|

*Programming note! We will now have (hopefully) a regular blog and video input from my wife Marie Felberg, who is a practicing clinical psychologist and a life coach! As you have undoubtedly learned the hard way, emotional control is of paramount importance to traders. Her coaching methods are very effective in helping traders keep the emotions in check, manage risk, and improve profitability. Check out Dr. Marie Felberg, Psychologist/Life Coach site! |

|

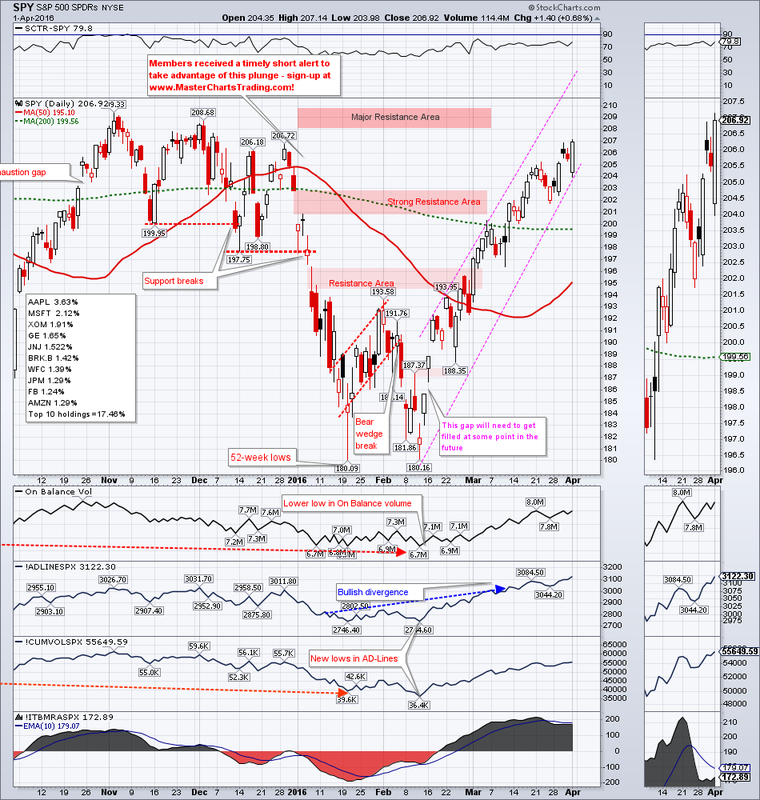

It is, however, one thing to have the model tell you to go ahead and look for shorting opportunities, and a completely another one to time a short entry. So far all attempts by the bears to regain control of the tape have ended in tears. As SPY approaches previous peaks in the $207-$209 area will the bears finally succeed in regaining momentum?

CHART OF SPY

One thing that has been sorely lacking from this rally is volume. I follow two important volume-based indicators: the Advance-Decline Volume Line and the On Balance volume. Both failed to break out above previous peaks from November. If they did, I would have been much more bullish by now. This could all change at any time and we must keep an open mind about all outcomes.

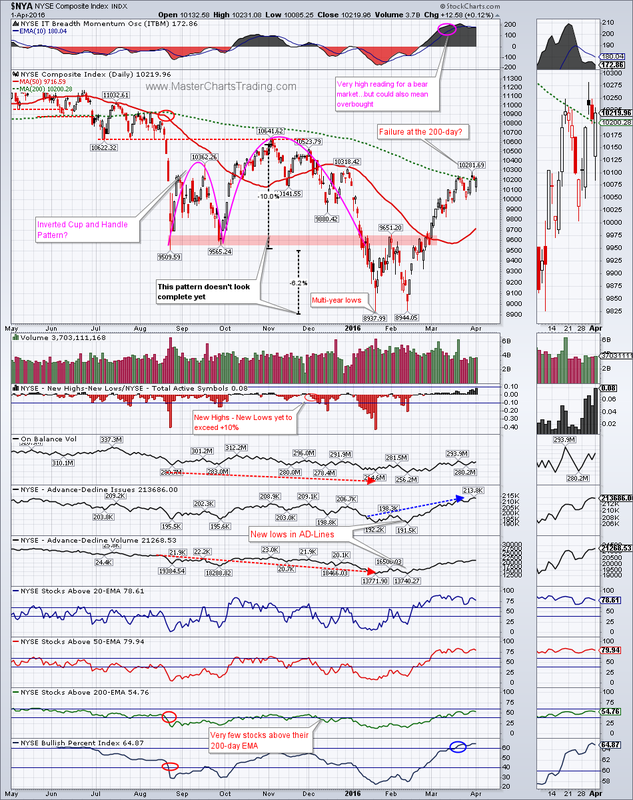

CHART OF $NYA

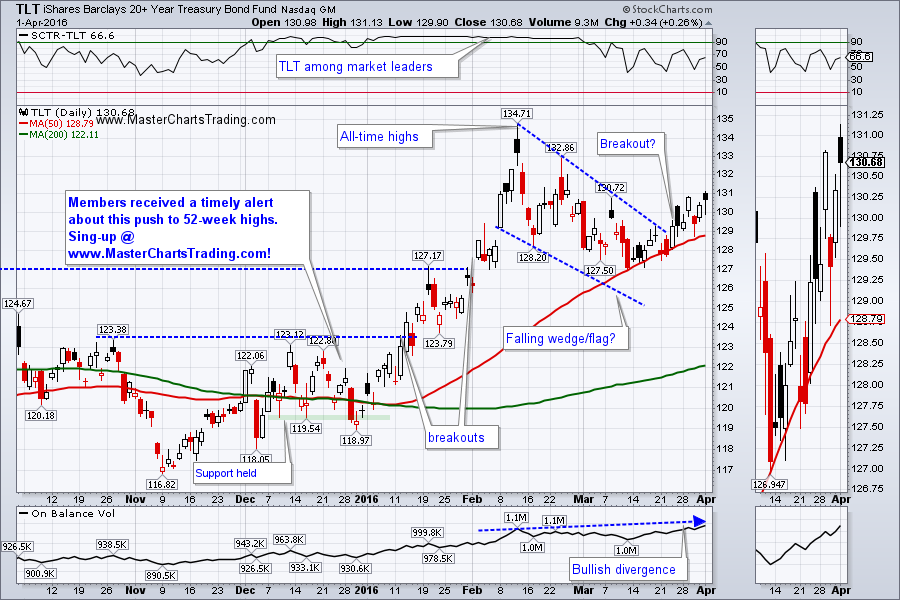

CHART OF TLT

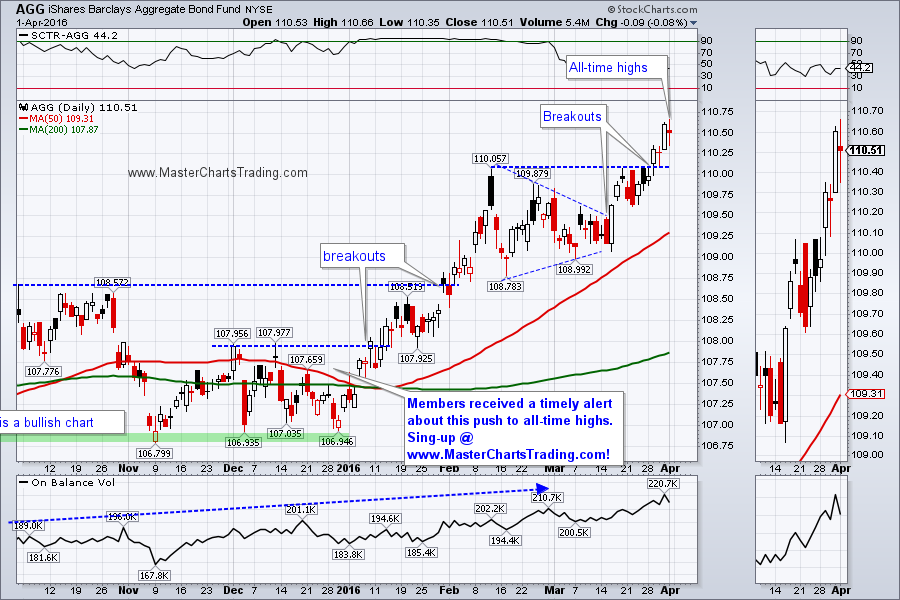

Similar patterns are evident on the chart of AGG as it hit all-time highs just this Friday.

CHART OF AGG

LONG-TERM CHART OF AGG

CHART OF $USD

On the weekly chart, DXY is currently at the bottom of the falling channel defined by the “handle” of the Cup and Handle formation. This would be a good place for DXY to rally. Should it fail here, a