| www.MasterChartsTrading.com Friday, March 6 2015 Weekly Market Recap. The S&P 500 was down for the second week in a row. Friday’s losses contributed the most to the plunge, as $SPX fall almost 1.5% - on above average volume. We still have some of the position in SPY open that we entered on February 3rd, but we did take profits along the way. Watch on YouTube here | |

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

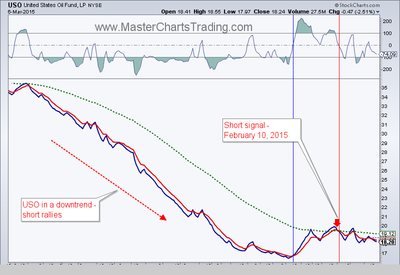

Open positions: SPY (took profits), SCO

New position:

Closed position: TLT

RSS Feed

RSS Feed