Tuesday, March 25, 2014

Market Breadth Has Not Improved.

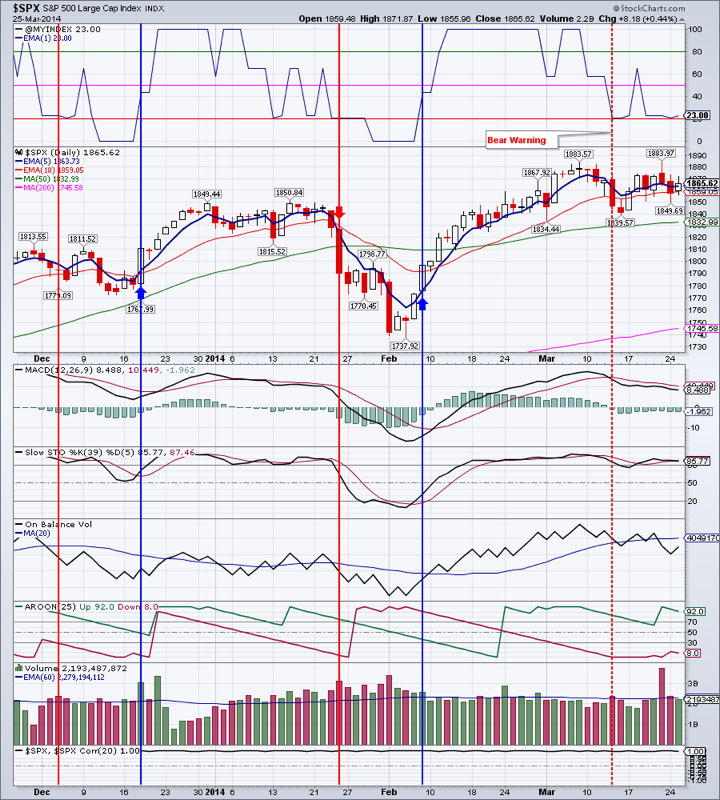

This market upswing that started February 5th, is likely coming to an end. Sideways action may continue for a while longer, but the markets need to flush out the “weak hands”, re-test the 50 day moving average (DMA) and renew the push higher. Market is bullish - no doubt about it.

Market breadth has been steadily deteriorating since the end of February. Our Market Breadth Index, the $VMBI, is barely positive and we are in a Bear Warning. We are certainly not increasing our equity allocation now. On the contrary, we have been steadily selling into strength and buying bonds.

TLT has done extremely well since the beginning of 2014, gaining over 8%. A close above $109.18, preferably on a weekly basis would likely cause a run-up to the $117 area.

IYR seems to be consolidating with a bearish bias, but there is decent support in the $65.89 area. A close over $68.54 would continue this rally.

EEM has been on a tear for the past 4 trading sessions gaining over 4 percent. The acid test comes now. Will it close above the 200 DMA and hold? Should EEM breakout above $40.22, we will once again become interested in emerging markets.

Gold is correcting into the Fibonacci retracement area of 38.2-61.8%. This is a rather large area as you can see, but keep in mind that gold has been in a steady uptrend since late last year, without a single correction. So a retracement into the $1261-1312 area is healthy before the next leg-up. We are currently at the 38 percent retracement. The good news is that gold just had a Golden Cross occur on its chart. This happens when the 50 DMA crosses above the 200 DMA - a bullish development.

Natural Gas, as we mentioned was very oversold and rebounded over 2%. Rebound is likely to continue at least to $4.54 area. We took profits on our DGAZ position yesterday.

Oil seems to be etching out a rising wedge/flag, which is a bearish pattern. As we have pointed out before, we expect lower prices ahead for oil. A retest of January low is likely.

Open positions: GDX, IYR, TLT, DVY (very small position), ETV (very small position)

Hedging positions: SDOW, TZA, DGAZ (took profits)

RSS Feed

RSS Feed