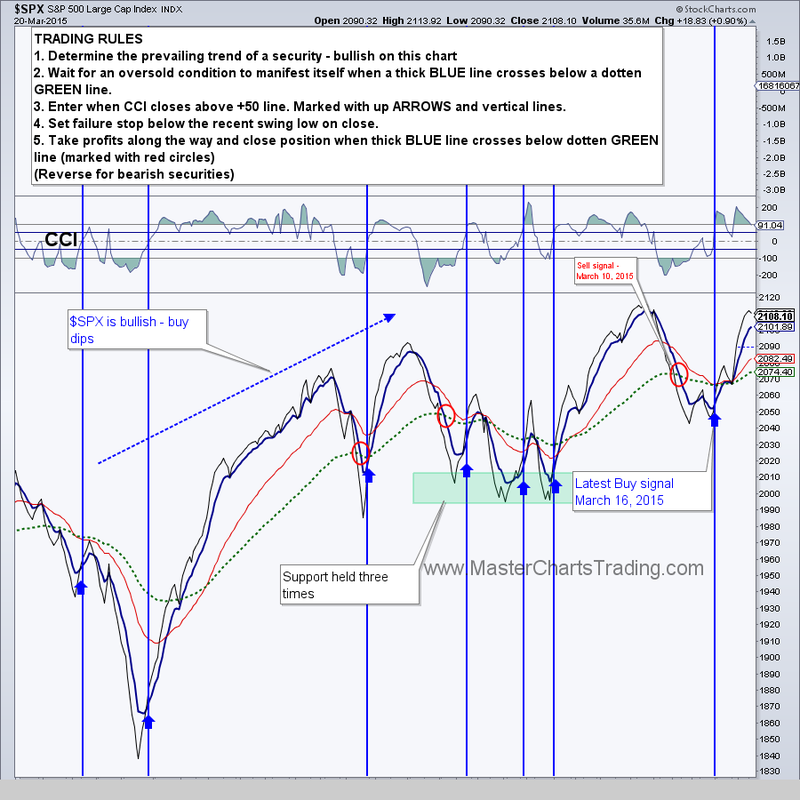

| Friday, March 20, 2015 Weekly Market Recap. SPECIAL ANNOUNCEMENT! We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership! Only 4 days after we closed our position in the S&P 500, an opportunity presented itself to re-enter the market. We did just that on this Monday, March 16th. Even before Janet Yellen delivered her statement, our charts registered sustained buying pressure in stocks. Following her statement, the stocks took off on a rally that continued through Friday. $SPX is up 2.66% for the week. | |

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

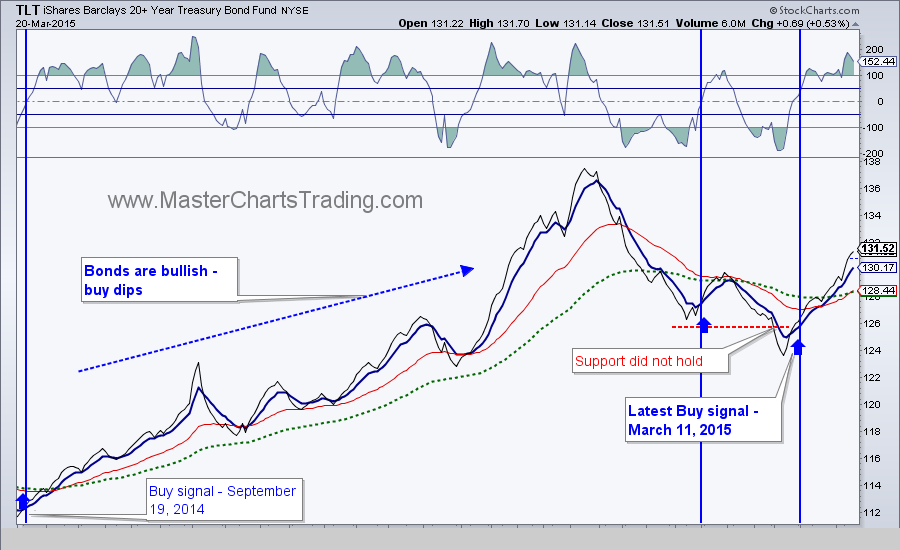

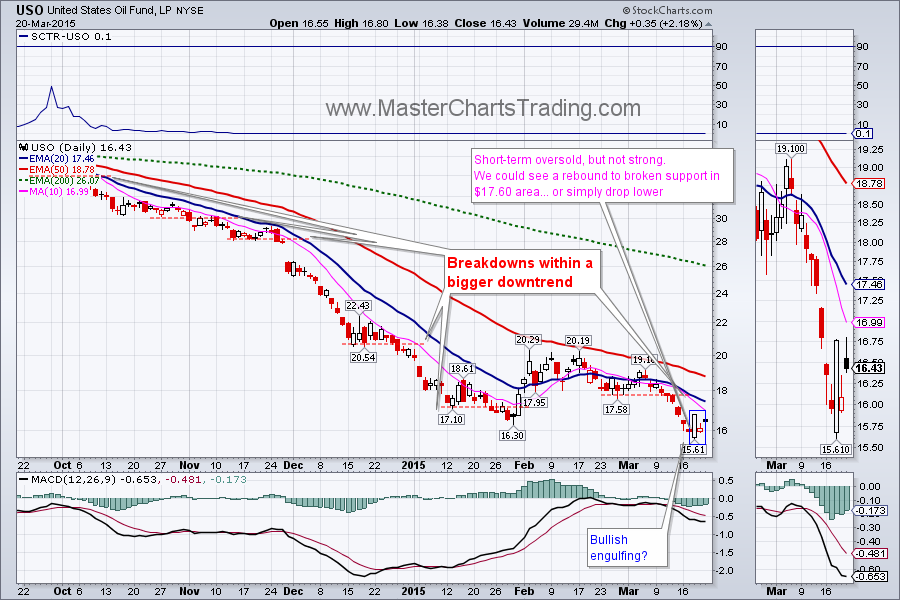

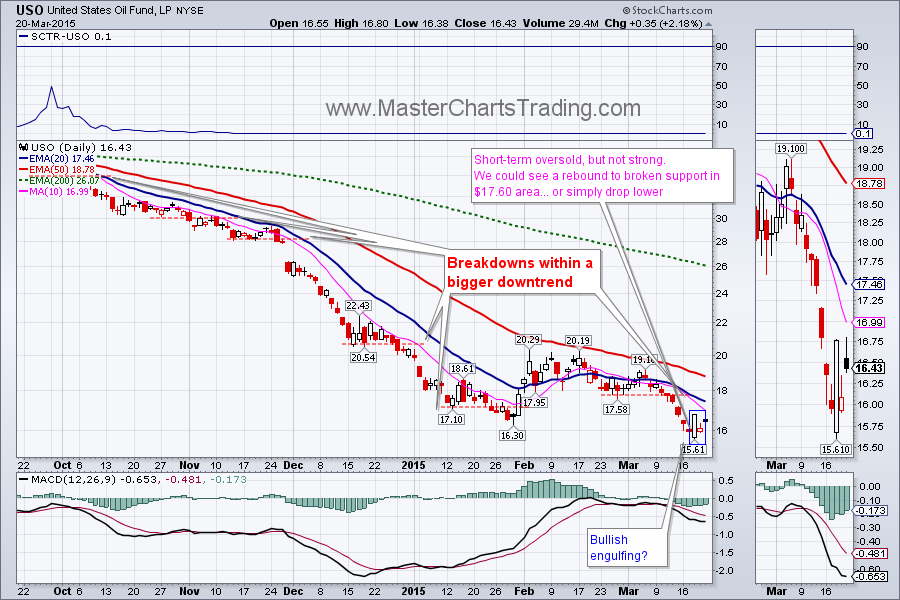

Open positions: SCO, TLT

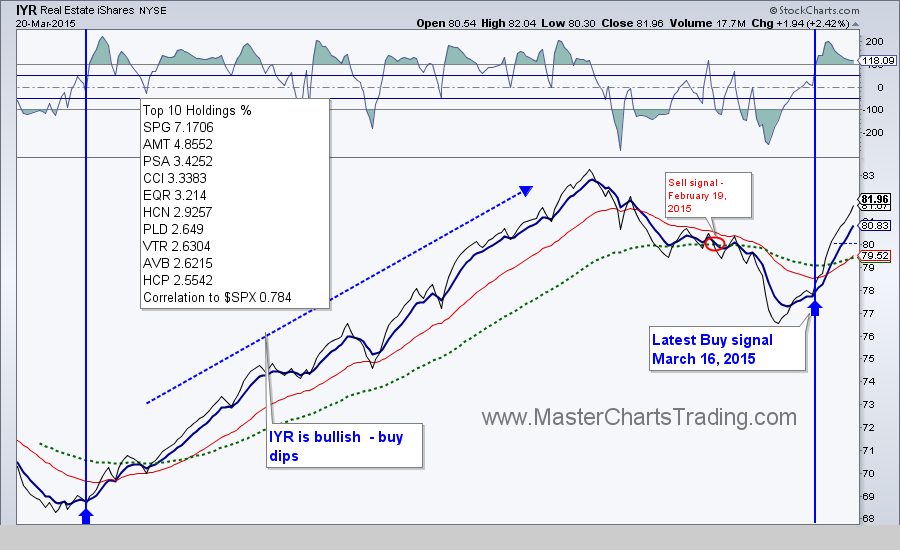

New position: SPY, IYR, XLU, ALKS, TTPH, NEM

Closed position: took profits in SCO

RSS Feed

RSS Feed