retest of the all-important 92.52 support leel would almost be guaranteed.

LONG-TERM CHART OF $USD

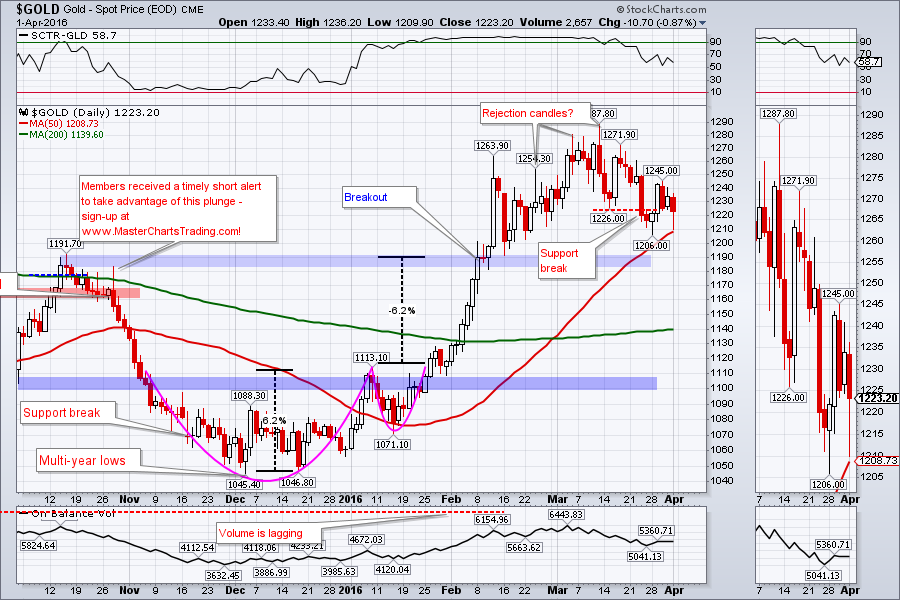

GOLD CHART

GDX is similarly bouncing around near the recent peaks. We had two Inside Days recently. One of them resolved to the upside, while the other one hasn’t resolved yet. If gold decides to go down, GDX would surely follow. I am watching the $18.50 level for a support break. If that gives, we could see a breakdown further to the $16.90 levels.

CHART OF GDX

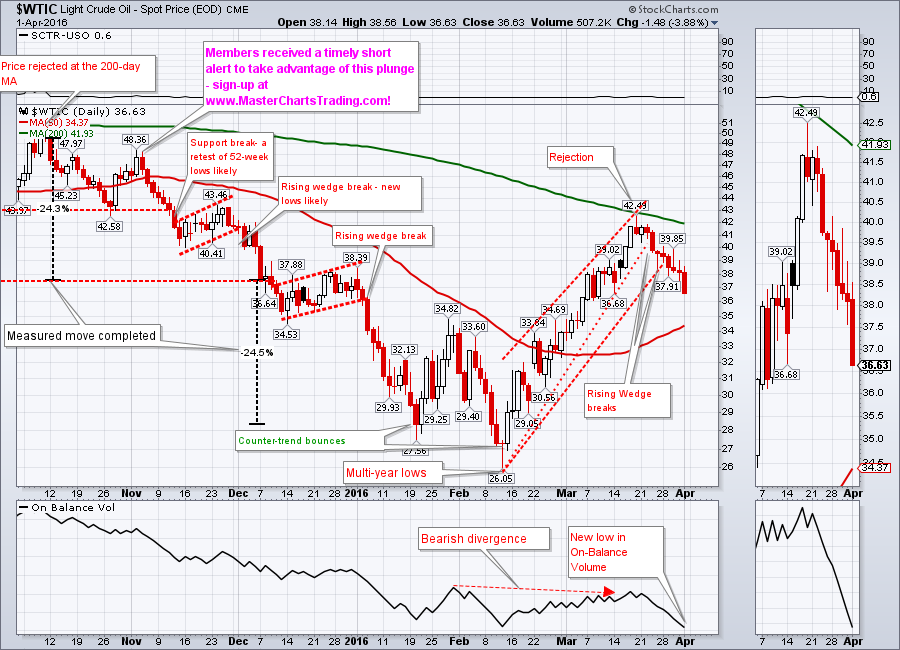

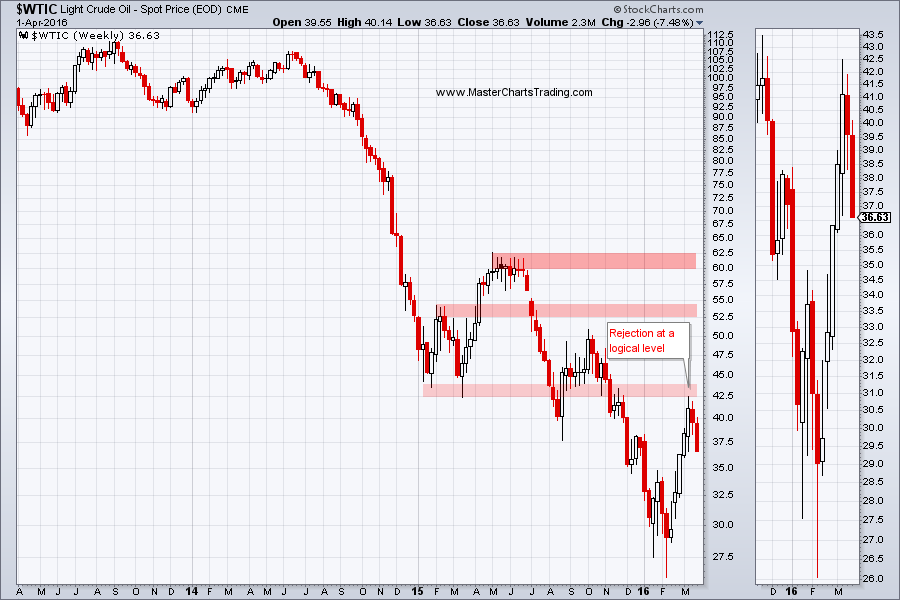

Long-term chart of oil shows rejection at a logical level of $42.50. This is the level where oil held support on two occasions in 2015, but ultimately broke it twice later same year.

CHART OF $WTIC

LONG-TERM CHART OF $WTIC

More significant resistance is around 2.315 and the very important one is at 2.50.

CHART OF NATGAS

Long-term picture hasn’t changed much, so I am quoting from last week. “The 2.50 level is of a particular importance because it is around there that NATGAS failed last September. It is also around 2.50 where the price was rejected in January. Currently there several bullish divergences present on the long-term chart of NATGAS (price made a lower low, but indicators made higher lows).

As of the writing of this blog post, I still consider NATGAS a bearish security and by extension only looking for short setups. Should NATGAS manage to break above 2.50 and hold on a retest my posture would change to a bullish one.”

LONG-TERM CHART OF NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed