|

Stocks managed to close the week with marginal gains: $SPX gained a little under ¾ of a percent, while QQQ and IWM held support and is ready for a bounce higher.

Wednesday’s action in many major indices highlighted the importance of waiting for the closing price. Intraday $SPX was down as much as 1.55%, yet after all was said and done the index closed up about 1/10th of a percent. This was a hammer candlestick forming for the day – a classic sign of a reversing downtrend. Thursday $SPX retested the hammer and Friday, I believe, we began the advance higher. $SPX is set for a push to new highs provided other indices cooperate Charts for SPX, QQQ and IWM |

|

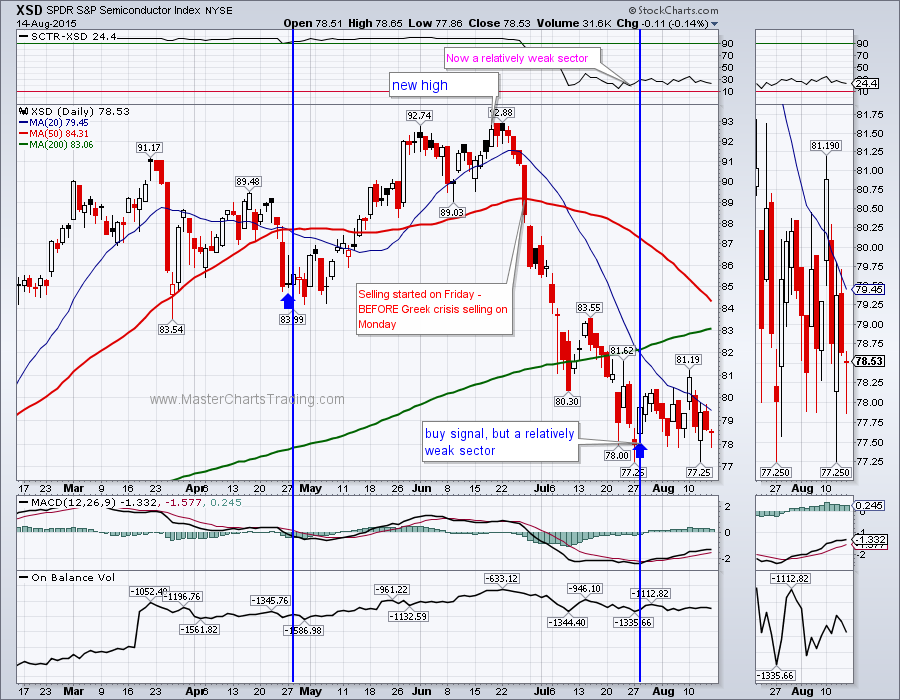

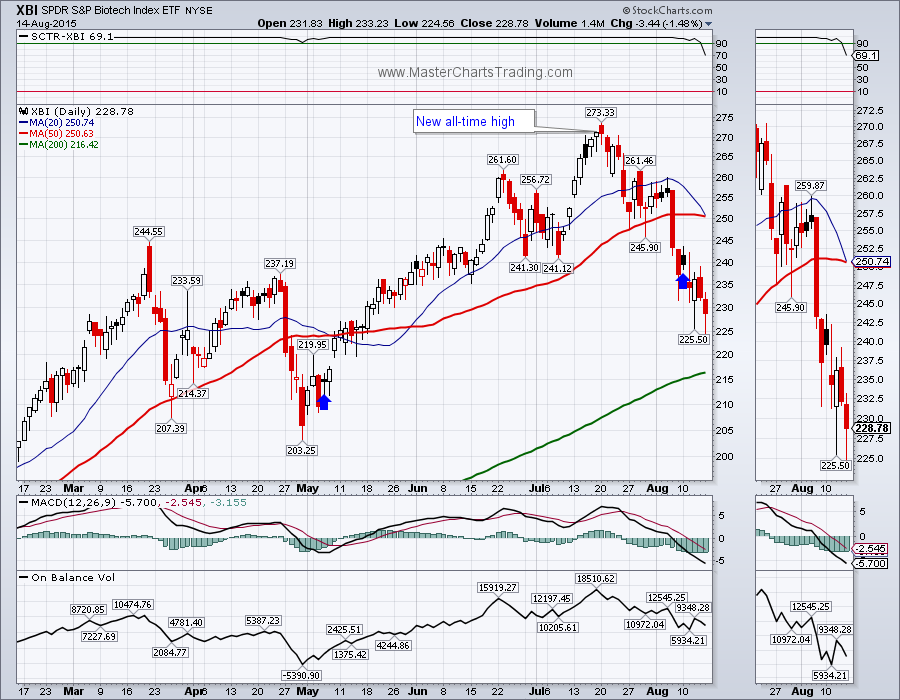

Two sectors that are weighing on QQQ are Semiconductors (XSD) and Biotech (XBI). QQQ is composed of about 15% biotech related firms and about 7% semiconductors related firms so weakness in these sectors is translating into confused price action for QQQ.

Charts for gold, silver, platinum, palladium and gold miners

That’s it for this week’s market recap,

Best Regards and have another great trading week!

** Special Announcement**

We are close to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed