|

The bulls better make a stand soon! $SPX is rapidly approaching the August 2015 lows in the 1860s range. A close below that area would most likely cause a further drop of about 10% or so. For now bulls have been largely unable to produce any meaningful rebound and the support break from the beginning of the year is still holding.

CHART OF $SPX |

|

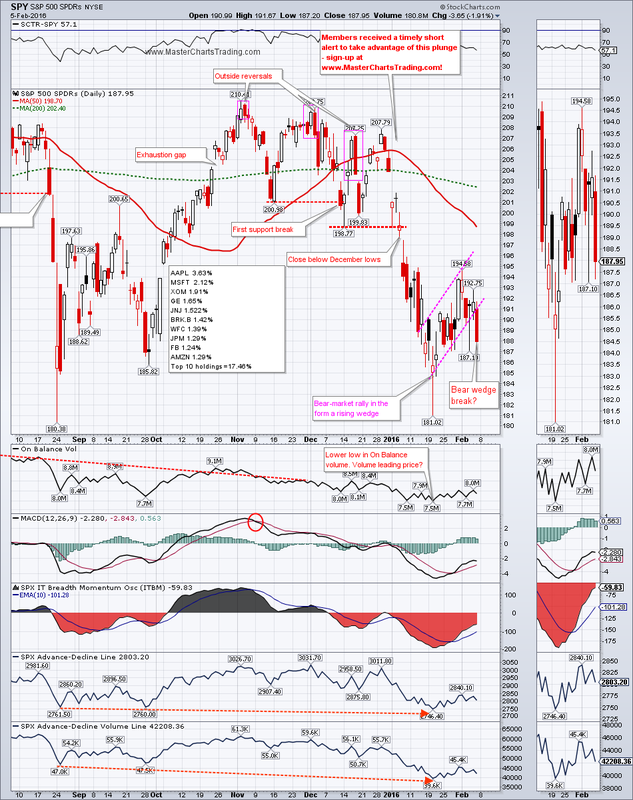

CHART OF SPY

1.Imminent Death (bear) cross of the 50-day moving average crossing below the 200-day moving average

2.Friday’s close took the ETF below its September 2015 lows

3.Relative weakness compared to the universe of other ETFs

4.A new low in the Advance-Decline Volume line

Weakness in technology is very negative for the general market because the technology sector accounts of over 20% of the stocks within the S&P 500.

CHART OF QQQ

CHART OF $NYA

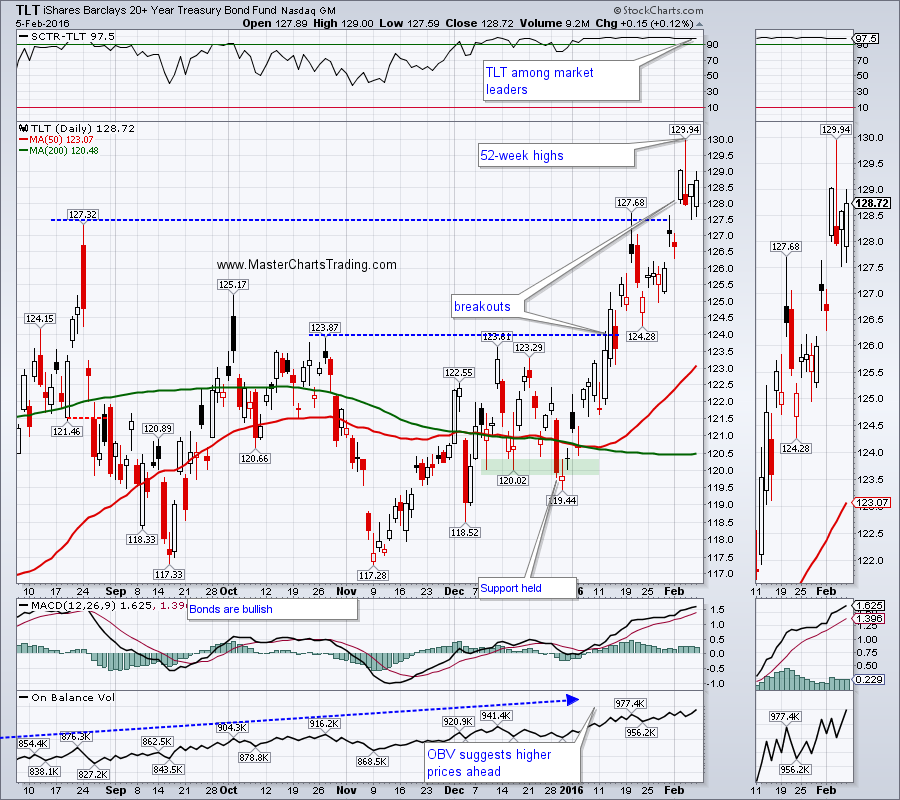

CHART OF TLT

LONG-TERM TLT CHART

CHART OF UTILITIES

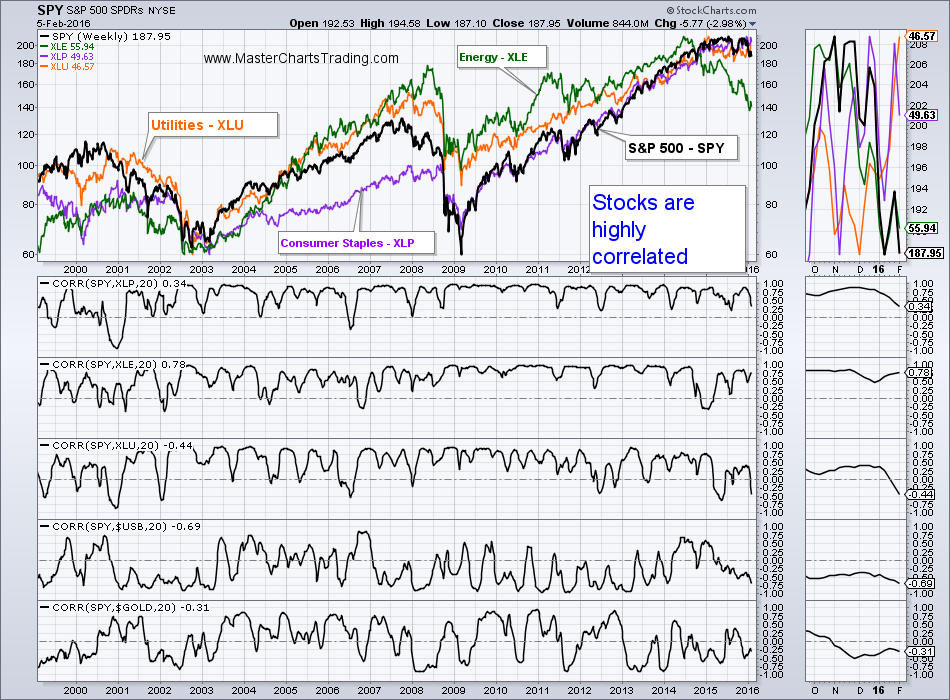

Please keep in mind the utilities are still stocks and thus correlate highly to the general market. If a true pandemonium starts and investors try to unwind their long positions, utilities will also get sold. Notice on the chart below that various stock funds move more or less together and correlate highly to the general market. I purposefully picked the most uncorrelated ETFs to the general market to prove a point (XLF, XLI, XLK, XLY correlate even higher). Even Utilities, Consumer Staples and Energy will get sold during the market routs – there is no place to hide in stocks.

ASSET CORRELATION TO SPY

CHART OF $USD

GOLD CHART

There are various ways of identifying the long-term trend of a security. One of the most common ways is to look at the 50-day simple moving average and the 200-day moving average. If the 50-day is above the 200-day, then the security is bullish and vice versa. This technique works OK most of the time, but it does occasionally produce whipsaws (false trend changes).

I presented my experimental Gold Miners in an Uptrend Indicator (GDXIND) last week. This indicator looks at a basket of gold miners and their trend indicators and attempts to quantify the signals. If a bullish signal is triggered, a bullish bias is maintained until a reversing bearish signal supersedes its. GDXIND gave a bearish signal in early 2012 and is yet to reverse direction.

Similarly data exists for the Gold Miners Bullish Percent Index ($BPGDM) going back to 2008. In the life of a market this is not a terribly long time period, but nevertheless $BPGDM does produce useful signals. $BPGDM gave a bearish signal back 2011 and it too is yet to reverse.

GDX itself just broke above the 200-day moving average and was able to close above the October highs – certainly a positive sign. The Advance-Decline lines and the On-Balance volume indicators are also showing a good participation. As with gold, I can unequivocally say that GDX is now overbought. GDX is ripe for either profit taking, or an outright bear attack, especially if the dollar rallies from here.

CHART OF GDX

Bottom line: We need to see a significant improvement in GDX market breadth, and a trend change in gold before a bottom in gold prices could even be contemplated.

LONG-TERM GDX CHART

CHART OF $WTIC

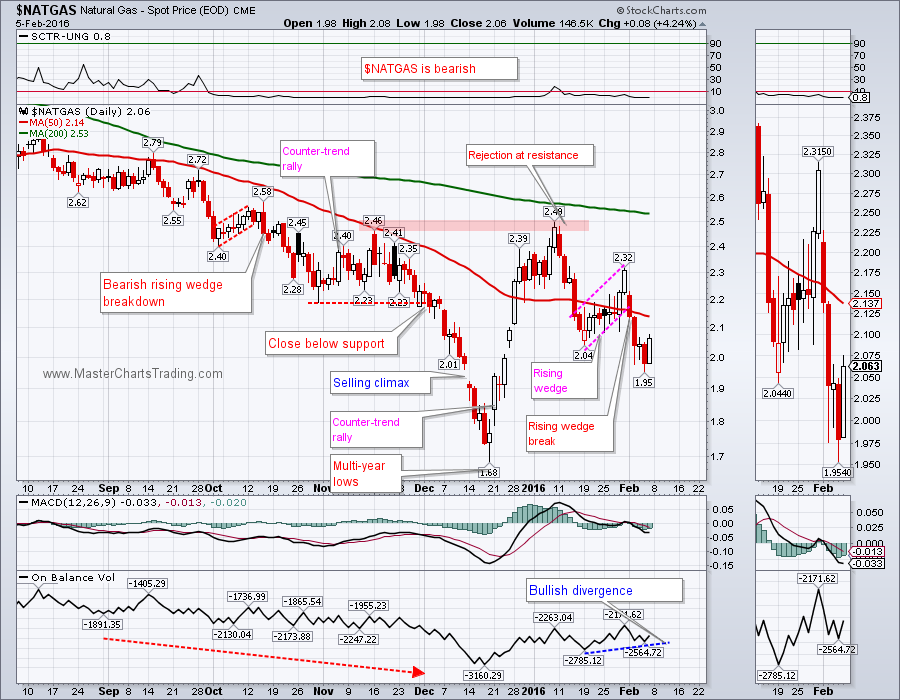

CHART OF NATGAS

Trade Alerts Service is now live – please sign-up here!

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed