|

www.MasterChartsTrading.com Friday, April 10, 2015 Weekly Market Recap.

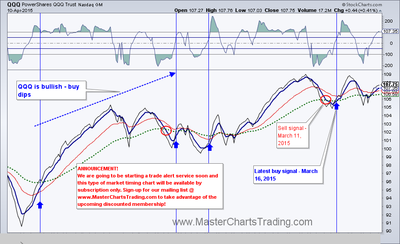

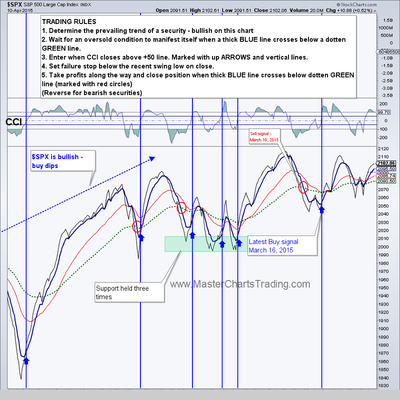

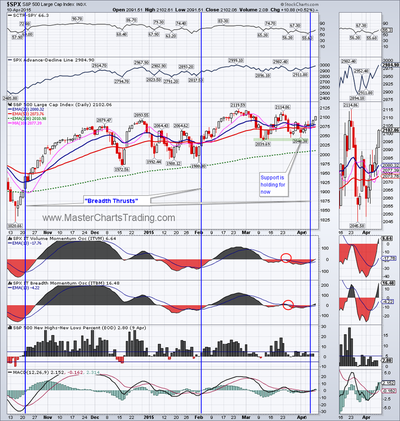

Last week, on Good Friday, the $SPX futures dropped hard and I was worried that we will get a gap down on Monday. Clearly the markets fooled everyone and Monday was a very strong day for $SPX. This week brought welcome relief to the stock market bulls. $SPX bounced off the support from early and mid-March and continued higher. $SPX is up 1.7% for the week. The NASDAQ 100 ETF – QQQ followed suit with a 2.5% surge. Charts for SPX and QQQ here |

|

A breadth thrust occurred on both SPX and QQQ this week. This means that the stock market has changed direction for the bullish and not yet overbought – another welcome sign for the bulls. We could retest the February highs shortly.

Bonds of all sorts were under pressure entire week. TLT lost 0.85% and almost retraced its entire breakout. TLT did not yet give us a sell signal, but we did lock in profits and moved the stop to entry. TLT charts at bottom of page here

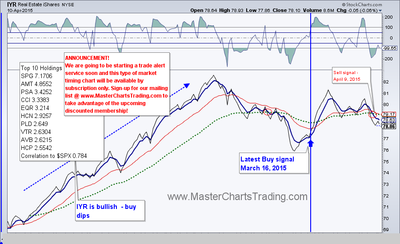

I highlighted weakness in the Utilities sector in a couple of my previous posts. A bearish divergence of sorts is taking shape on the graph of XLU. The underlying AD lines are making lower lows, while XLU itself is making higher lows. Also the price of XLU was rejected at the 50-day exponential moving average (EMA) for 5 times! XLU is still bullish long-term, but should bonds drop more, Utilities may follow suit. Anyway, there are stronger sectors out there to invest in. XLU and IYR charts at bottom of page here

GDX – the gold miners ETF is following gold as well, but in a more volatile fashion. There was a couple of decent shorting opportunities in mid-March and again in mid-April, but they were both very short-lived and not confirmed by gold itself. For now GDX is in a short-term uptrend that could take it to around $21 where the 200-day EMA currently resides. If at that point our timing charts trigger a short signal, I would be more inclined to play GDX on the downside (provided gold confirms).

Another thing going for GDX is a bearish divergence between GDX and its underlying AD Lines. I wrote a post about this recently. Since then the divergence has gotten worse. GDX is making higher lows, while its AD Lines are making lower lows. Did I mention GDX is bearish long-term, so a bearish resolution of this rebound would be more likely?

Gold and gold miners charts are located here

Commodities charts located here

Commodities charts located here

Best Regards and have another great trading week!

** Special Announcement**

We are weeks away from launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership!

Alexander Berger (www.MasterChartsTrading.com)

Disclaimer, we have:

Open positions: SPY, LULU, TLT (took profits)

New position:

Closed position: ERY (stopped out), IYR (took profits then closed), XLU (took profits then closed)

RSS Feed

RSS Feed