|

There was lots of excitement this week as S&P 500 gained 2.84%. Is this a beginning of a new bull market, or a mere pause before another leg down? Let’s try to look at the market objectively and attempt to ascertain what is going on.

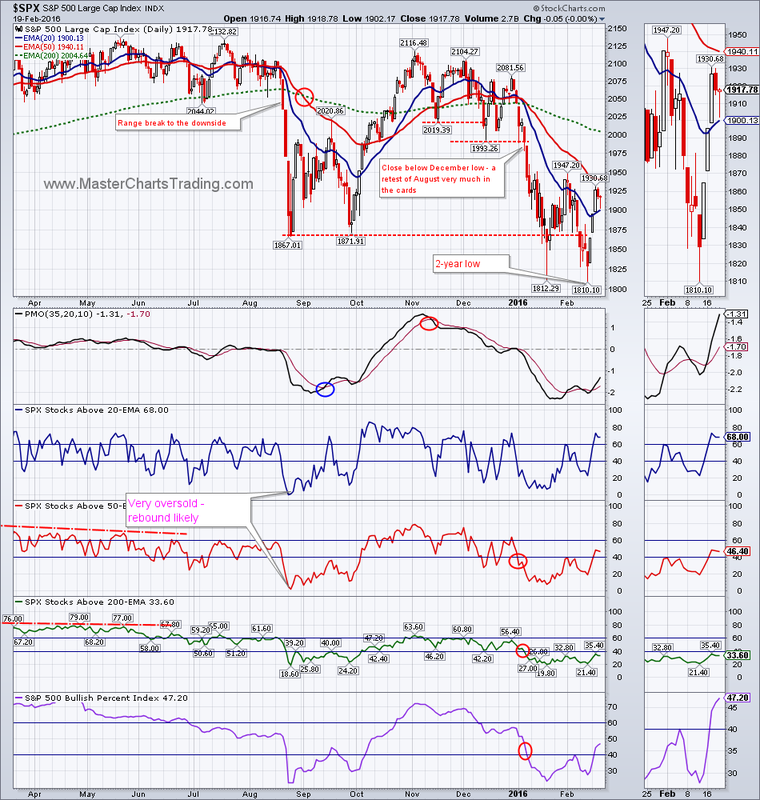

Last week SPY printed a spinning-top candlestick, then Monday, Tuesday and Wednesday there were gap-ups, followed by a run higher. If SPY was in a long-term uptrend, I would not hesitate to call it a strongly bullish action. However since we are in a long-term downtrend, the best I could say is that this bounce is a strong short-covering rally. As a matter of fact, SPY is already getting somewhat overbought. Just slightly higher is the steeply declining 50-day moving average and a small gap-down around $195-$197. A rejection in that area would be most bearish and new lows very likely. CHART OF SPY Market breadth for $SPX is still decisively bearish. If anything, this rebound could be a setup to short again. CHART OF $SPX |

|

CHART OF $NYA

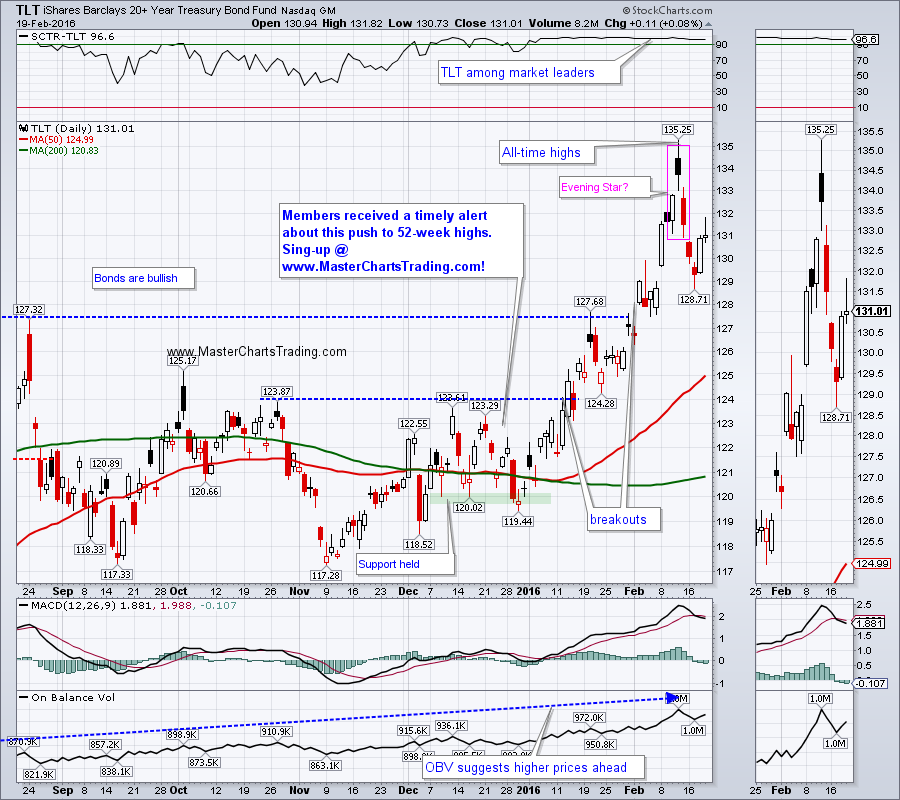

CHART OF TLT

LONG-TERM TLT CHART

CHART OF $USD

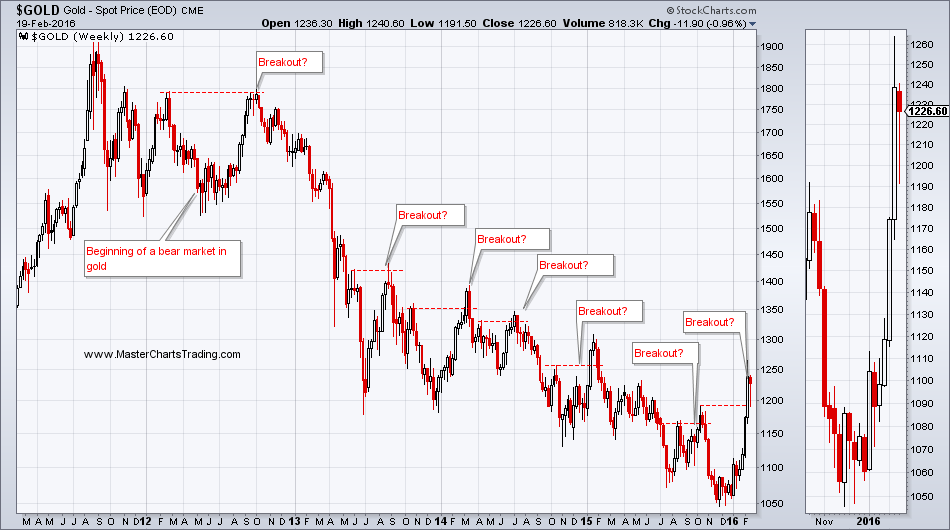

Lets take a look at some of the charts then. Gold gained a little over 21% from the multi-year lows set in early December until the February 11 peak. This is indeed a powerful move, but we had similar powerful moves in the past during the current bear market in gold dating back to 2012.

GOLD CHART

LONG-TERM CHART OF GOLD

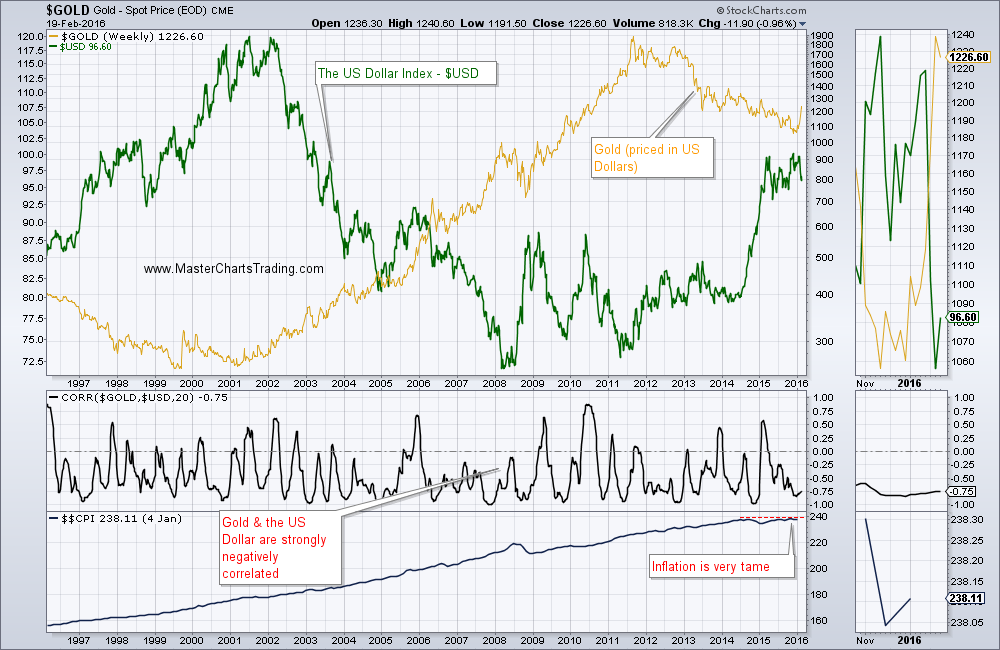

Additionally many people believe that gold is a good hedge against inflation. But as can be seen from the chart, inflation has been rather tame, especially of late.

GOLD vs. US DOLLAR AND INFLATION

The Gold Breadth Index (GBI) attempts to decrease the number of false trend changes. GBI does this by looking at a basket of gold mining stocks and using the signals generated by the gold miners to augment those signals generated by gold itself. Take a look at the chart below. GBI was able to eliminate the vast majority of the false trend signals. In fact, as it stands right now, GBI had a reliability of 75% from 1985 till today. (Reliable data is only available from around 1985).

Point of this exercise: so far, we have not seen GBI and by extension gold turn bullish. It’s getting close, but not yet.

CHART OF GDX

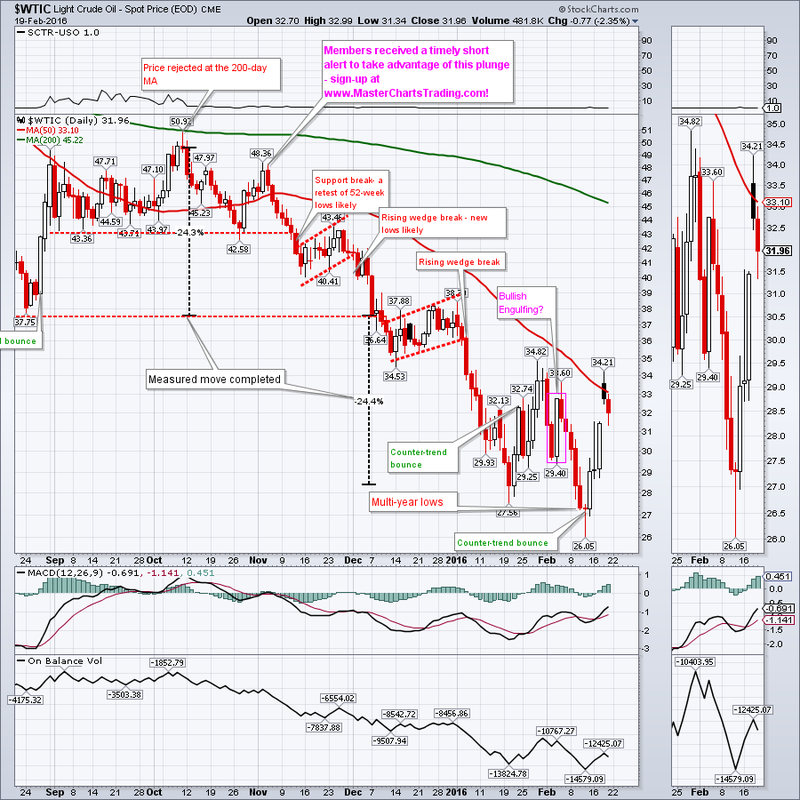

CHART OF $WTIC

CHART OF NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed