Wednesday, April 2, 2014

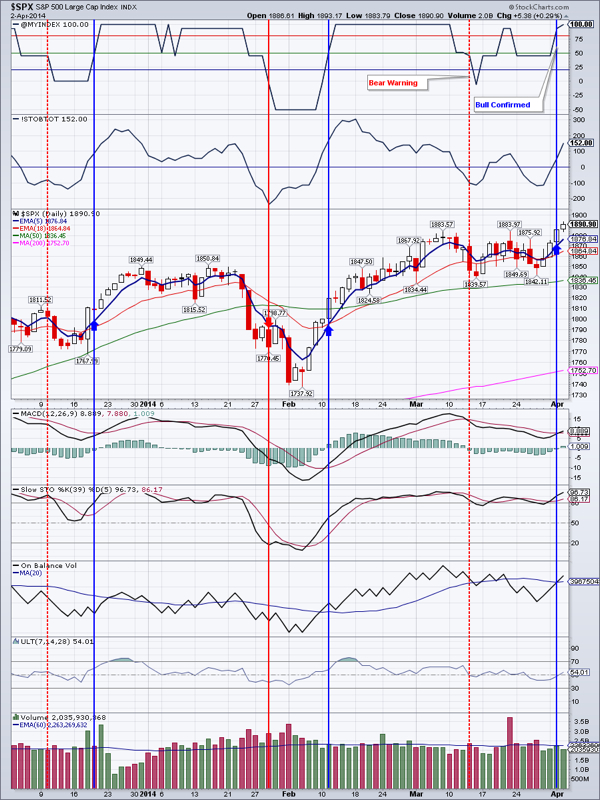

Market Breadth Index Predicts Higher Prices Ahead

Our in-house Market Breadth Index, the $VMBI, has flipped into strongly positive territory. In the past this indicated that the general markets are going to be going up. $SPX made a new high, while NASDAQ, the Dow and the Russell are playing catch-up.

Emerging markets had had 10 upside days in a row. It is clear that throwback is very near. This should be a good buying opportunity once the uptrend has resumed.

TLT may have found support. It is very important that it stay above the 50 day moving average (DMA), currently at $107.27. Otherwise a drop to at least 200DMA or maybe even the January lows is very possible.

GDX is leading gold’s rebound. It gained 2.66% yesterday. We have opened a small NUGT position to play this rebound

Gold gained about ¾ of a percent, albeit on rather meager volume. $1277.40 should now act as support, but I would not be surprised to see a hammer candlestick with its tail somewhere in the $1260 zone. Should gold close below $1260, we could see prices as low as $1186 soon. There is, however, decent support in the $1245 area.

IYR is putting on a stellar show again. It just had a bullish MACD crossover, so higher prices are very likely

Natural gas gained 2.49%. I still have bearish bias on natural gas.

Oil may have found support around $99 following 3 days of price drops. There is strong support in the $97 area, but if that gives, we are almost certainly headed to the $91 area.

Bottom line: Markets are making new highs on good breadth

Open positions: GDX, IYR, TLT, ETV, DVY, EEM, NUGT (new small position)

Hedging positions: DGAZ, SDOW (closed with small loss)

RSS Feed

RSS Feed