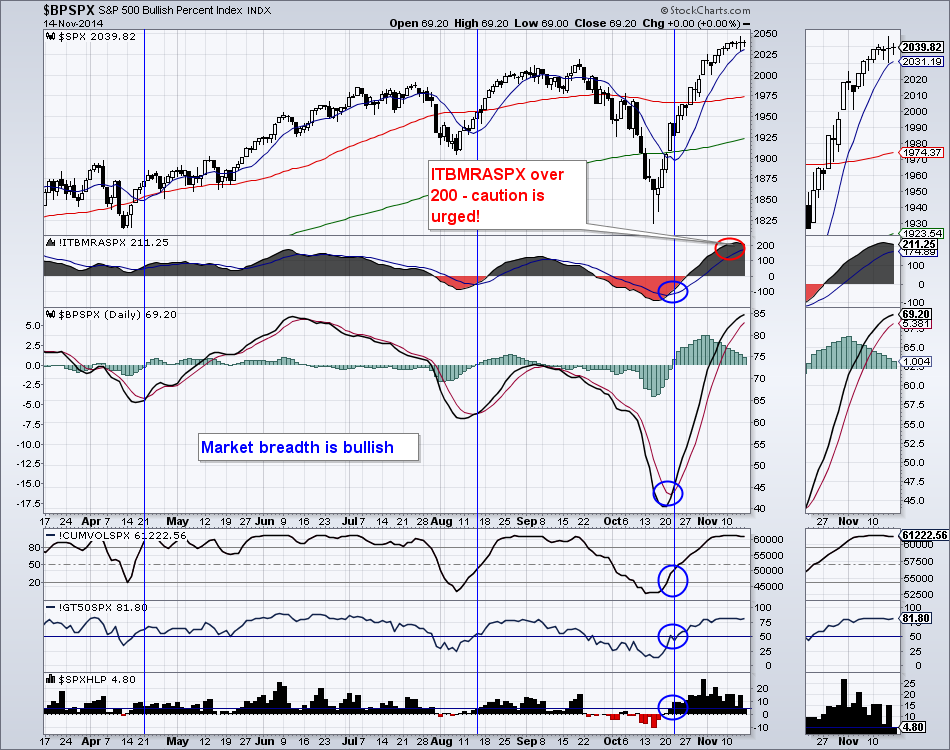

From our entry point on October 21st, we are up a little over 7% in S&P 500. The S&P 500 has been busy eking out new (marginal) all-time highs and this upswing may have overstayed its welcome. S&P 500 is extremely overbought on all indicators that I monitor: MACD, Commodity Channel Index, and the market breadth indicators such as ITBM (Intermediate Term Breadth Momentum Oscillator).

I covered ITBM in my previous video from November 10, when it first recorded a very rare reading of over 200. Looking back, I was only able to find 2 other instances of this high of a level. Both times a market decline followed.

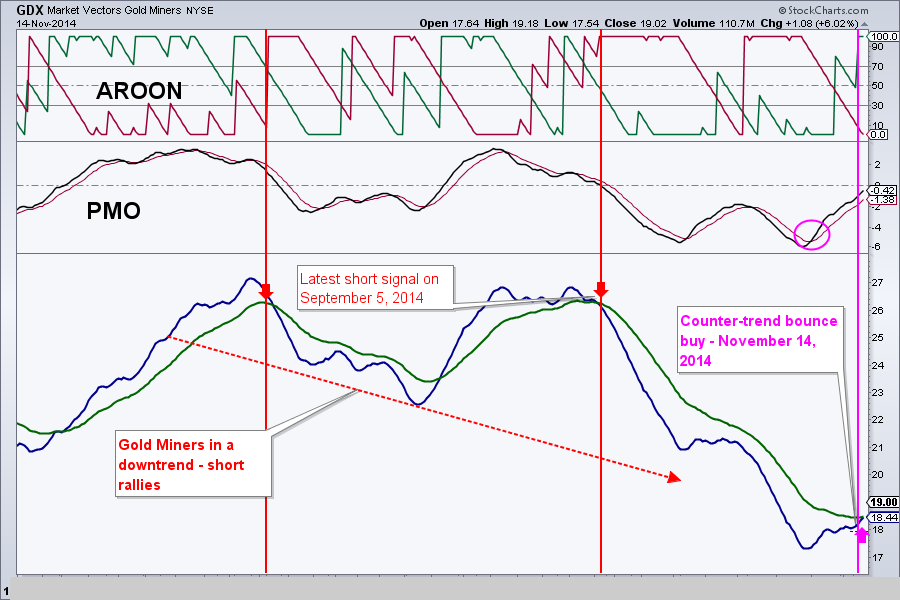

1. counter-trend bounce

2. GDX is a very volatile security

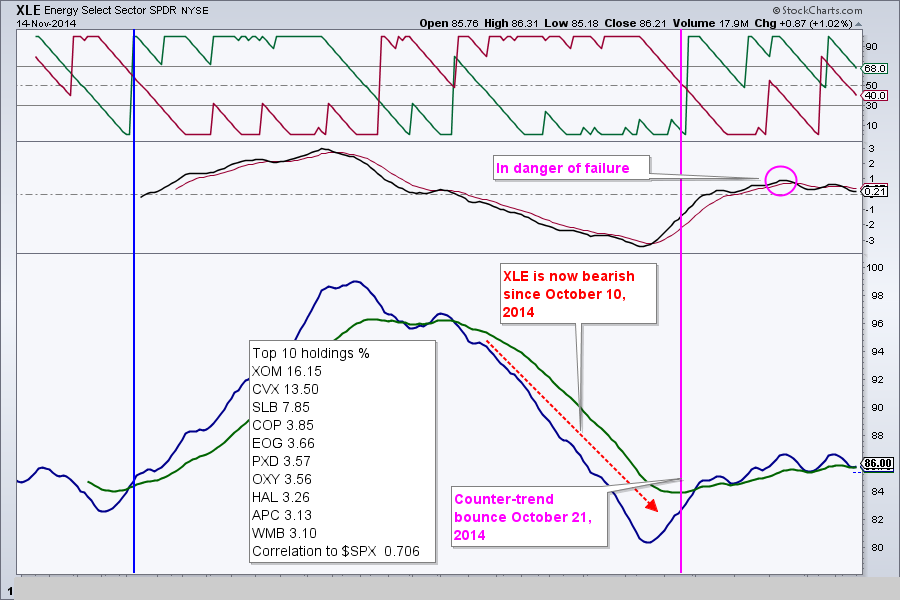

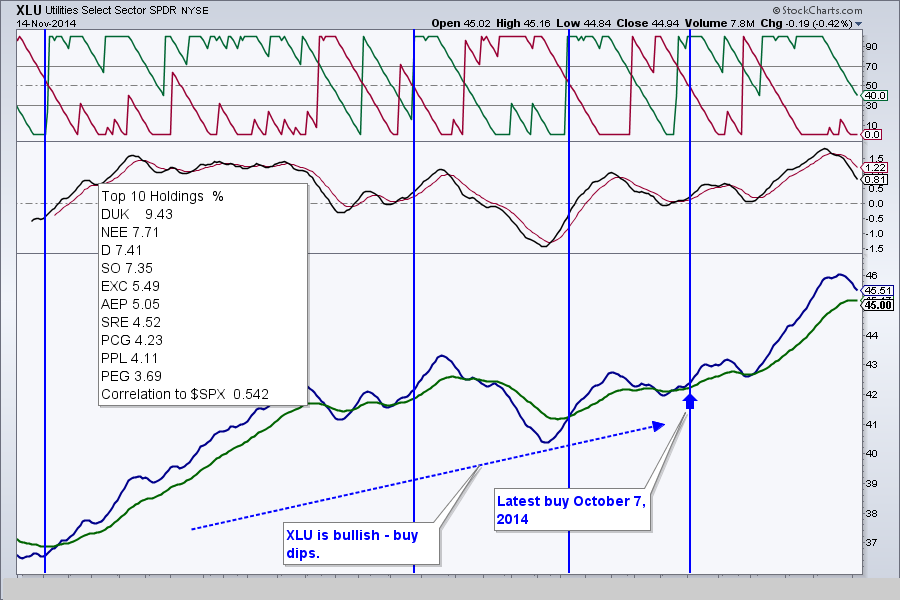

XLF came under some selling pressure/profit taking, while the rebound in XLE was rather weak to begin with - no doubt because of an unending slide in oil prices.

That’s it for this week. Thank you for reading and listening and have another great trading week!

Best Regards,

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed