|

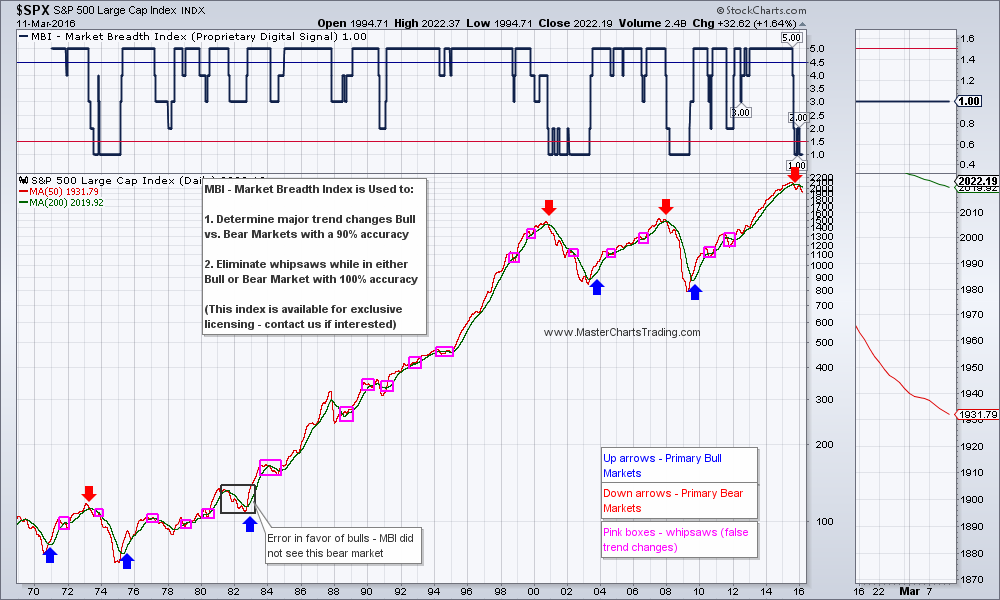

Oftentimes when we are trading, we tend to focus on the near-term events and charts and ignore the bigger picture. This week I wanted to start with the very long-term charts and work our way towards the more recent events. Being a trend follower, before jumping into any trade I ask myself a very basic question: is the security I am about to trade bullish or bearish? Truly this is sometimes one of the toughest things to do in trading to simply figure out the very basic question: am I going to be buying the security in question or am I going to be selling (shorting) it. I use various methods to determine this including: various trend indicators, market breadth, bellwether stocks, etc. |

|

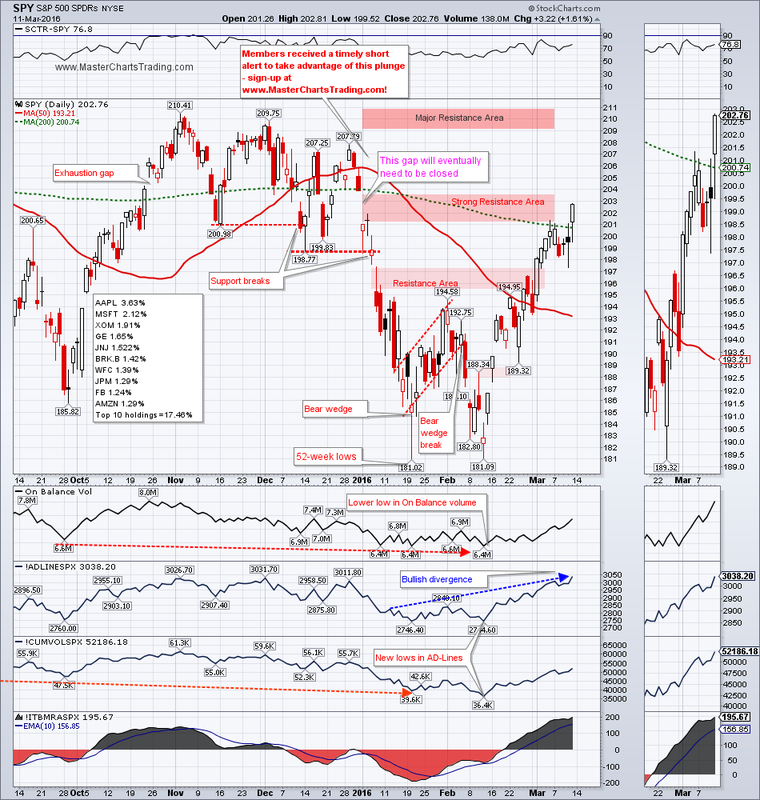

In my view the current condition is significantly overbought, while SPY is in a primary downtrend. This is a recipe for the bears to step in.

CHART OF SPY

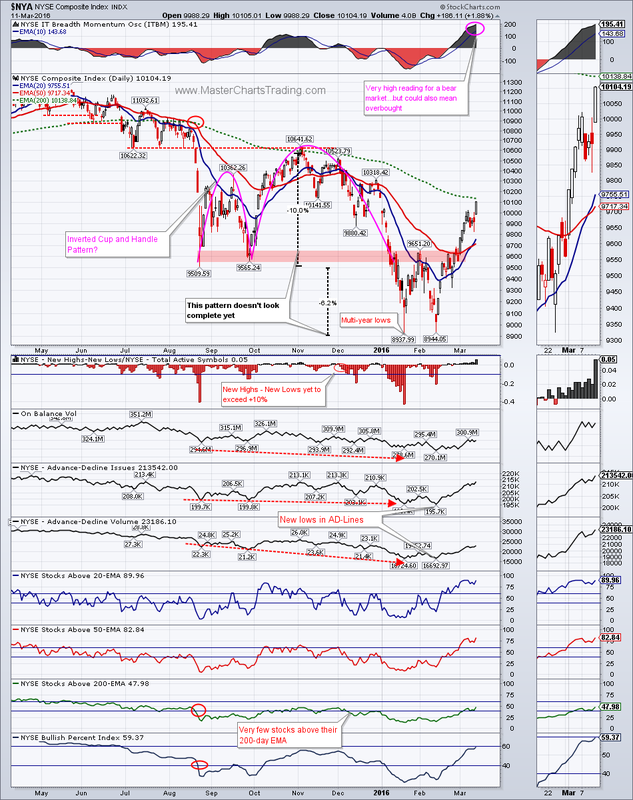

A version of the McClellan oscillator is Carl Swenlin’s Intermediate Term Breadth Momentum Oscillator (ITBM). ITBM has also registered a very high reading on Friday. Let us now examine what this high reading could mean in the context of the current bear market.

