|

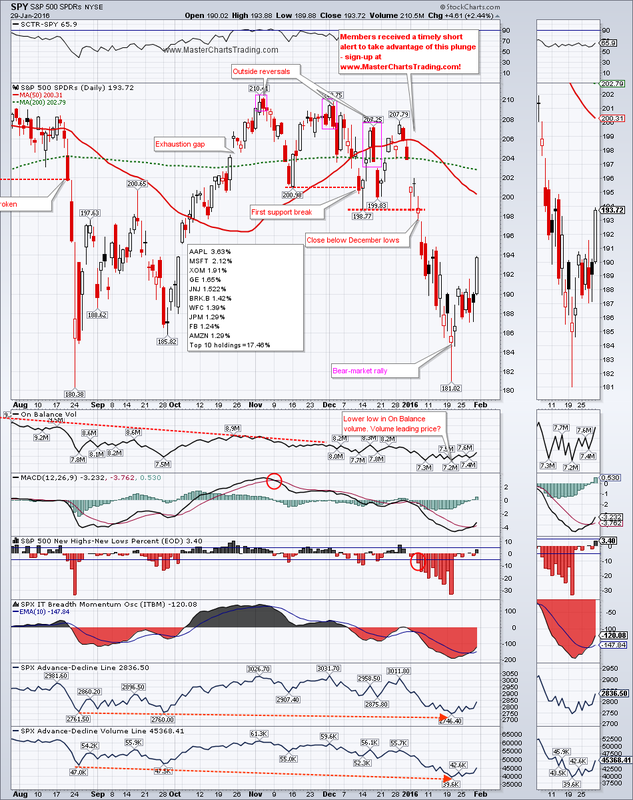

Quantitative easing (money printing), extremely low or even negative interest rates around the world are helping stock indices recover from the somewhat oversold levels. SPY gained a little over 1.6% for the week to end the week at $193.72. This oversold bounce was expected and it sure came as a relief for many investors. The question on everyone’s minds is of course whether or not this is a sustainable rally, or simply a short-covering one.

CHART OF SPY |

|

CHART OF $SPX

CHART OF QQQ (video bonus)

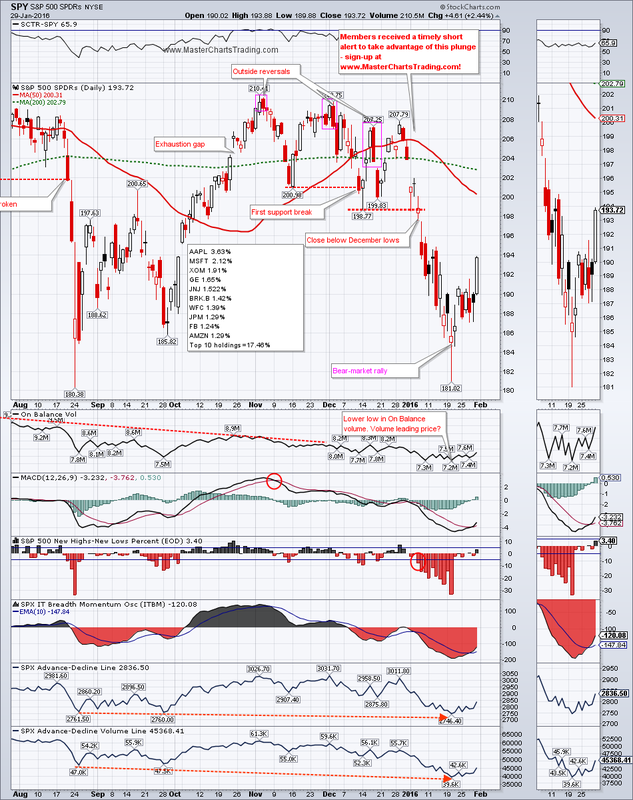

1.The 50 and the 200-day simple moving averages

2.New Highs less New Lows Percentage

3.Bullish percent index

4.Percent of stocks above the 200-day exponential moving average

What I am seeing is that market breadth for $NYA is still very much bearish. Currently all 4 of the above indicators are in the bear mode. If/when at least some turn bullish, we will re-assess and see if a new bull market is upon us.

CHART OF $NYA

I use MBI in generating tradable signals for my subscribers – check out the backtesting results here: http://www.masterchartstrading.com/performance.html

