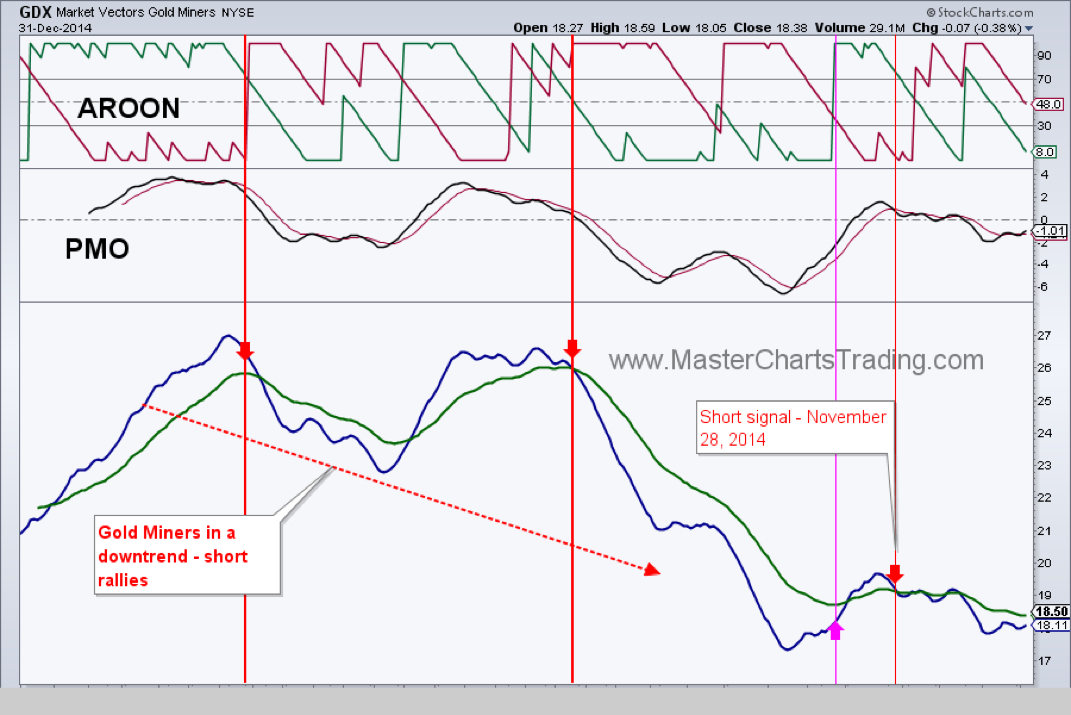

If the primary trend is down, then it is more profitable to "short the rebounds or rallies". In other words, when for some reason the security that has been in a long-term downtrend rises in price and then stops rising, you short it hoping it will go down. Example of shorting rallies is Gold Miners ETF . Since most people do not have a margin account that would be required to short, the simplest way of shorting, would be to buy an inverse ETF such as DUST.

RSS Feed

RSS Feed