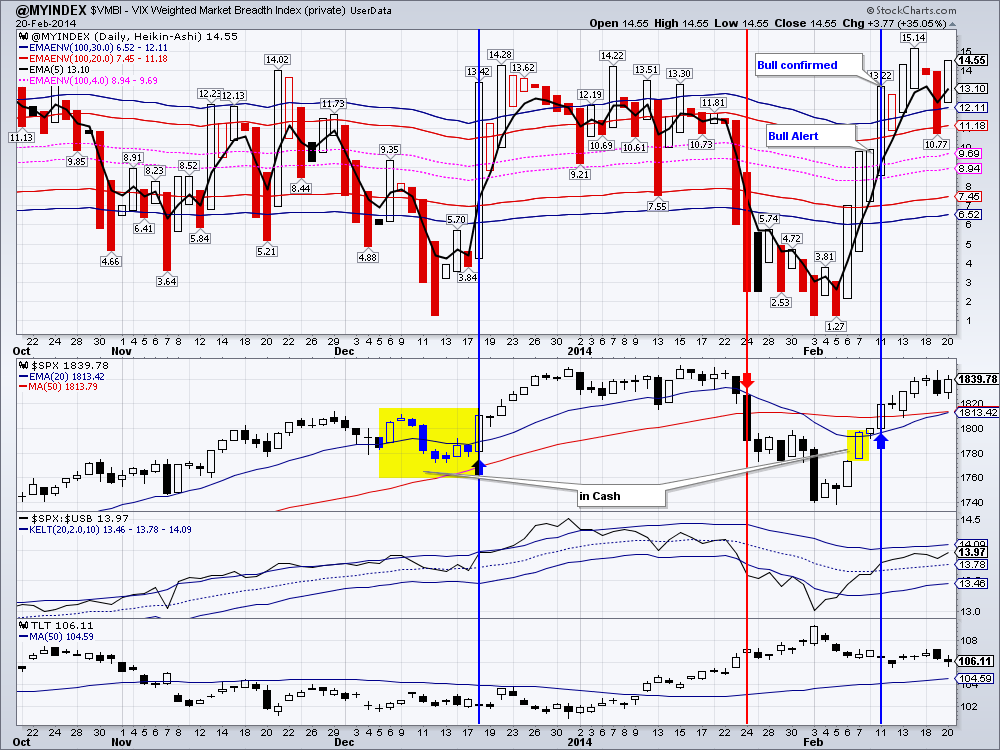

$VMBI - Our proprietary market breadth index is confirming the northerly market direction. We see no weakness yet and continued to add to our long general market positions.

TLT sold-off again yesterday, but held support at the 40 day eMA. Should it close below the 40 day eMA, we may consider shorting the long treasuries.

$GOLD held its ground at the 200 DMA and bounced back up with a bullish candle. It now needs to close above $1332.40 to signify continuation of this bull move that started on December 31.

GDX is confirming gold’s bullish behavior. This pause in the current rally will come to an end once it closes above $26.68

IYR did close above its October 25 high yesterday at $67.65, but the candlestick wasn’t particularly bullish. Some sort of sideways consolidation is probable at this point, in light of recent bond market weakness.

Commodities continued their upward march. DBC, now overbought, needs to close above $26.38-its next resistance level to consolidate the recent breakout over the December highs.

EEM is holding at 40 day eMA. On Balance volume and momentum are bullish, but it desperately needs to close above $39.87, or ideally above its 200 DMA to confirm the recent bullishness.

We are long: GDX, IYR, DEM, DVY, ETV

RSS Feed

RSS Feed