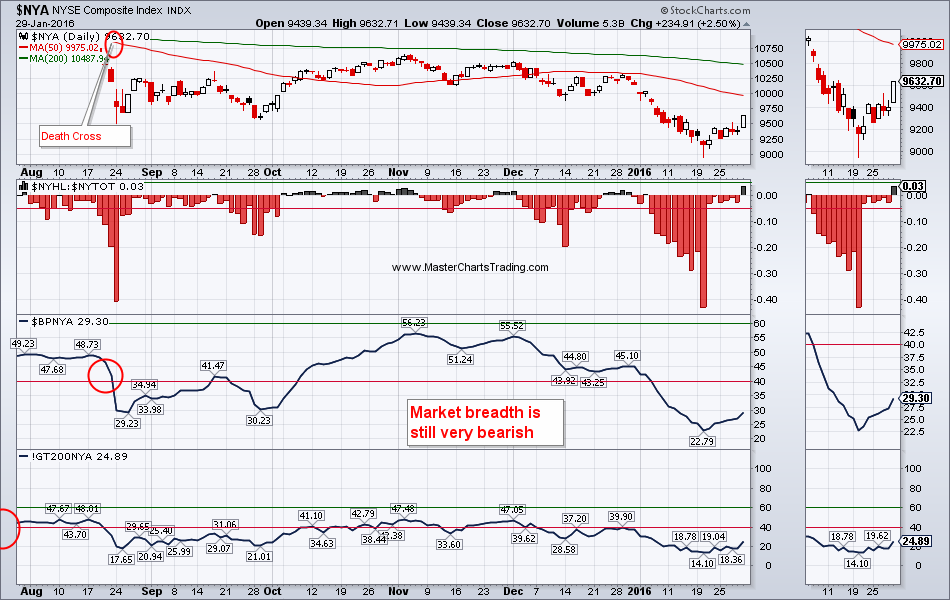

CHART OF TLT

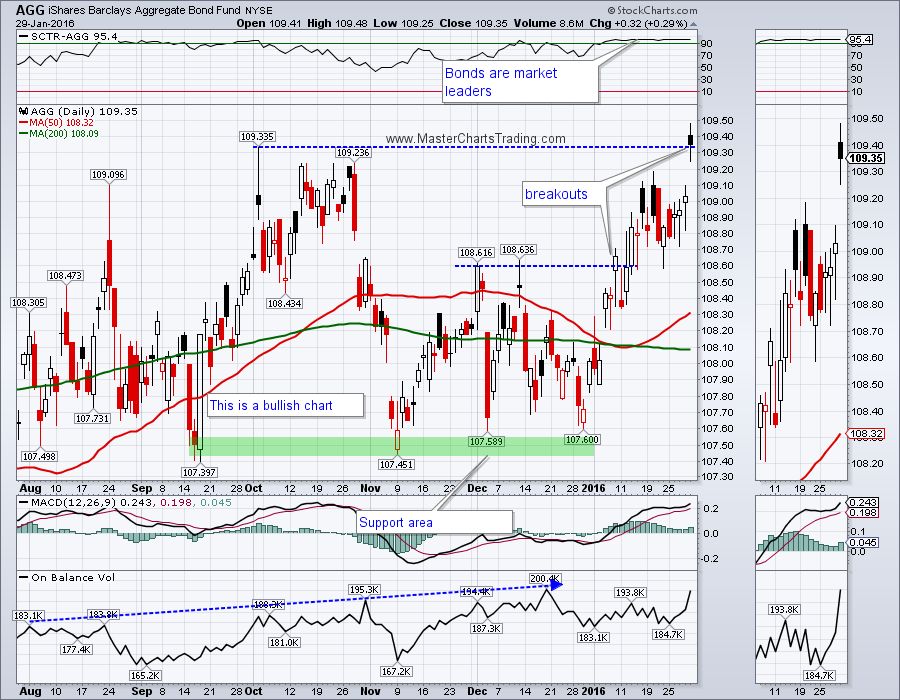

CHART OF AGG

LONG-TERM CHART OF AGG

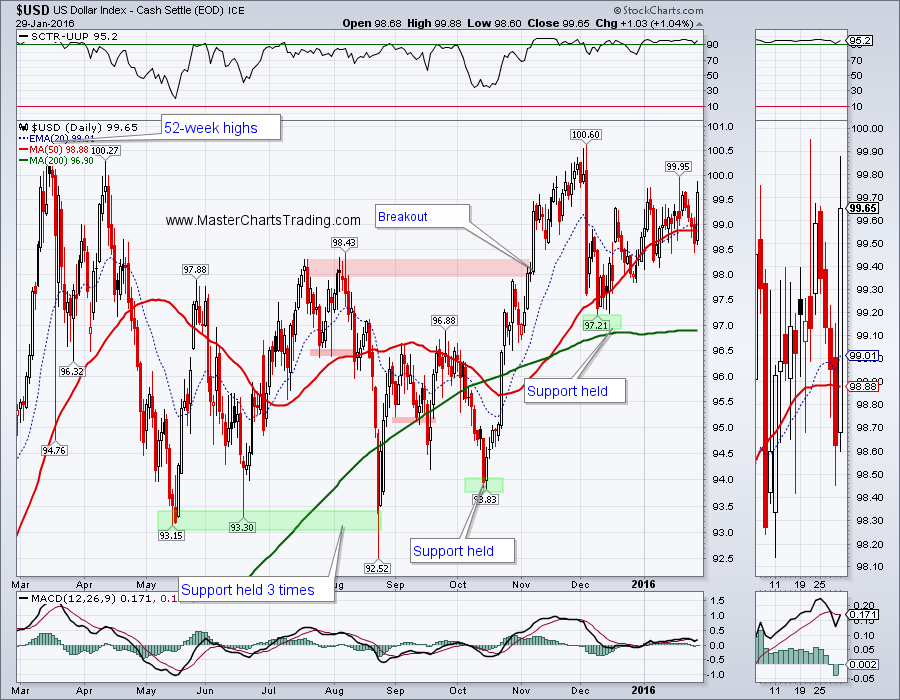

CHART OF $USD

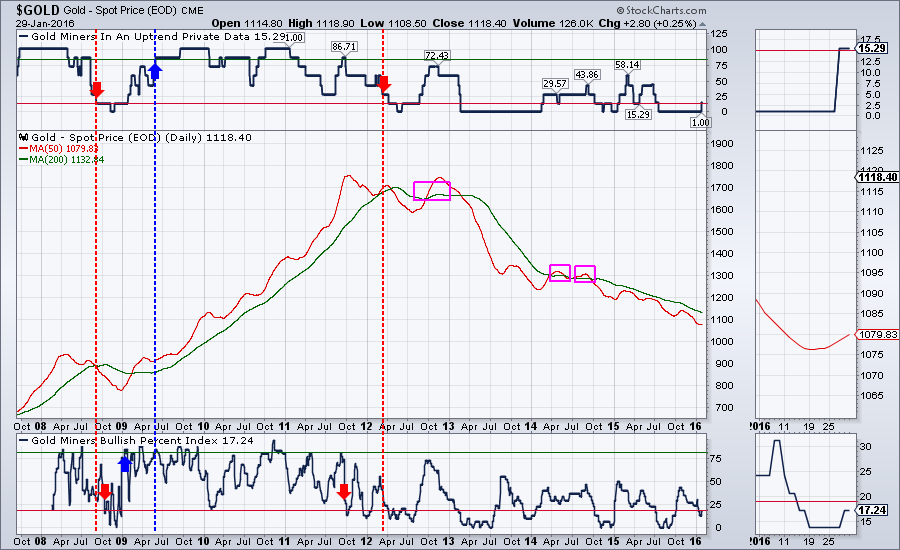

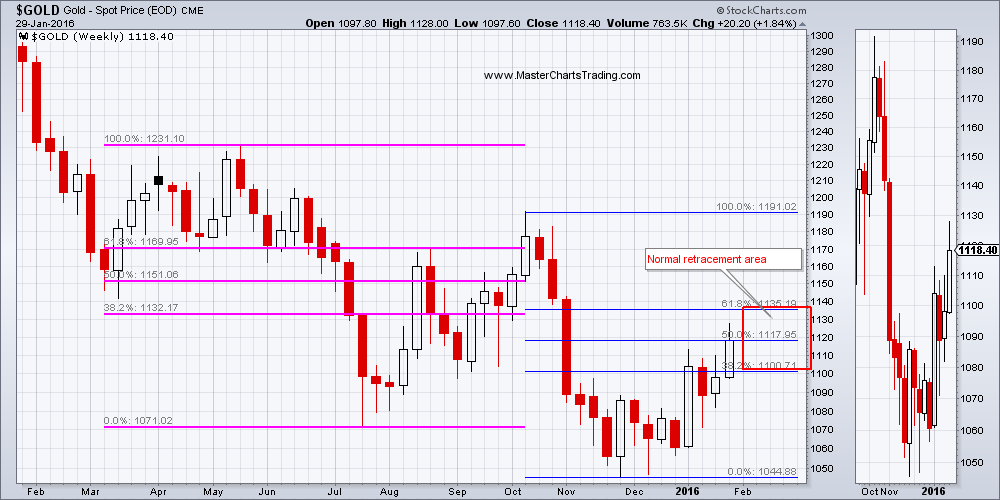

The long-term weekly chart of gold below shows lower lows and lower highs being made – a trademark of a bear market. The latest rebound is currently in the Fibonacci retracement area off the lows set in November of last year. This would be a good place to look for a failure for gold prices.

LONG-TERM CHART OF GOLD

GOLD CHART

CHART OF GDX

CHART OF $WTIC

“NATGAS is super volatile and trading the triple leveraged DGAZ is kind of like riding a racing motorcycle – it’s very exciting, but also very dangerous. If you haven’t yet watched my psychology of trading videos in the member’s section, please do so soon here: http://www.masterchartstrading.com/login.html

1. NATGAS is not for everyone. Compared to stocks and bonds, I allocate a rather small part of my account to trading NATGAS (and other commodities)

2. A loss should not hurt your portfolio and position sizing is of extreme importance. "

NATGAS fall hard to $2.04, then started rising in what I think is a rising wedge formation. A rising wedge in a bearish security, like NATGAS, is a bearish continuation pattern. A close below the trend line, would almost certainly call for at least a retest of multi-year lows. NATGAS is currently at the high-volume resistance area, so a failure here is likely.

CHART OF NATGAS

Trade Alerts Service is now live – please sign-up here!

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed