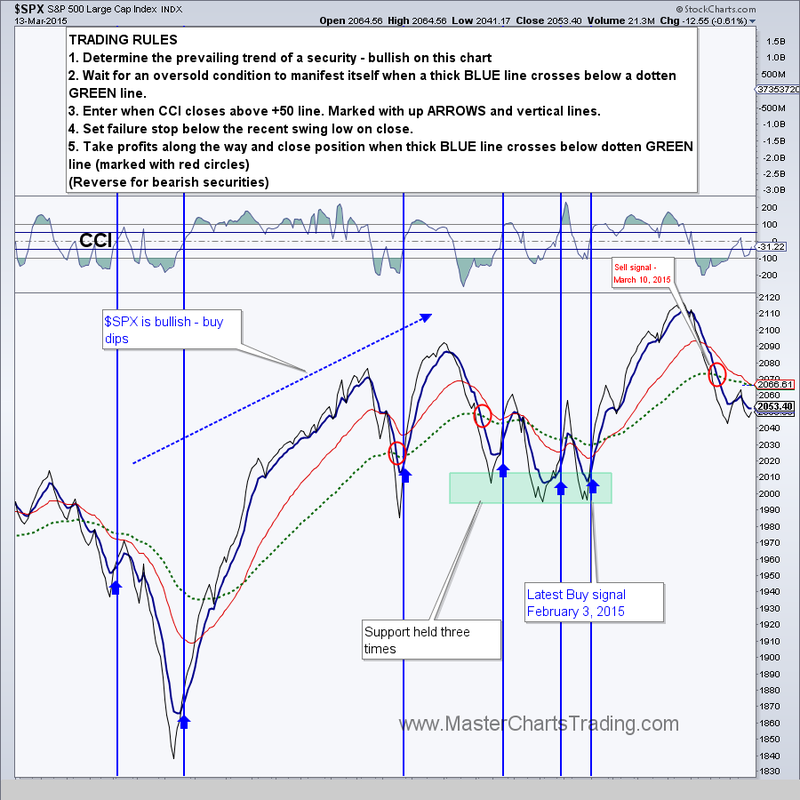

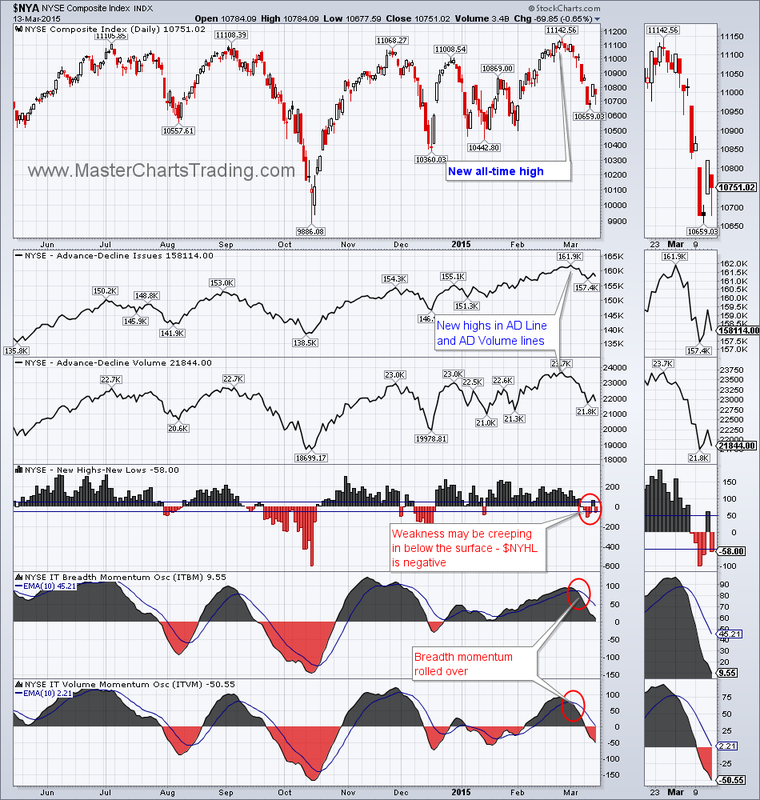

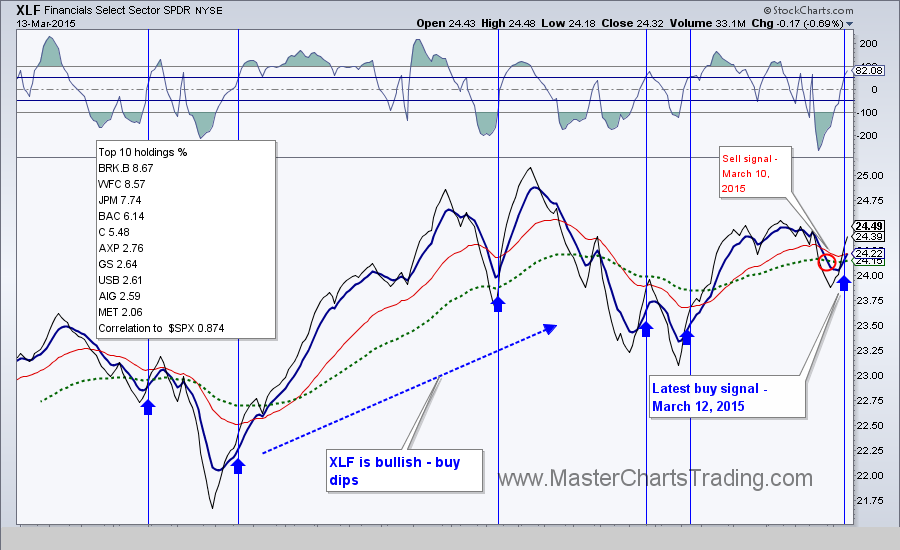

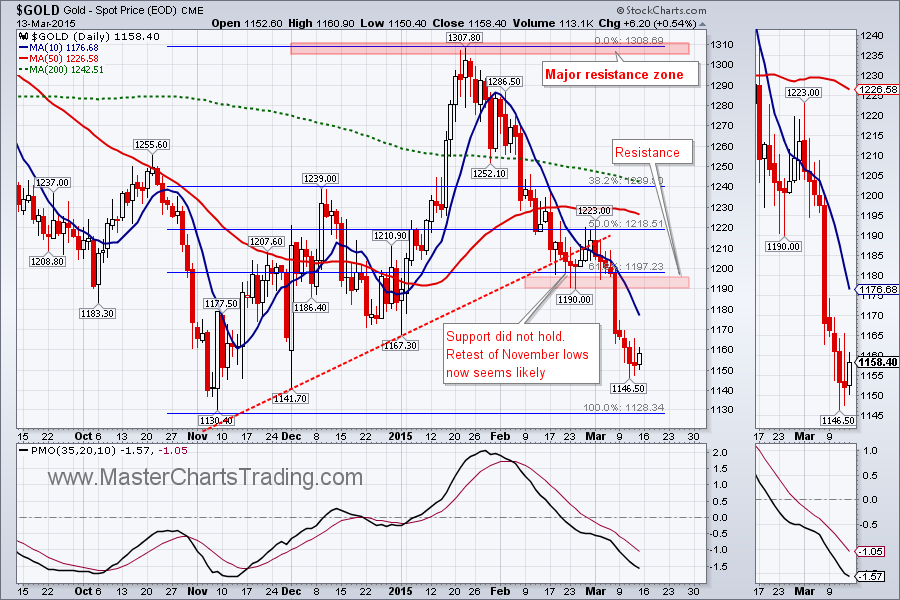

| Friday, March 13, 2015 Weekly Market Recap. Watch this video on YouTube here. The beauty of following a rules-based trading system is that it removes most of your own bias out of trading. We followed our own rules and exited the long position in SPY on March 10th. For now, we are letting cash sit on the sidelines while watching which way the market will head next. I am not yet convinced that this correction that started in in late February has run its course. | |

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

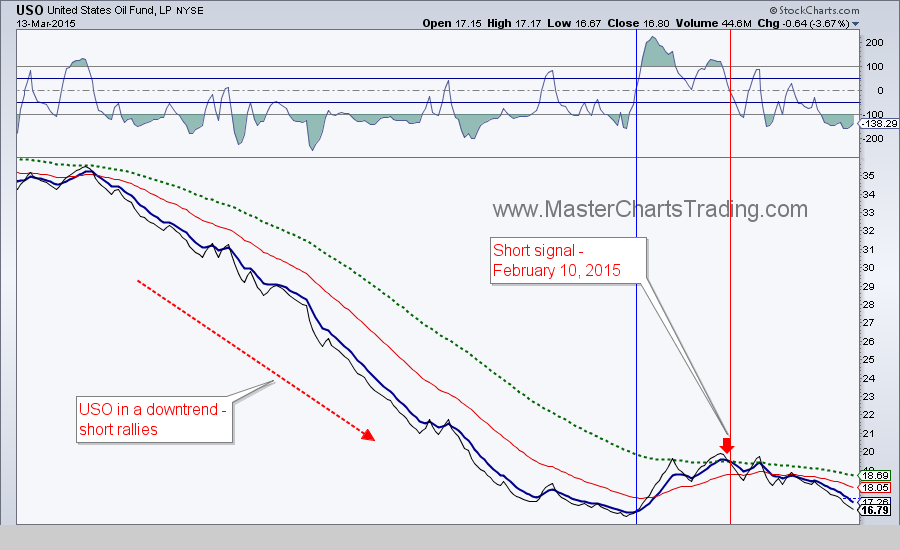

Open positions: SCO

New position: TLT

Closed position: SPY

RSS Feed

RSS Feed