CHART OF $NYA

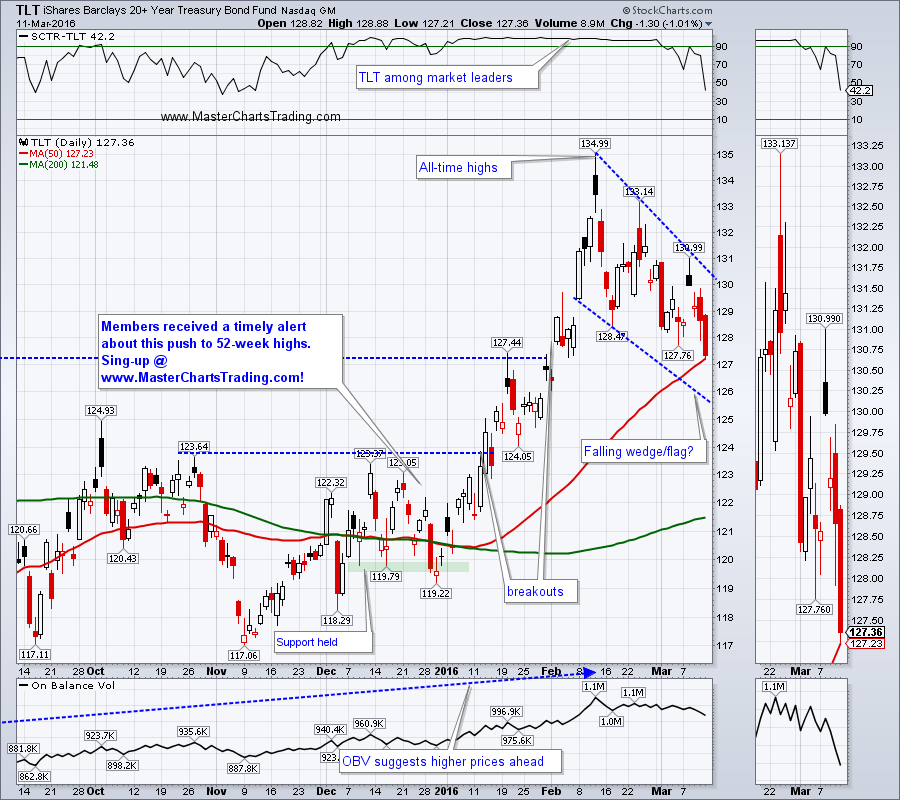

Bonds have been feeling the pressure of money rotating into the riskier assets and corrected to their breakout levels. TLT may be tracing out a falling wedge/flag of sorts. We all know that a falling wedge in the context of a bull market means – it’s a continuation pattern. After this pullback is over a break above $131 for TLT would likely mean a re-challenge of all-time highs set last month.

CHART OF TLT

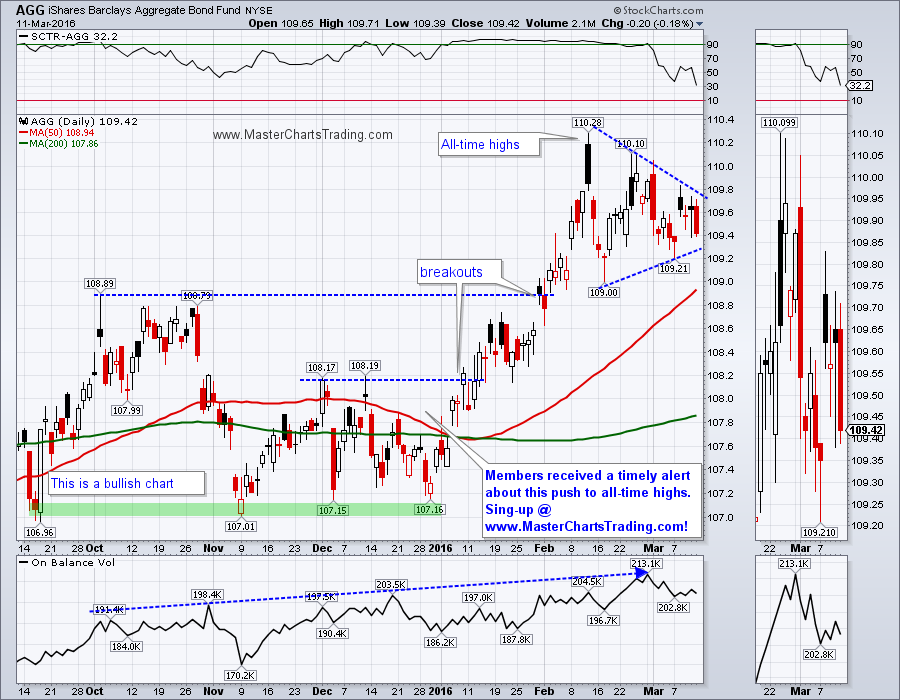

The diversified bond fund AGG looks even stronger then TLT and is still way above its breakout levels. AGG seems to be tracing out a pennant of sorts. Similarly to TLT, a breakout above $109.90 for AGG should lead to a retest of all-time highs.

CHART OF AGG

CHART OF $USD

Long-term $USD is clearly in a bull market and is trading not very far from the 52-week highs. Next Wednesday FOMC is due to release its interest rate decision, which is certain to send more shockwaves through the currency markets. Should FOMC surprise the markets with an interest rate hike, the Dollar could easily bounce.

