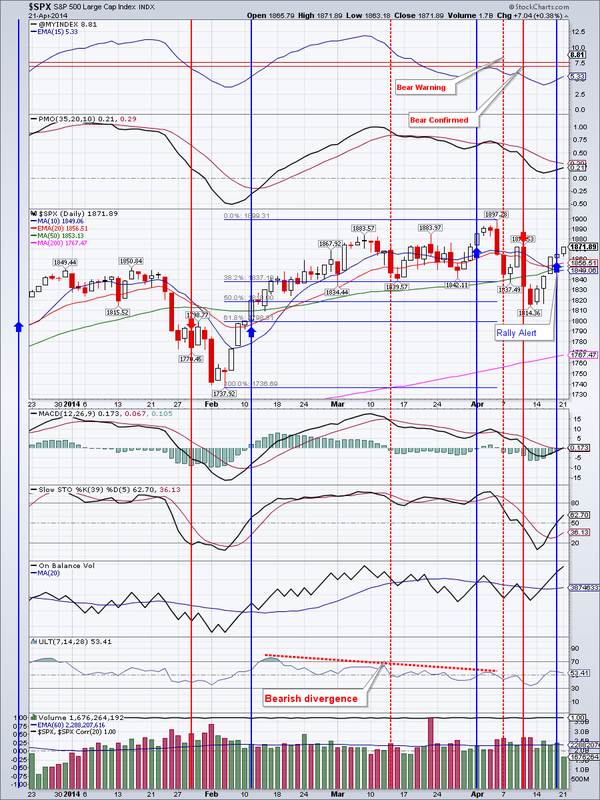

Market Breadth Signals More Upside.

Major indices gained today, although the volume was way below average. Markets lack strong conviction.

Market breadth is improving steadily and return to a bull phase could be just one or two positive days away. We have added to our longs by opening a position in QQQ.

TLT so far did not confirm the bearish engulfing pattern from Thursday, but it did have an inside day. A close below $109.70 would be bearish. Alternatively, a close above $111.45 would continue the uptrend in treasuries that started in late December.

EEM had an inside day as well. The MACD is negative while OBV and PMO are rolling over. A close below $42.01 would further my call for a revisit of $39-40 area. This revisit should be a nice buying opportunity once buying has resumed.

The following points are regarding Gold:

First the positives.

a. It may have found support in the $1290 area

b. This support is within the 38-62% Fibonacci retracement zone from its May 17 peak

c. Gold is short-term oversold

The negatives:

a. Gold broke the rising wedge formation with a sharp decline on April 15.

b. All momentum oscillators (MACD, PMO, Stochastic) are negative

c. On Balance volume is making lower peaks and troughs

Should gold close below its April 1 low at $1277.40, I believe a flood of selling would occur and prices may retest the December lows

GDX may have found a temporary support today and printed a hammer candlestick. Since it did not close below $23.27, we did not add to our open DUST position.

IYR is pushing higher and the momentum is bullish.

Oil had a second inside day in a row. This action usually precedes a strong move ... either up or down. First support is at $103.34

Natural gas looks bullish, but closed below the 50 DMA today. It may be developing into a bullish flag formation with the last Thursday's long white candlestick as the flagpole. Next several days should confirm Thursday's breakout.

Open positions: TLT, IYR, EEM, DIA (added to position), TNA (added to position), QQQ (new position)

Hedging positions: DUST

Bottom line: Markets are rebounding and we added to our longs

RSS Feed

RSS Feed