|

More choppiness this week in the markets as the S&P 500 rebounded off the 200-day moving average. $SPX gained a little over 1% for the week. Market breadth picture improved somewhat as the New highs – New lows percent indicator flipped back into positive territory. I think the longer-term picture for the stocks is still bullish, and we may see new highs soon, provided breadth improves further. Chart of $SPX |

|

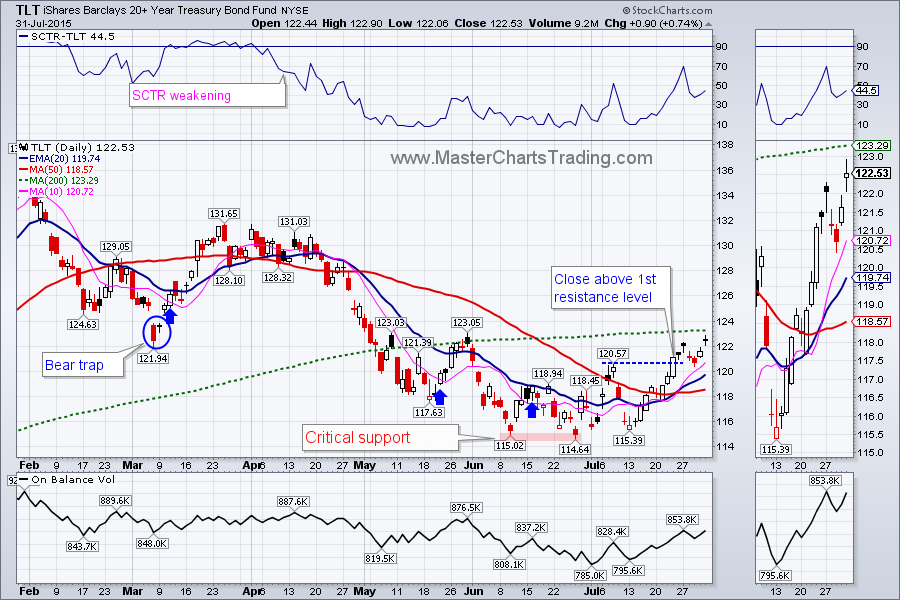

TLT chart

Charts of gold and other precious metals

Chart of GDX

Best Regards and have another great trading week!

** Special Announcement**

We are close to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed