Wednesday, March 26, 2014

(Insert Dramatic Title)

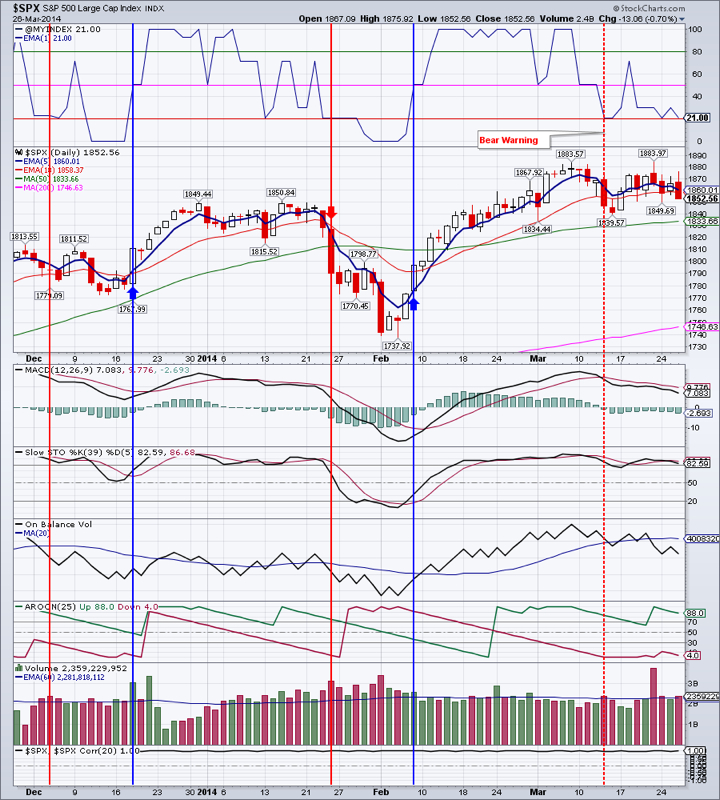

Many financial publications' headlines today highlighted the fact that both the NASDAQ and the Russell 2000 Small Cap indices closed below their 50 day moving average (DMA) and lost 1.43% and 1.92% respectively. This was on heavy volume. If that's not enough to kindle fear in the heart of a technical trader, they printed long red candlesticks and closed on, or very close to the day's lows. Large cap Standard and Poor 500 and the Dow Jones Industrial Average fared slightly better, only loosing 0.7% and 0.6%.

Market Breadth Index ($VMBI) deteriorated further. It is now barely in the territory where we are still holding a very small amount of equities. Today we further reduced our equity allocation and...

...Increased our TLT allocation. TLT gained about ¾ of a percent on decent volume, most importantly though, it closed above the February 1st high. Should this breakout hold through Friday, we could easily see prices in the $115-116 area. This would be bearish for stocks.

EEM ran into resistance (as expected) around $40. There is just not enough momentum in the emerging markets yet. A close above $40.22 is needed, preferably on a Friday basis, to get us interested in the emerging markets again.

Gold continued its downward slide. It is certainly not done correcting and prices as low as $1260 could be seen shortly. Should gold turn around after reaching that area, it could be a very nice buying opportunity.

GDX had a nasty day as well. We have pared our GDX holdings. Should GDX fall through $23, next support is around $21.50.

IYR is looking precarious again. A close below $65.89 would be bearish and a retest of 200 DMA, currently at $63.99 would be likely. We took profits to lock in gains on part of the holdings.

Natural gas is drifting sideways. As we mentioned before, we have a bearish bias, but it may rebound to around $4.50-4.80.

Oil may have possibly made a turnaround. It gained a little over 1% on a bullish candlestick. Should it close above the 200 DMA, the rising wedge/bearish flag scenario we talked about may be called into question. A close below $97.55 would continue this slide down to at least $95, but probably $91 area.

Bottom line: Even though our market commentary title may sound tongue-in-cheek, today's declines should be taken seriously.

Open positions: GDX (reduced), IYR (reduced), TLT (increased), DVY (reduced), ETV (reduced)

Hedging positions: SDOW, TZA, DGAZ

RSS Feed

RSS Feed