Thursday, April 5, 2014

Gold is Looking Bullish. Stocks Take a Breather.

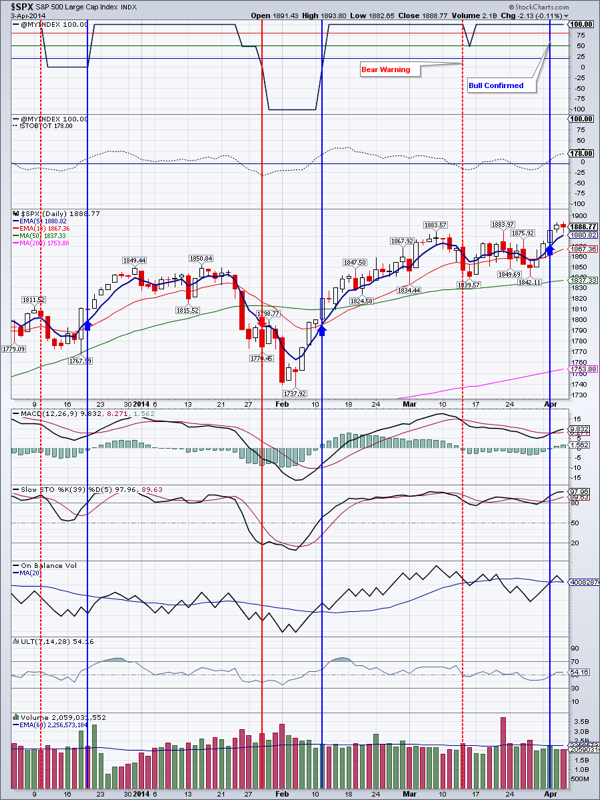

Stocks took a breather today. Large caps were slightly down, while the NASDAQ and the Russell underperformed by a wide margin. NASDAQ could easily roll over here.

Market Breadth Index is bullish. We increased our Large caps allocation two days ago.

TLT rebounded somewhat, but on weak volume. Today’s jobs report would undoubtedly cause a strong move, one way or the other. A close below the 50 day moving average (DMA) would cause selling to at least $104 (the 200 DMA).

EEM finally stopped advancing and printed a Hanging Man candlestick. Could this be the beginning of a throwback I mentioned several days ago? If yes, first support is around $40. Should that hold, it could be a great buying opportunity.

Gold is at a precarious junction. It is below both the 50 and the 200 DMA and about to have a Death Cross (when the 50 DMA crosses below the 200 DMA). It desperately needs to rally from here.

GDX printed a tiny Doji Hammer, but it looks more bullish then gold itself. It could either rally strongly from here, or should it close below $23.27, collapse to the $21 area. I believe that it will rally and have a NUGT position open.

IYR is taking a breather along with stocks.

Oil rallied more then 1 percent and looks poised to continue higher. First resistance is at $102.24

Natural Gas is in a middle of an oversold bounce. First resistance is at $4.57. But I am still bearish on it because it has been dropping since end of February. It is making lower highs and lower lows. Minimum downside target is $4.

Open positions: GDX, IYR, TLT, ETV, DVY, EEM

Hedging positions: NUGT, DGAZ

RSS Feed

RSS Feed