February 6, Thursday

Markets bounced up from oversold levels. $SPX gained 1.24%. Small caps lagged. Financials and emerging markets lead.

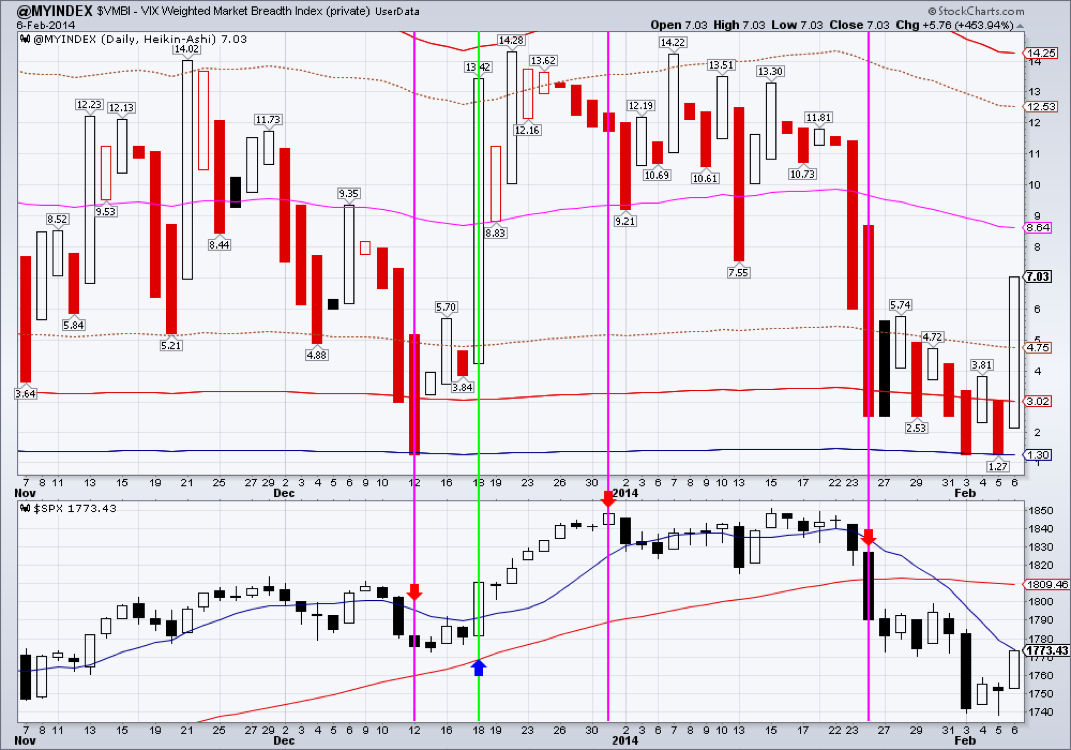

Market breadth, as measured by $VMBI, improved somewhat. A bullish reversal is not yet here, but it was a step in the right direction. We need to see a follow through in breadth before issuing a bull alert or confirmation.

TLTs firmed somewhat just above the 200 DMA with a hammer-like candle. Short-term momentum in bonds have shifted in the southerly direction. We are still waiting for a confirmation from PMO and OBV before selling/going short. This confirmation should come on Friday in a form of employment report. A miss in the employment could send TLTs back over the 10 DMA and possibly higher. While a positive report will most likely cause it to tank.

OBV pattern in GDX is showing selling pressure. If confirmed by PMO and a breakdown in $GOLD we will short this ETF.

RSS Feed

RSS Feed