|

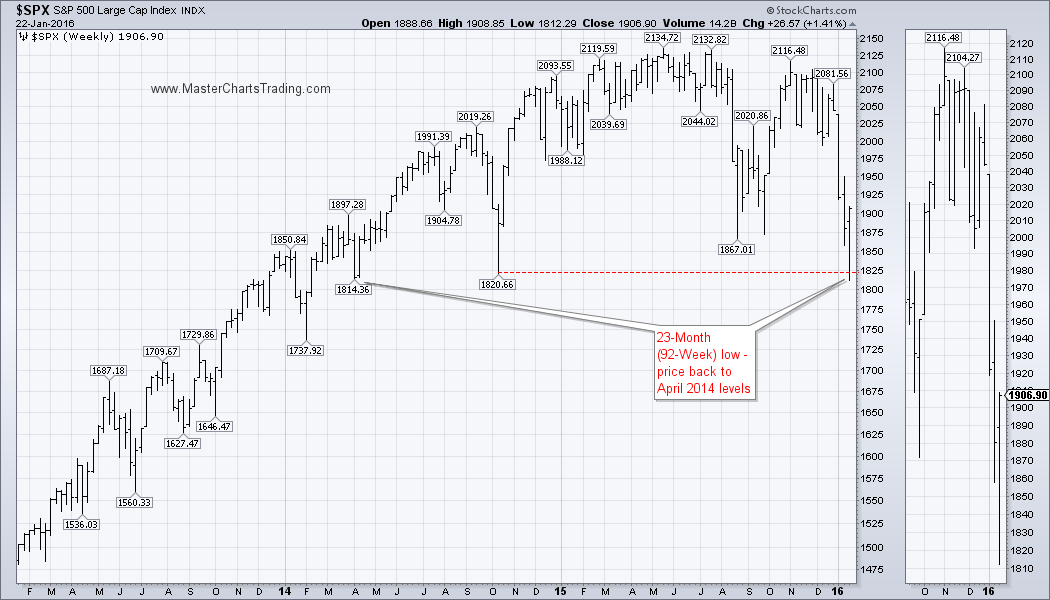

Stocks spiked to 92-week lows on Wednesday and bounced towards the end of the week. 92-week low is an awkward number, but it translates into a 23-month low not seen since April of 2014. Technically, I cannot call this a multi-year low just yet, but we certainly look set to continue on the downside.

CHART OF $SPX LONG-TERM $SPX CHART |

|

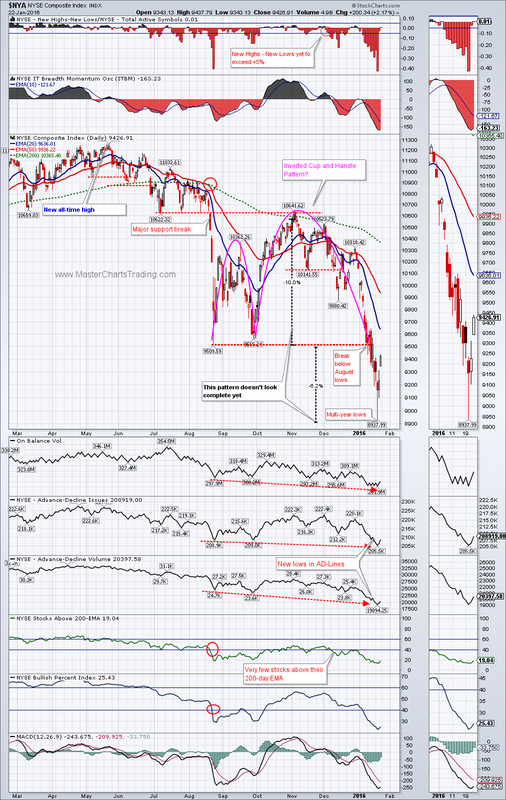

For now market breadth is decidedly bearish and the only positive thing I could say about it is that breadth is somewhat “oversold”. However, oversold in a downtrend is not very relevant because during the downtrends oversold is a rule rather then an exception. In downtrends we will look for overbought conditions to time short entries rather then attempt to pick bottoms. The bigger trend is down, so why fight it?

CHART OF SPY

CHART OF $NYA

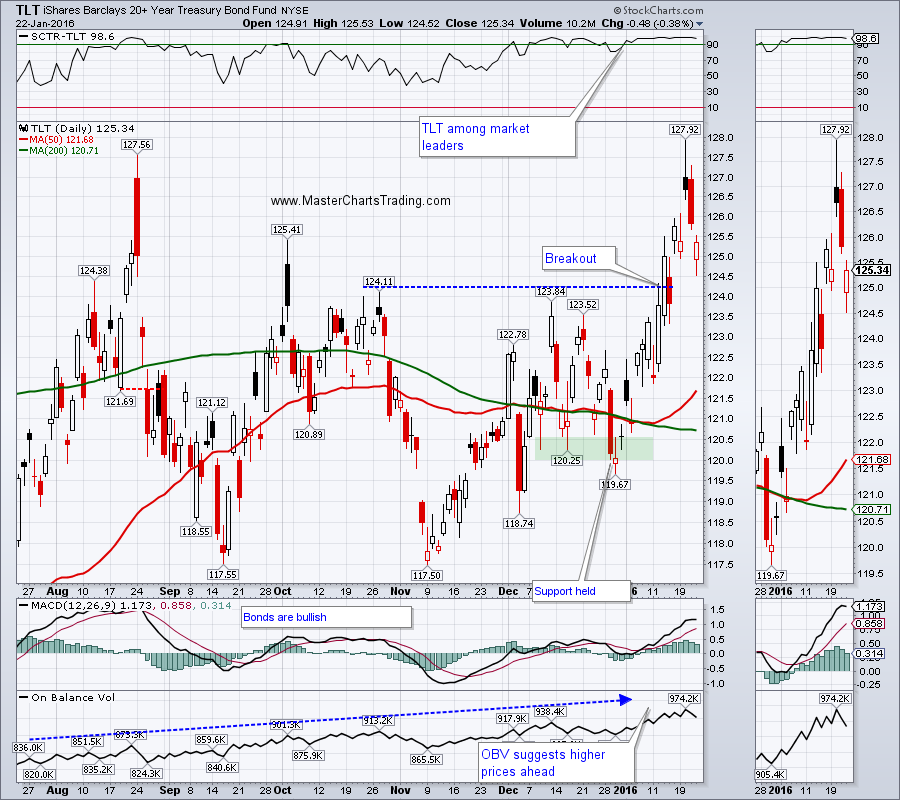

CHART OF TLT

LONG-TERM TLT CHART

CHART OF $USD

My gut feeling is that gold is correct and a rally to $1140 or even $1190 is not to be ruled out. Its possible that a cup and handle pattern is playing out on the chart of gold. If correct $1190 would be the upside target for the move.

GOLD CHART

CHART OF GDX

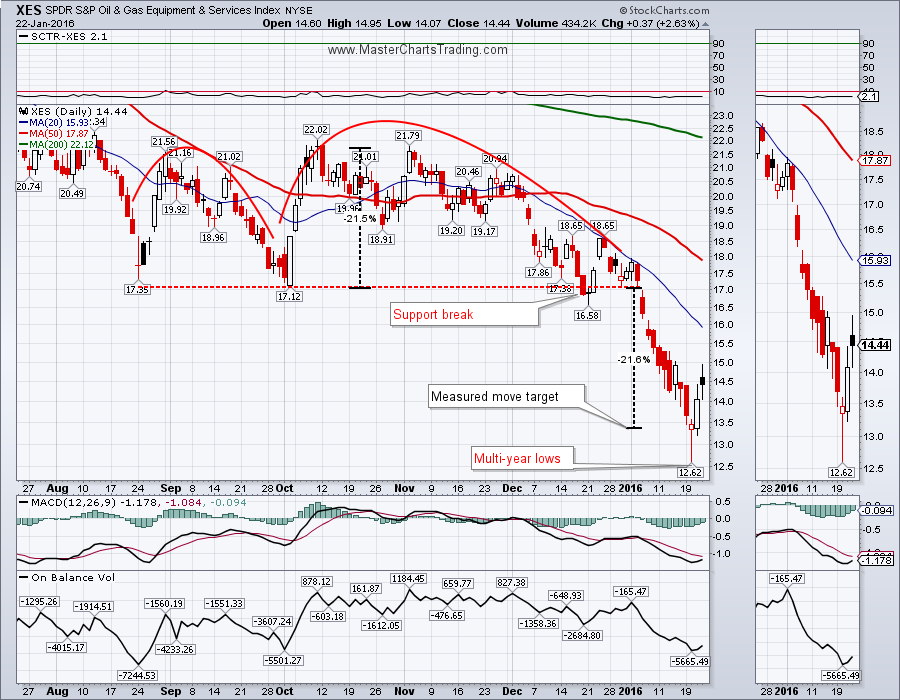

CHART OF $WTIC

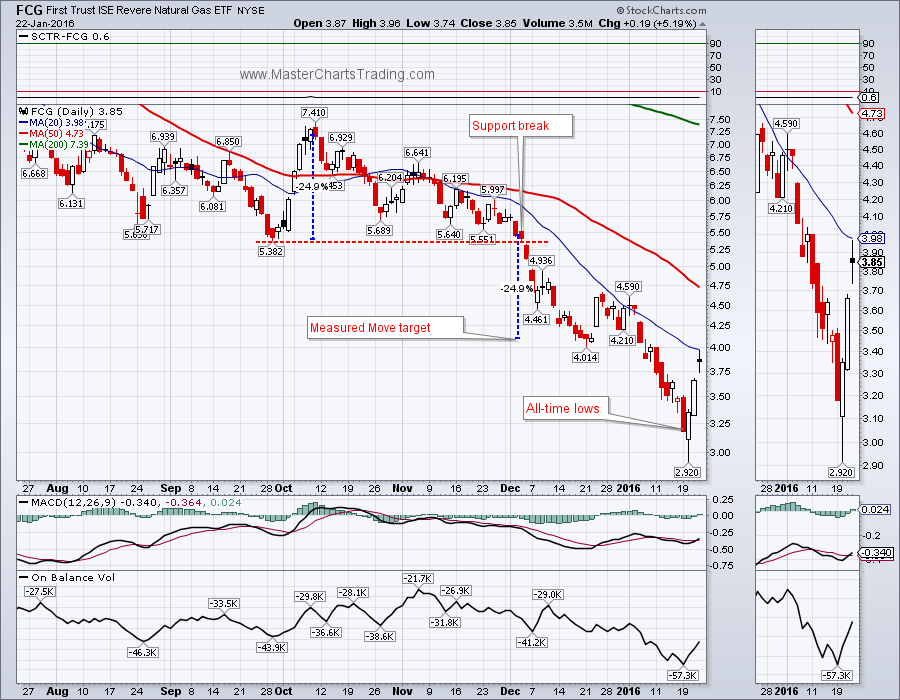

CHART OF NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed