|

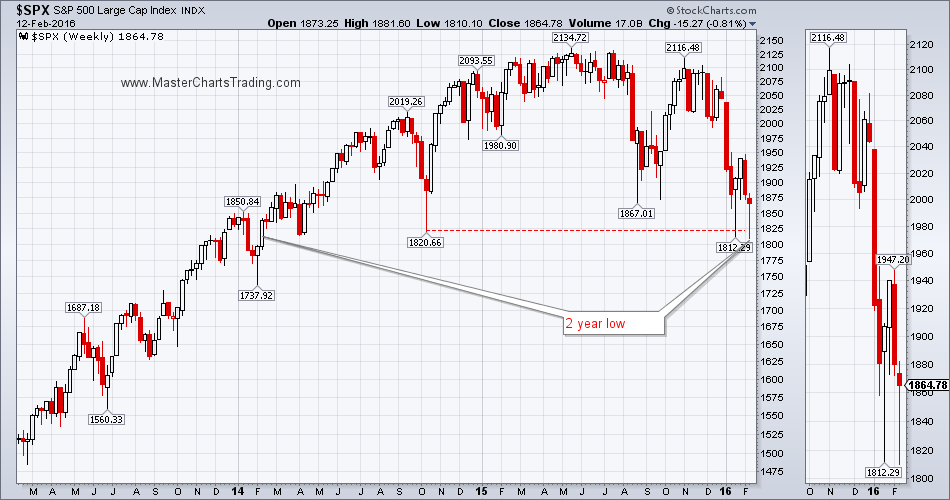

S&P 500 hit a two-year low on Thursday and then bounced strongly on Friday. Could this be the beginning of the long-awaited oversold bounce? Many signs are pointing towards it. For me, should this bounce materialize, it would be an opportunity to get short, as I am certainly not looking to bottom pick. Many traders attempt to pick bottoms in down trending stocks only to find their trading accounts shrink.

CHART OF $SPX |

|

Many of the market breadth indicators for $SPX just hit new lows for the move. The On Balance volume, the Advance-Decline (AD) Line and the AD-volume line are all pushing lower. This is all confirming a long-term bearish posture. As I mentioned above, for now I am treating this rebound as a counter-trend rally.

What will it take for me to turn bullish? We need to see a strong, broad rally that would turn many of the indicators I am watching into the bullish territory. Then a pullback would provide for a good entry opportunity for me.

CHART OF SPY

Unfilled gaps on chart of SPY

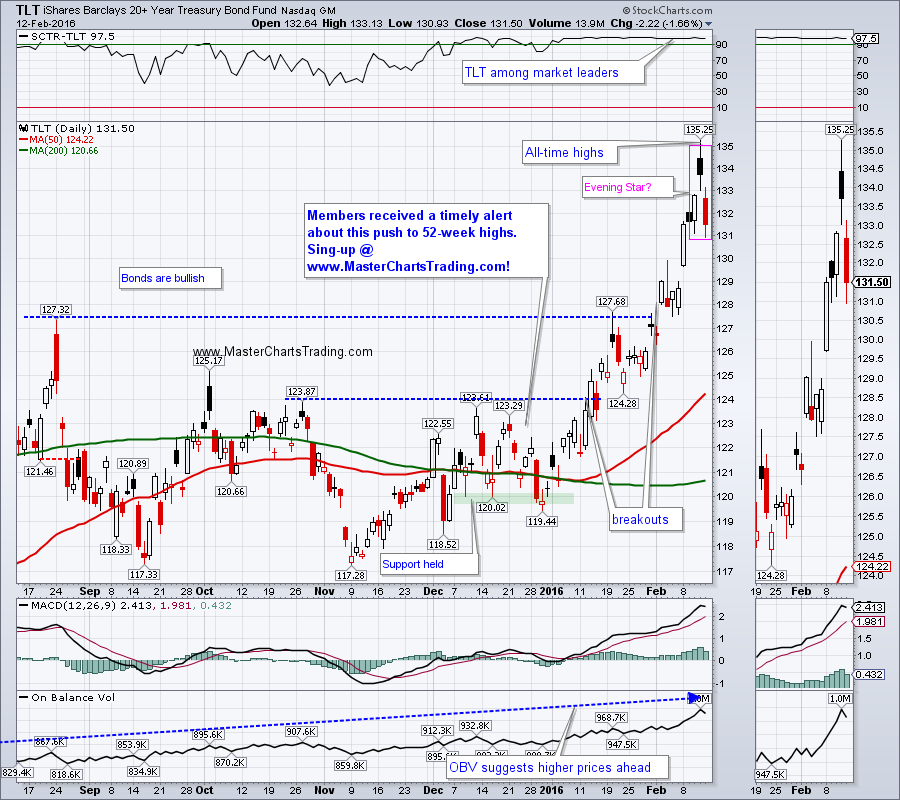

CHART OF TLT

LONG-TERM TLT CHART

CHART OF $USD

Now the long answer…

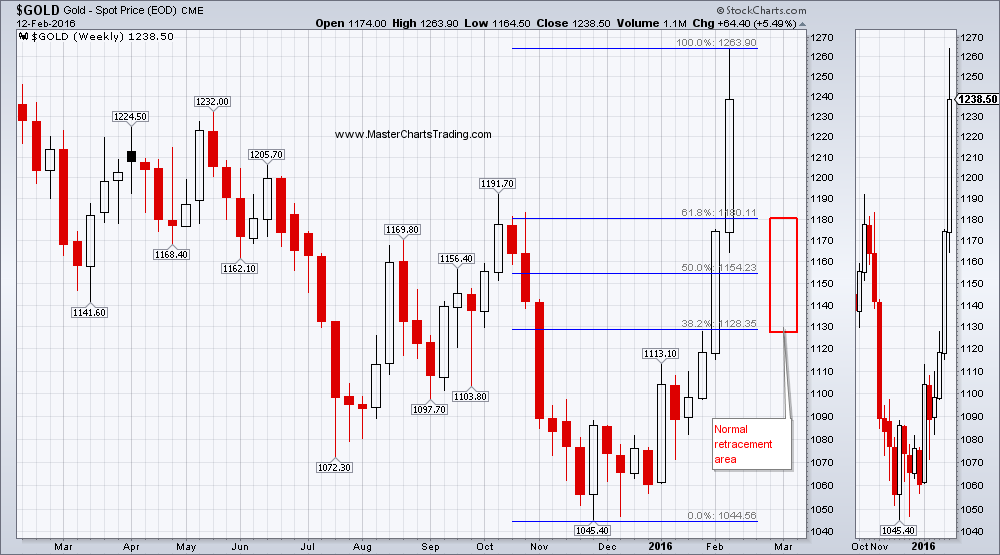

Gold bottomed out in early December of last year at $1045.40. If you were lucky enough to buy at the very bottom and exit at the very top in just 2 month, you would have made around 21%. One doesn’t have to be a market professional to see that gold is extremely overextended to the upside in the short-term. So even the ardent gold bugs would agree that at the very least a short term pullback is in order.

GOLD CHART

LONG-TERM CHART OF GOLD

CHART OF GDX

1.A 50-day moving average cross above the 200-day moving average

2.Bullish Percent index surge above 80

3.My in-house Gold Miners in an uptrend indicator cross above the bullish threshold.

As of the close on Friday, February 11 there were zero of the above three in the bullish camp. Until more improvement manifests, I will treat this “breakout” as a bear-market rally.

CHART OF $WTIC

Interestingly, the Brent benchmark for crude oil did not make a lower low, unlike its US West Texas Intermediate counterpart. We could potentially read it as a bullish divergence.

CHART OF $BRENT CRUDE

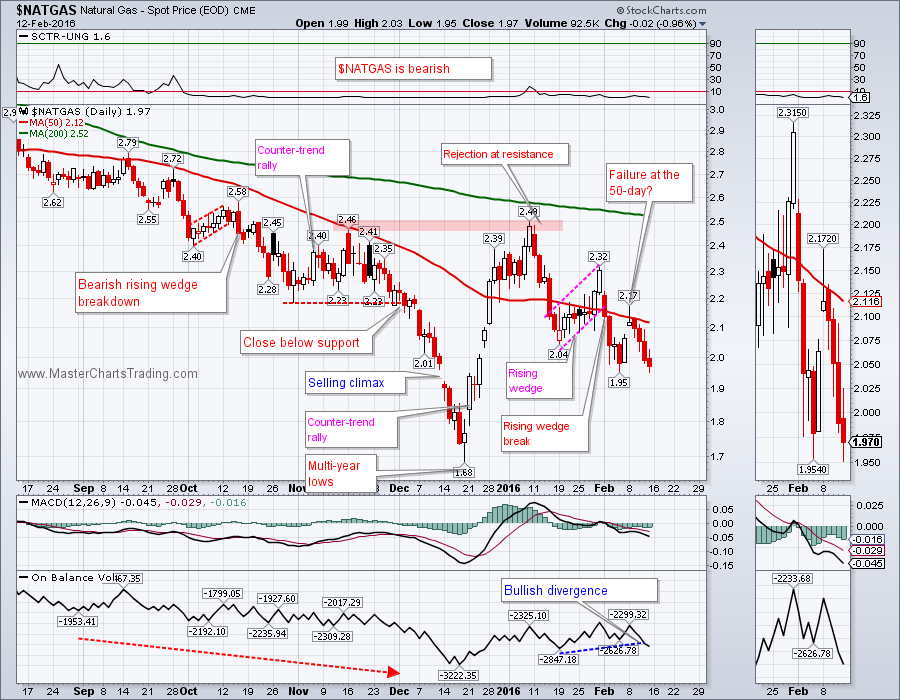

CHART OF NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed