Tuesday April 15, 2014

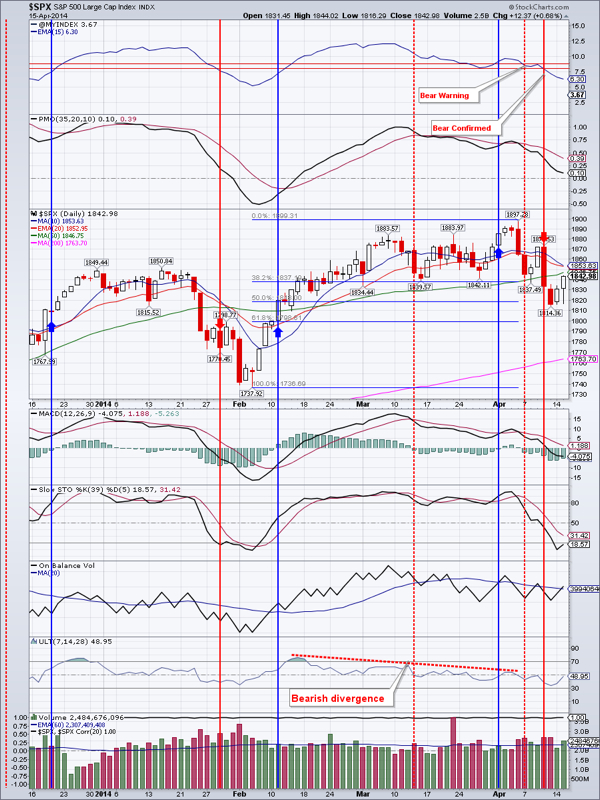

Is This a Rally Into Resistance?

Volatility continued. IWM and QQQ had a large range day. IWM gained and lost as much as 2.64%. It crossed the 200 day moving average (DMA) and finally printed a doji hammer above the 200 DMA. Hammers generally are signs of support. All indices are oversold, so a rally is likely, but will this rally take out the recent highs, or will it simply be a rally to the 50DMA followed by another leg down?

NASDAQ is certainly ripe for a rebound as are the small caps, yet so far there was no buy signal given by any of the market breadth indicators we follow. General market is still in a corrective phase as indicated by our Market Breadth Index ($VMBI) and other indicators.

Defensive sectors continued to outperform. Utilities, Consumer staples and the treasuries all gained. TLT is pushing higher, but is short-term overbought, so a retrace to around $109 is likely.

As I explained in my previous several newsletters, EEM is in the middle of a throwback to the $39-40 area (Fibonacci 61-38% retracements). Once it stops retracing and holds support, it would be a great buying opportunity.

Gold had a very bad day. At one point, it was down as much as 3%, before settling at $1302.70 with a 1.84% loss. If this rally in gold is to continue, gold needs to rally soon, preferably to above the 50 DMA.

I mentioned before that even though gold closed above the 50 DMA, GDX did not yet do so. Now the rising wedge formation that started on March 26 may have been broken to the downside. If true, GDX can collapse by around 15% and retest December 2013 lows.

IYR is pushing higher with an over 1 percent gain on good volume. There is some resistance in the $68.50-68.90 area, but I believe it will take those highs out.

Oil is consolidating. Resistance is at $104.55-105.22 area. It is likely to push above this resistance.

Natural Gas is getting closer and closer to closing below $4.52-my threshold for going short again

Bottom line: Markets are ripe for a rebound, but no buy signal has been given yet.

Open positions: GDX, NUGT, IYR, TLT, EEM

Hedging position: SPXU

RSS Feed

RSS Feed