Wednesday, May 7, 2014

Divergent Markets

Indices went their own different way today. Large caps gained, while the higher beta NASDAQ fall. Most concerning is the Russell 2000 which again retested mid-April lows. The correlations are at historic lows, especially for the Russell which is becoming an uncorrelated asset.

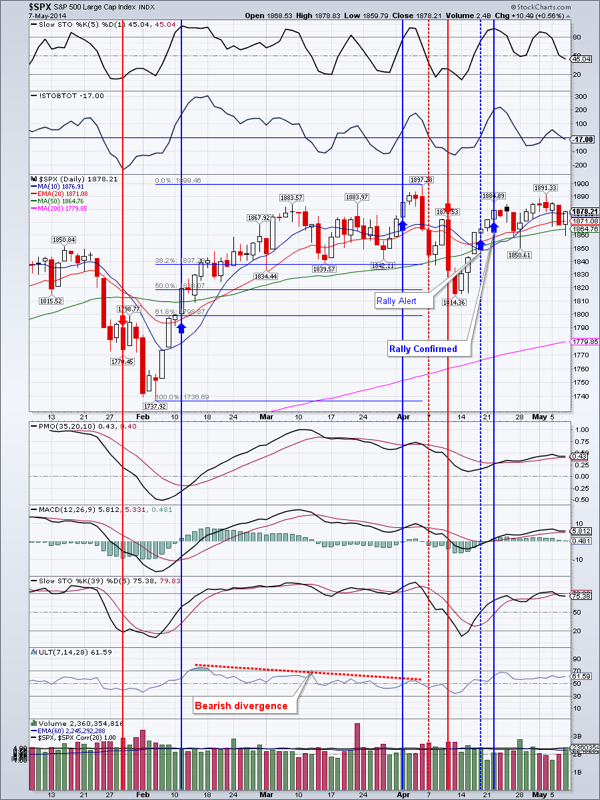

SPX tested and held the 50 day moving average (DMA). Good support is at 1850 and clear resistance is at 1891

$COMPQ lost about 1/3 of a percent, but may have reaffirmed support in the 4025 area. Lots of overhead resistance in the 4149-4177 area

IWM support at 108.60-109 area. Plenty of resistance at $113, then $115

TLT is ripe for profit taking. First support is around $111.

EEM may be working thru its weakness. A close above $41.81 will open the door to taking out the early April peak. Support is in the 40.50 area.

Gold plummeted 1.38% on heavy volume. Should it close below $1277.40 it just might fail all the way back January lows

GDX: similarly to gold, should it close below $23.27.

IYR: profit taking is about to commence. Some support at $68.89

Oil is rebounding likely to the $102 area

Natural gas lost 0.75%, but I think the bigger trend is up for now. My initial target is $5

Open positions: TLT, IYR, EEM, NUGT, UGAZ

RSS Feed

RSS Feed