|

www.MasterChartsTrading.com Friday, June 26th, 2015 Weekly Market Recap.

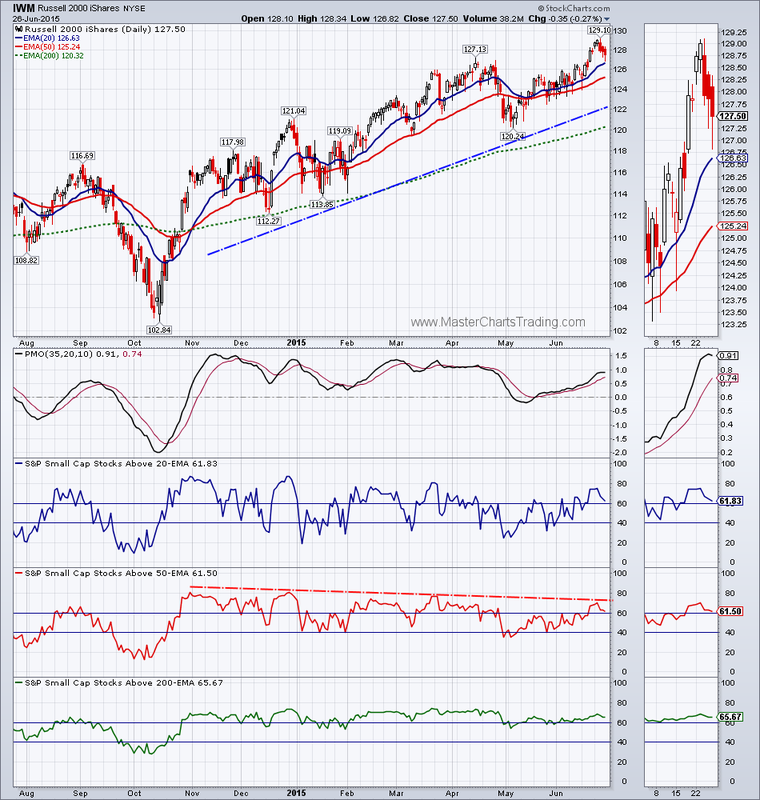

We are continuing to see both relative and absolute strength in the small-cap universe. This week IWM hit both an all-time high and an all-time closing highs – this is a bullish development. Market breadth for IWM has some minor divergences, but overall, the underlying breadth is confirming the new highs. IWM breadth chart 1 IWM breadth chart 2 |

|

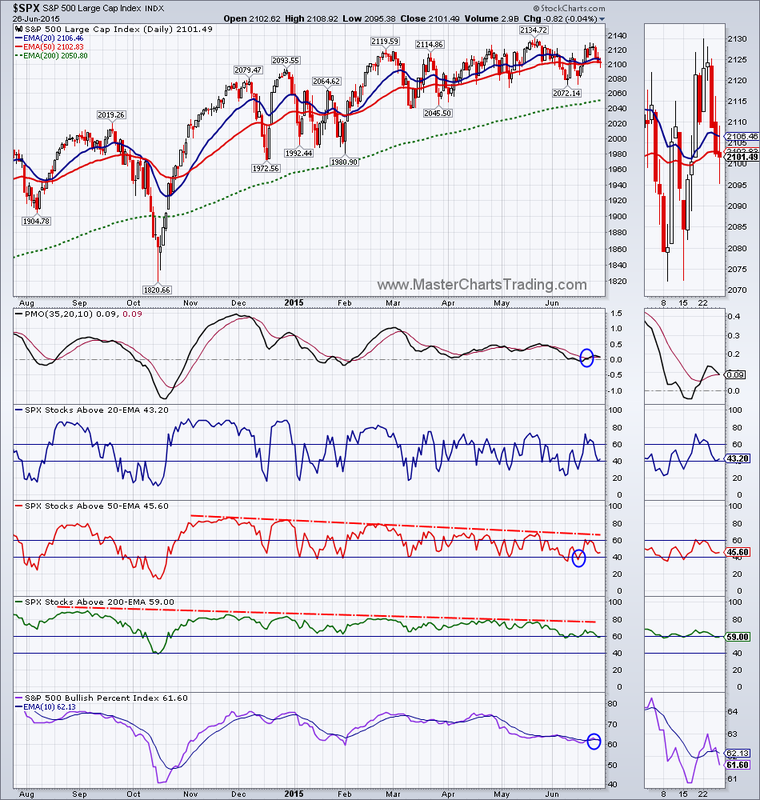

Percentage of stocks above the 200-day and the 50-day exponential moving averages (EMA) for $SPX has also been steadily trending lower since December. This indicates that the participation in this rally from the October low is steadily dropping.

$SPX Market breadth chart 1

$SPX Market breadth chart 2

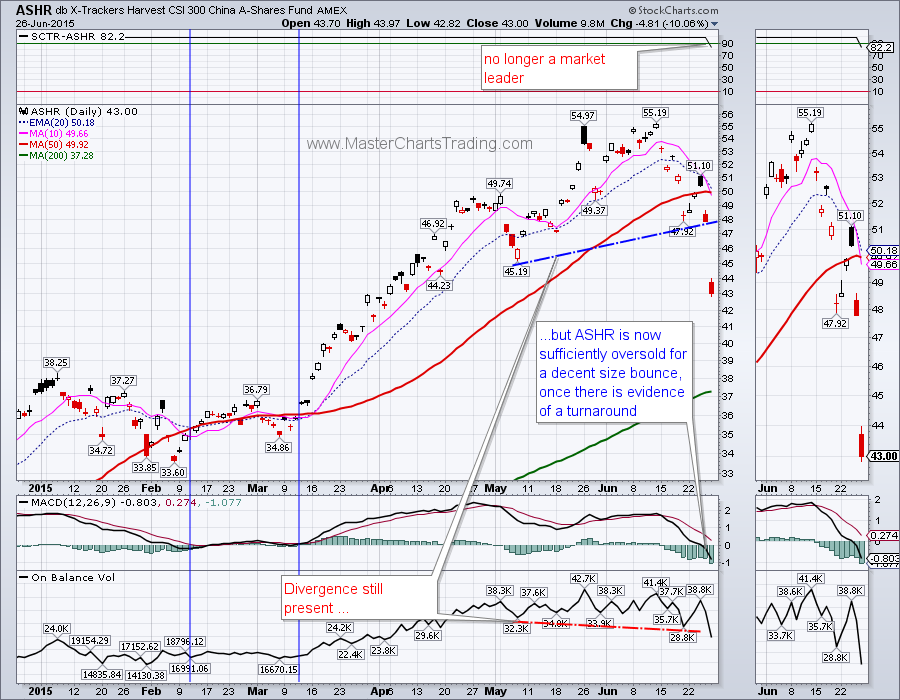

Positives for Chinese Shares:

1. ASHR has had an uninterrupted SCTR rank of over 90 since September of last year. This means ASHR outperformed most of the other ETF’s in the non-leveraged, non-inverse universe

2. From the time ASHR’s SCTR rank popped above 90 to its peak just a few days ago, it gained over 120%

3. ASHR is now oversold on momentum indicators, such as MACD, or stochastic.

Now the negatives

1. SCTR for ASHR is now below 90. This means that other sectors and areas of the stock market are outperforming the Chinese shares and speculative money may no longer flow into China as freely as before

2. The On-Balance Volume (OBV) showed a bearish divergence in mid-June and now OBV broke below that low. This is indicating large distribution volumes

The bottom line: ASHR is still long-term bullish, and considering how oversold it is right now, a pop higher is very likely. But since it is no longer a market leader with SCTR below 90, we have to be even more careful with our timing.

Chart of ASHR

GDX fared even worse as it ended the week on a decidedly negative note with two bearish candles in a row on Thursday and Friday. Market breadth for GDX is hitting new lows already before the price of GDX itself. This is a bearish divergence and would likely weight further on GDX price. I am expecting at least a retest of March lows around $17.50.

Gold and gold miners charts here

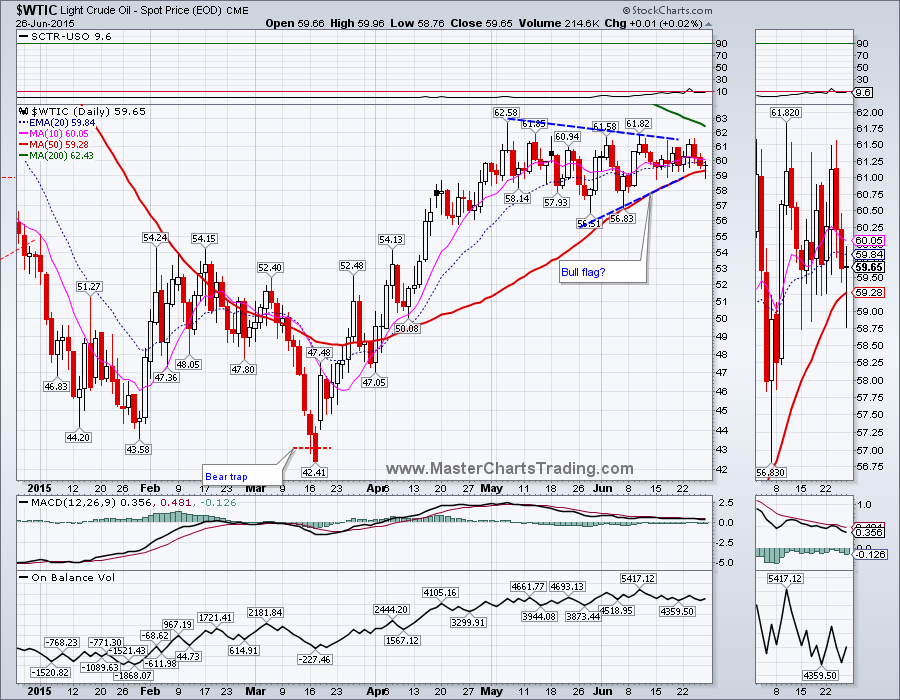

Oil may finally be rolling over to the downside (it is still long-term bearish). On Friday, the West Texas Intermediate (WTIC) tested and barely held the 50-day moving average. A close below the late May lows at $56 would call for at least a drop to the $54 area and possibly lower. If XLE is any indication, we might get this move soon.

Chart of XLE

Chart of West Texas Intermediate Crude Oil

Best Regards and have another great trading week!

** Special Announcement**

We are close to launching a stocks alert service. Please sign-up for our mailing list to be the first to take advantage of the discounted membership once it becomes available!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed