Stocks showed some resiliency on Wednesday, as major indexes dropped in am, but recovered by the close, thus forming hammer candlesticks. But indexes' indicators (PMO, OBV, STO) are still falling into oversold territory.

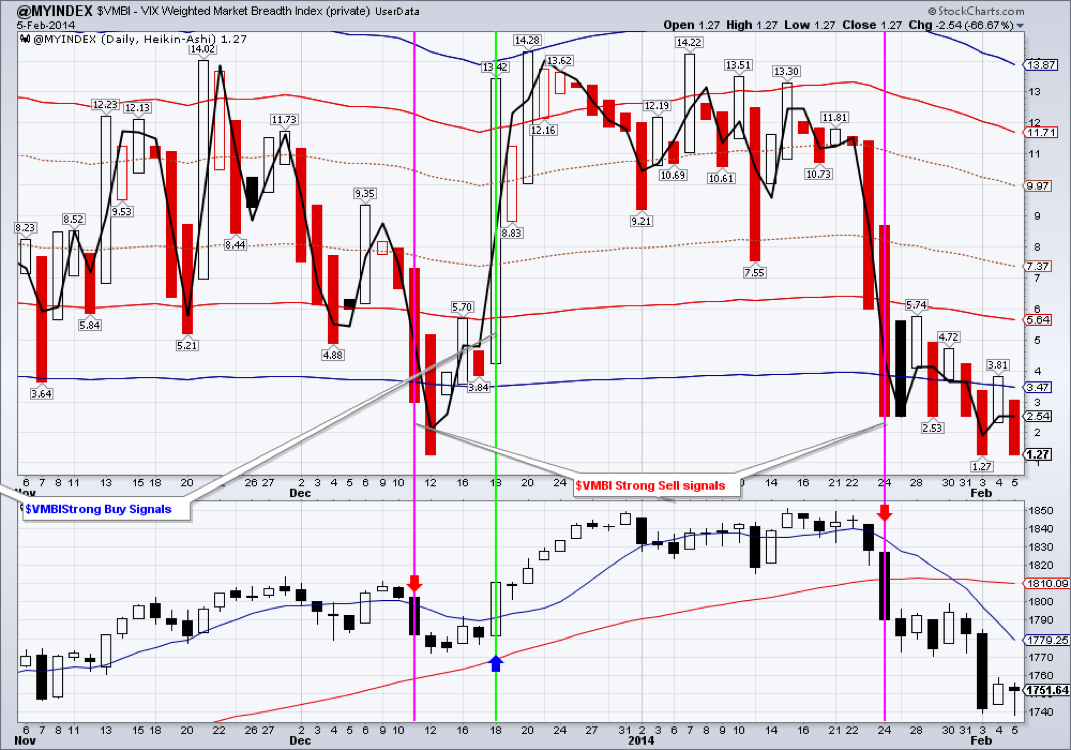

$VMBI, our proprietary market breadth index, is showing strongly bearish readings with no signs of reversal yet.

A rally in gold and gold miners may be running out of steam. GDX volume patterns are deteriorating, and its stochastic indicators are rolling over. Now could be a good time to lighted positions if there is no improvement soon.

Bonds have been outperforming stocks, but TLT sold-off quite sharply today and closed below its 10 day MA. It also broke its Inside Day range to the downside. Its PMO and OBV have turned down as well. Could it be that the employment report on Friday will be better then expected?

RSS Feed

RSS Feed