|

The S&P 500 retested support in the 2072 area on Monday and held it. Stocks then continued up strongly for the rest of the week, taking a breather on Friday. For the week, all major stock indices are up.

All major indices are showing improved breadth momentum and participation. There are divergences present in the $SPX. Namely in the AD-Line and the On Balance Volume indicator. Whether these divergences would lead to a deeper pullback, or simply disappear, remains to be seen. For now, stocks continue to show bullish resolve and are very close to new all-time highs. Charts of major indices |

|

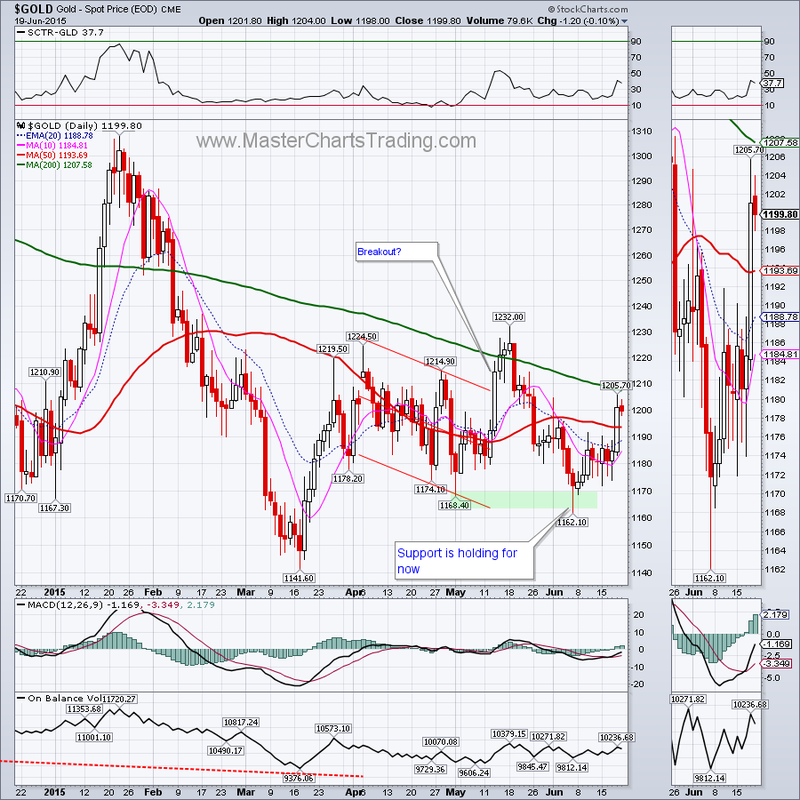

Gold miners bounced along with gold, but Friday’s close leaves much to be desired for the gold bulls. Whereas gold dropped a fraction of a percent on Friday, GDX plunged 2.4%. GDX was not even able to close above its 20-day exponential moving average. With new lows registered just a few days ago in the AD-Lines for GDX, my money is (literally) on more downside for gold miners.

Gold and gold miners charts

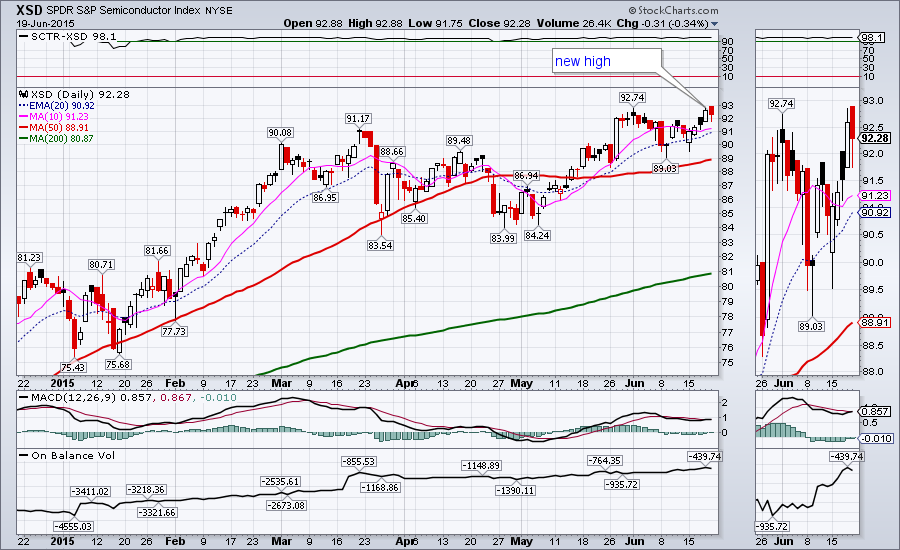

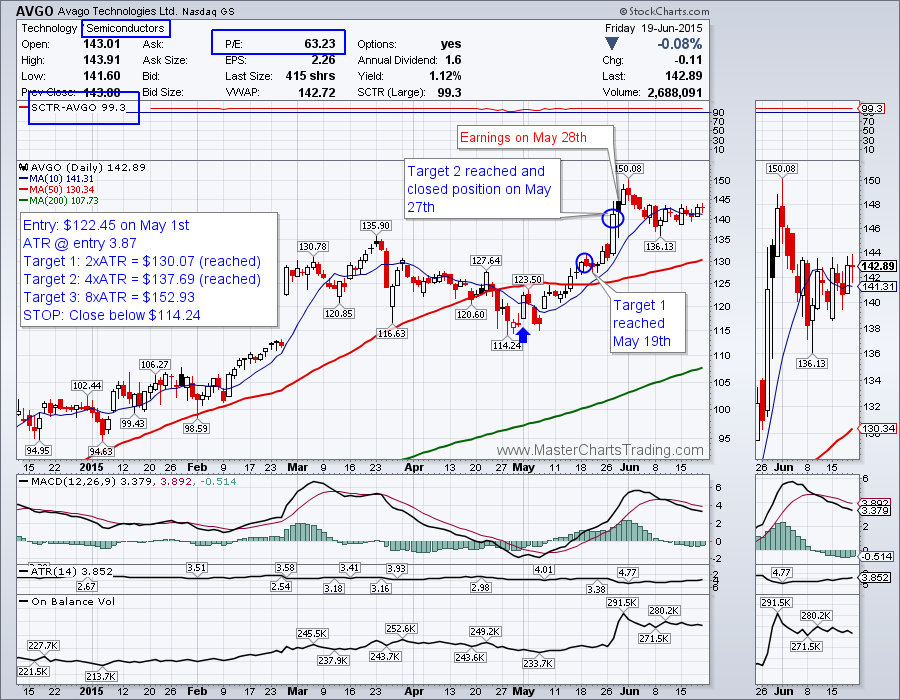

Avago Technologies is a semiconductor stock that has been on a tear for the past few years. Semiconductors (XSD) are also among the market leaders currently, so the industry group is helping with a bullish momentum for AVGO.

We entered the trade in AVGO on May 1st with a stop below the recent low and 3 target prices set based on the ATR. ATR (average true range) is a measure of how much a stock fluctuates in a time period.

Our 1st target was reached on May 19th. We took profits and moved our stop to break-even. Then several days later our 2nd target was reached on May 27th. However we closed our entire position on that day because of the earnings report that was due on May 28th. Our average gain for this trade was over 11% in just 17 days!

If you look on the chart of AVGO, you will notice that the price continued higher after the earnings, but what if there was an earnings miss? The price could have just as easily gapped down and we would have been left with a much lower profit for the trade or possibly a loss. In other words: why gamble on an earnings report and risk loosing your profits?

Link to AVGO chart

Best Regards and have another great trading week!

** Special Announcement**

We are close to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed