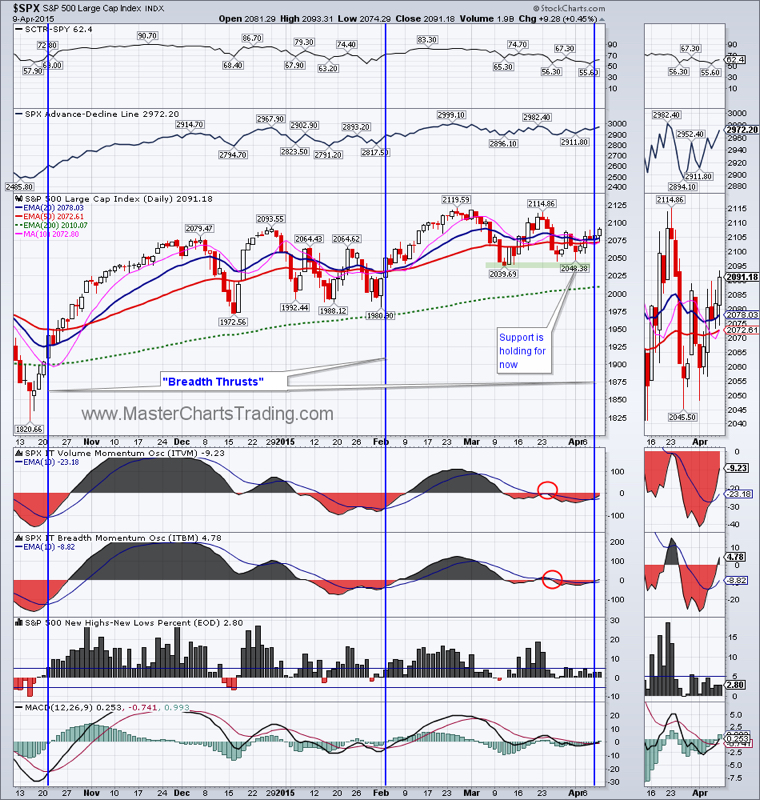

A lot has happened in the markets today.

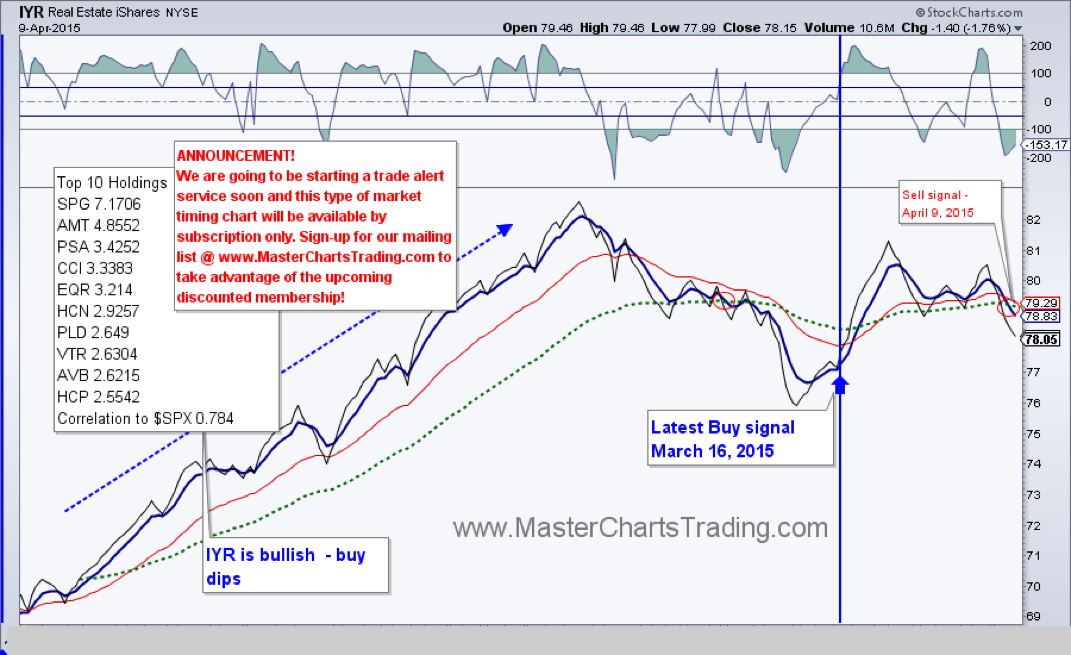

In my opinion, the most important event was the serious under-performance of the interest rate-sensitive sectors (and bonds themselves) and the relative strength in stocks.

Bonds (especially Treasuries), Utilities and Real Estate all sold off rather hard. We took profits in TLT and closed our positions in XLU and IYR. I mentioned the weakness in Utilities in my recent posts.

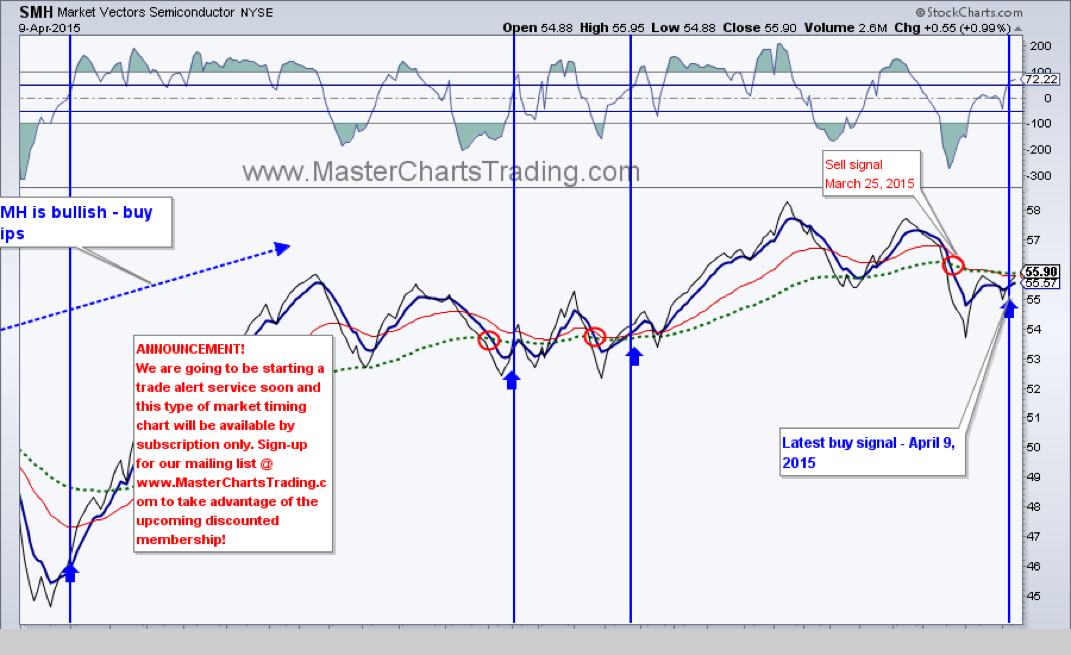

The semiconductors fund, SMH , rebounded and went on our buy signal.

While natural gas hit another 52 week low and remains in a long-term downtrend

Stay tuned for the upcoming market recap video on Friday/Saturday that will cover most of the major trends in the markets!

RSS Feed

RSS Feed