Tuesday, May 6, 2014

IWM Fails Mini-Upswing

Markets have run into resistance and closed lower. Market breadth was significantly negative. Small caps closed below the 200 day moving average (DMA) and our bullish argument may be coming into question.

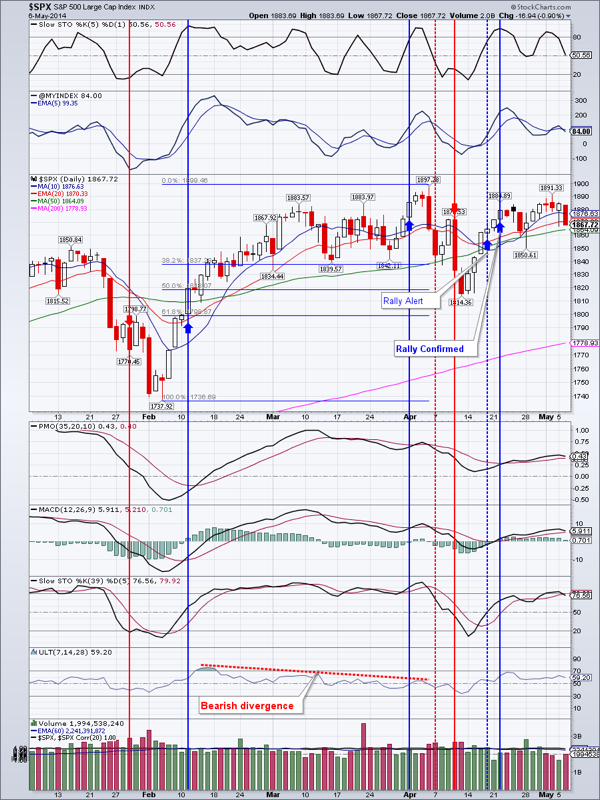

$SPX lost almost 1% and is currently at first support, I don’t think it will hold. Next support is at the 50 DMA (1804)

DIA slightly weaker then SPX. Good support is at $162.78

IWM lost 1.63% and is likely now to break support at $108.66

QQQ lost over 1%. It is much stronger then IWM, but is likely headed down to the 200 DMA also

TLT: 3rd inside day in a row. Get ready to see some strong movements…either up or down. First support is around $111

Gold looks to be consolidating with an inside day a close above $1315.80 would be rather bullish

GDX a close above $24.67, or better $25.34 would confirm a bullish breakout

IYR is overbought and near the highs. I expect profit taking very soon

EEM is attempting to continue its rally, but is having a hard time. Lower prices are likely first before we see higher prices.

Oil: more sideways action. A break below $97.55 would be bearish and a retest of January lows likely

Natural gas: Sideways action with a bullish bias. A breakout above $4.85 would be rather bullish

Open positions: IYR, TLT, EEM, DIA, NUGT, UGAZ

Closed position: TNA

RSS Feed

RSS Feed