LONG-TERM CHART OF $USD

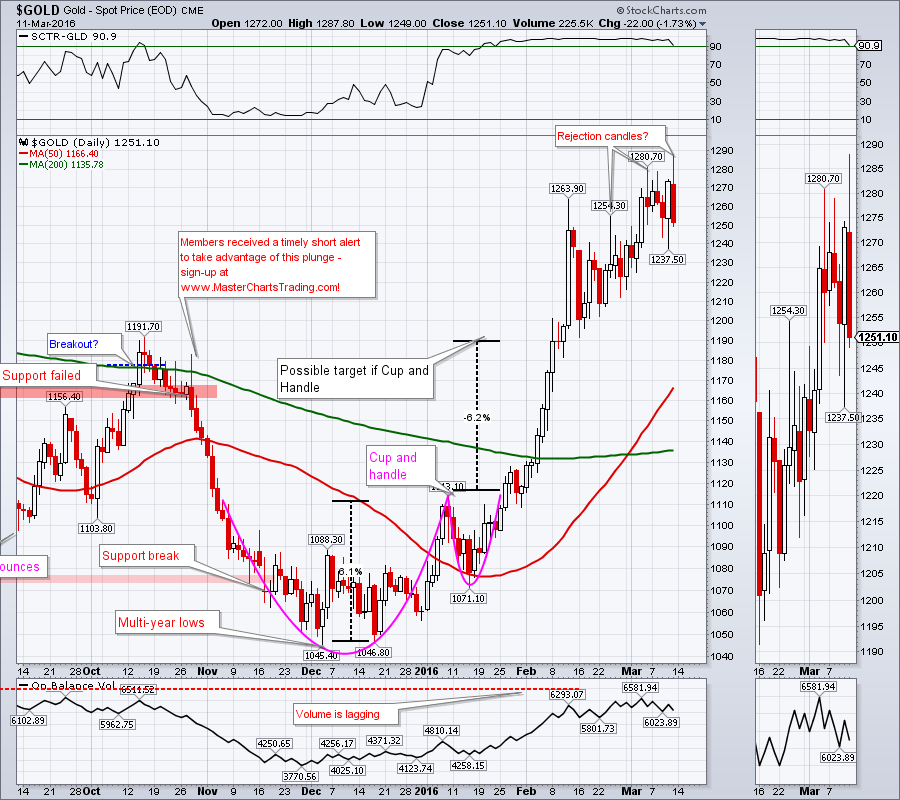

1-YEAR WEEKLY CHART OF GOLD

Friday’s action in gold looks particularly bad, it shows both a possible rejection of higher prices and significant selling pressure. Friday’s candlestick had a large wick out the top (rejection) and it is also a large red candlestick (selling pressure). We will see if next week brings more selling, especially around the FOMC time.

GOLD CHART

CHART OF GDX

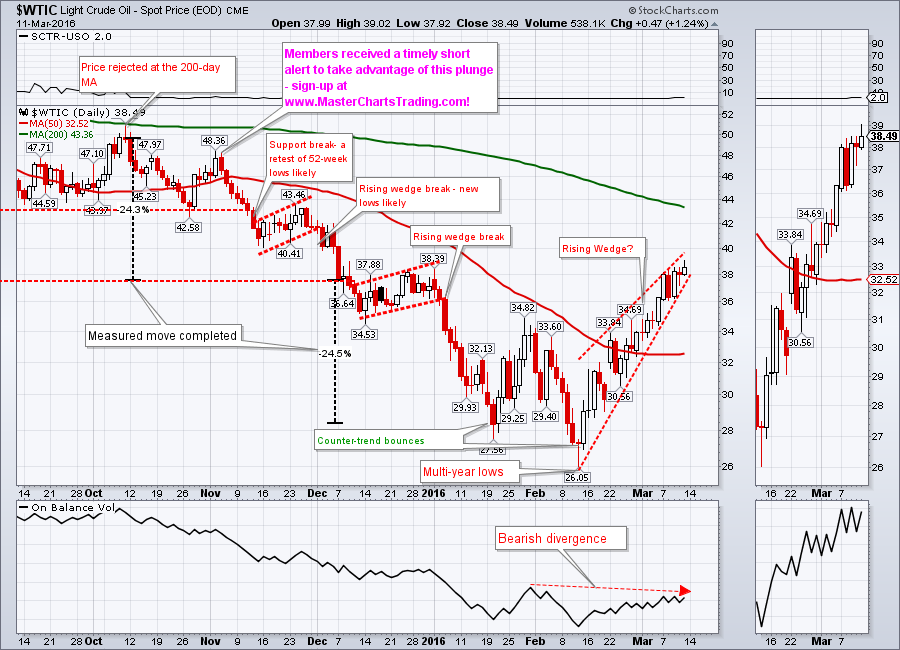

CHART OF $WTIC

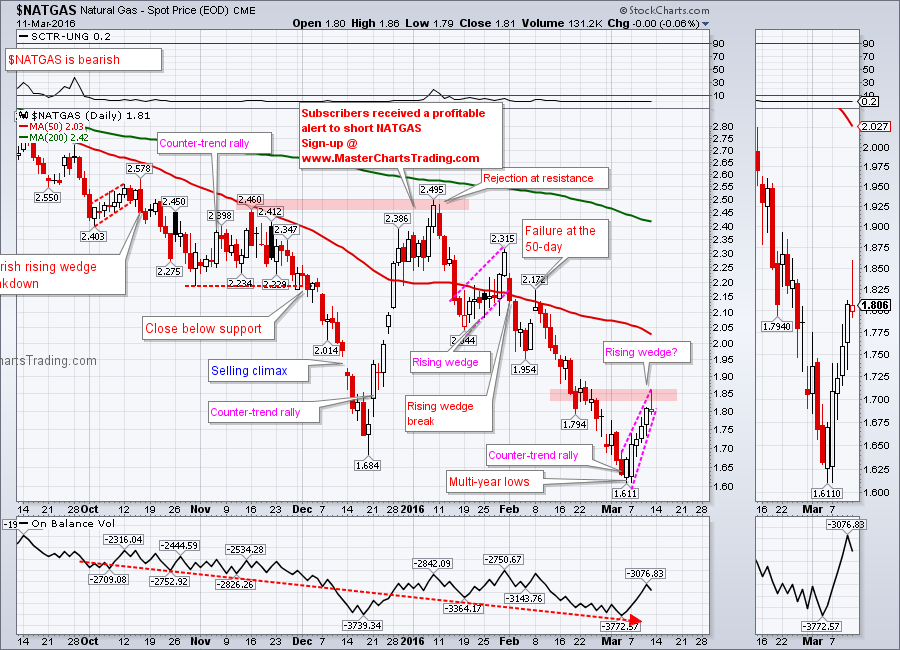

CHART OF NATGAS

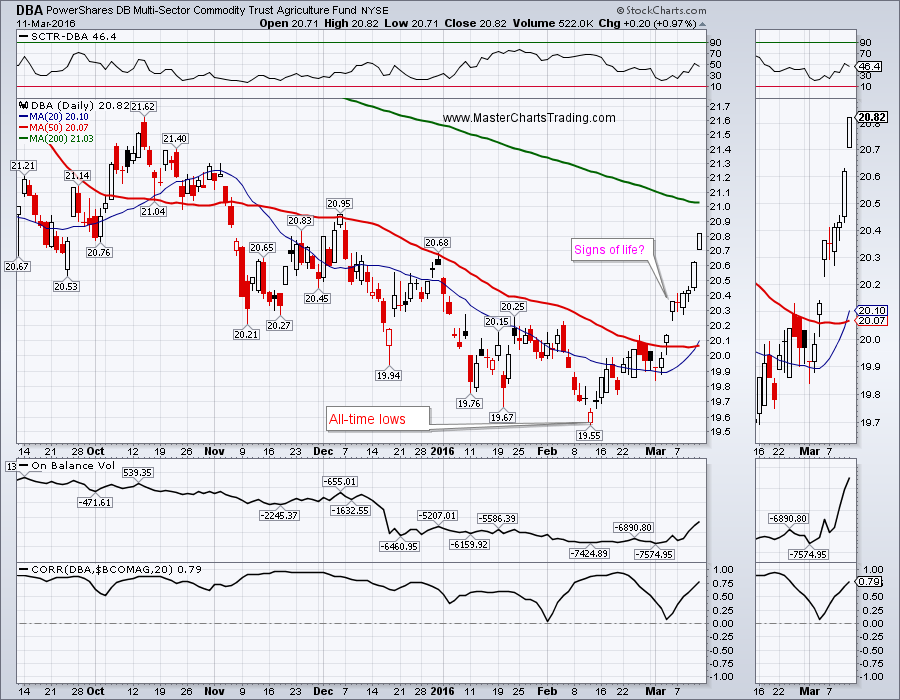

CHART OF DBA

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed