|

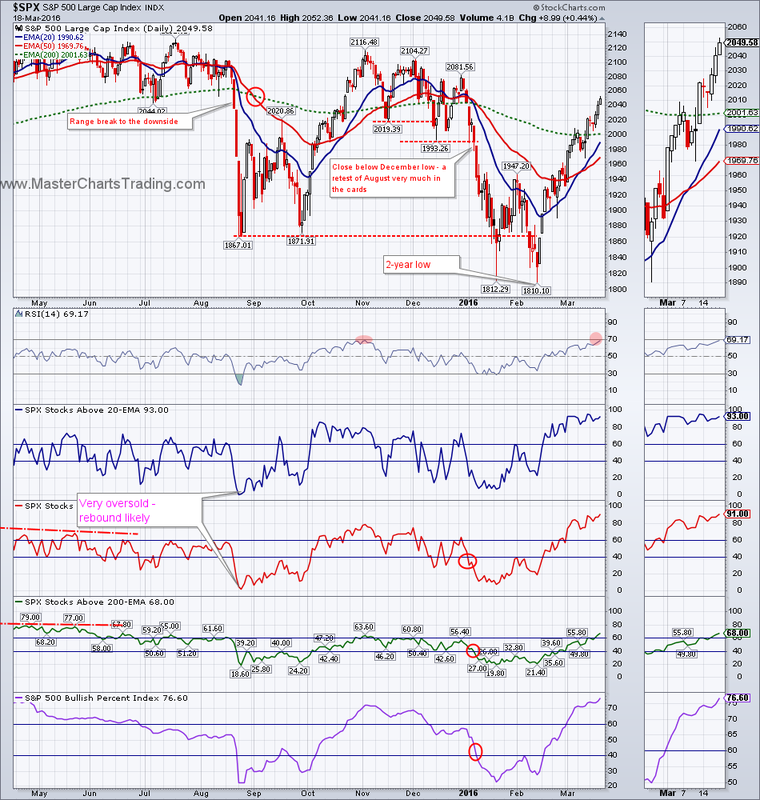

There is no denying it: a stock rally off the 52-week lows set in January of this year is impressive. SPY keeps pushing higher towards the all-time highs set in July of last year. Stocks were able to clear the strong resistance in the $201-$202 area and close above the gap-down from the beginning of this year. Bulls will argue that these are all positive developments.

CHART OF SPY |

|

CHART OF $SPX

Currently we have a very similar picture as $NYA rallied almost 15% off the multi-year lows set in February. Can stocks continue higher? Absolutely! However within the context of the existing and ongoing bear market, stocks could easily roll over with a vengeance and break the January lows.

CHART OF $NYA

CHART OF TLT

LONG-TERM TLT CHART

Diversified bonds fund, AGG, hit all-time highs this Friday, but pulled back. New highs are very bullish and we could expect more highs in the not so distant future.

CHART OF AGG

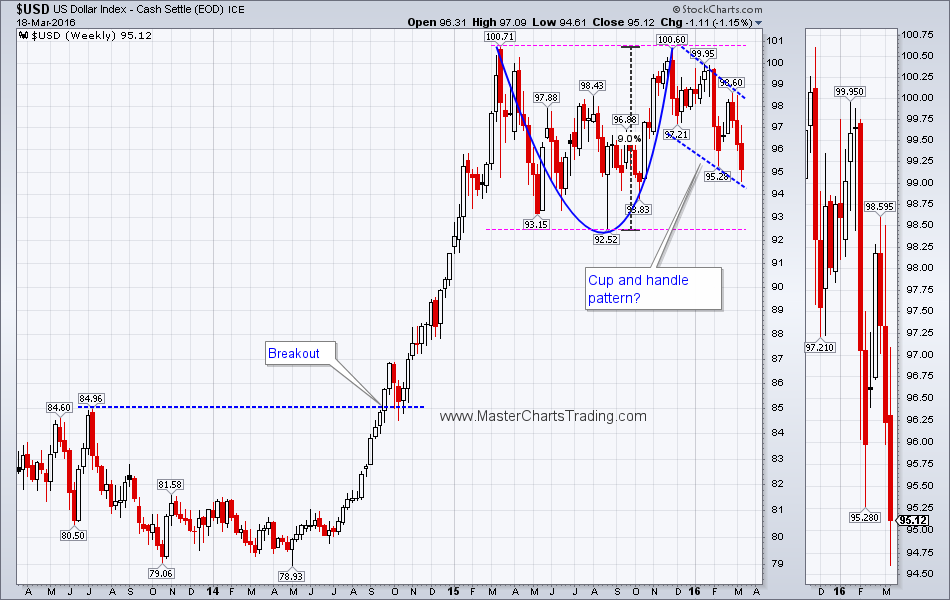

CHART OF $USD

Long-term there could be a cup and handle on the chart of $USD, and a breakout above the 100 level would be quite bullish. An alternative scenario is a push lower to around 92, and a break below it. Should this breakdown occur, it could mean a pull of the $USD back to the 2014 breakout levels around 85.

LONG-TERM CHART OF $USD

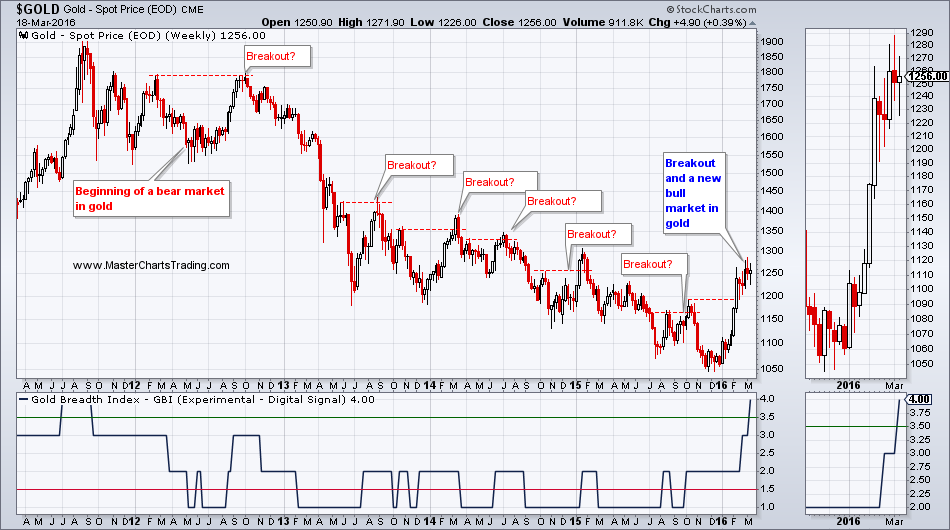

My long-term gold model (GBI) has flipped into a bullish mode.

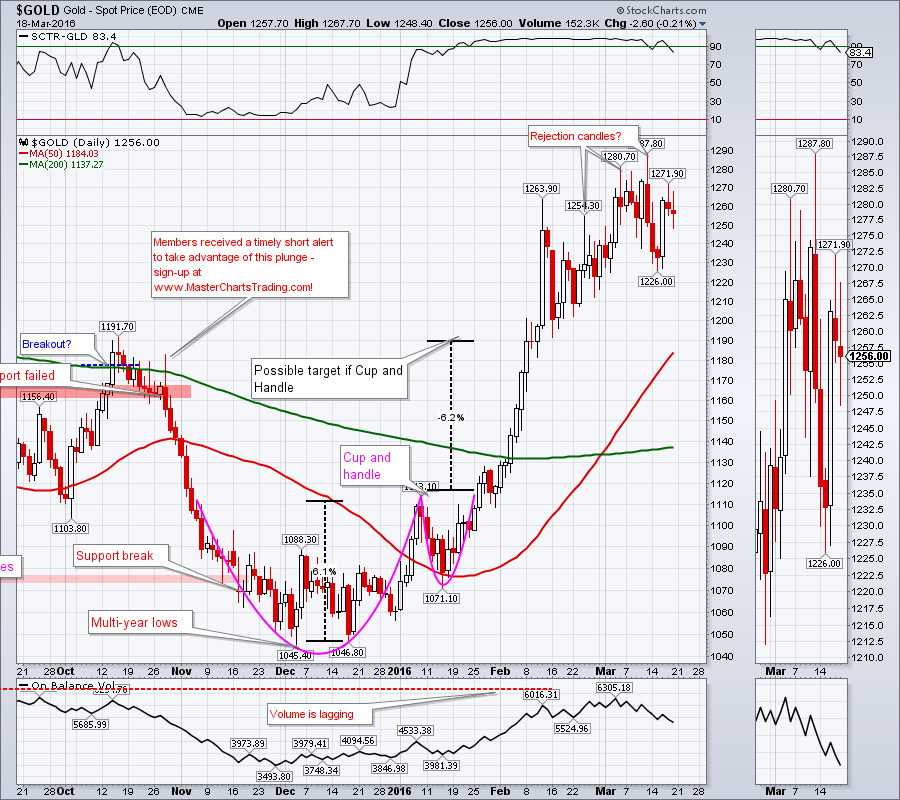

I am now around 90% confident that a new bull market in gold has started. What does it mean in the near future? Currently gold is very overextended to the upside, but it can get even more overextended by pushing above the recent highs. I am not going to be chasing this “once in a blue moon" trend change, but will patiently wait for a pullback and look for bullish setups. Gold may take a few days, a few weeks or a few months to get there, but it will eventually get there. This is synonymous to waiting for the market to come to you and avoiding chasing the market.

GOLD CHART

Even if gold did become bullish in the long-term, a retracement to the Fibonacci levels as pictured in the chart below is very likely. However now this could mean a buying opportunity, rather then a downside target.

1-YEAR WEEKLY CHART OF GOLD

CHART OF GDX

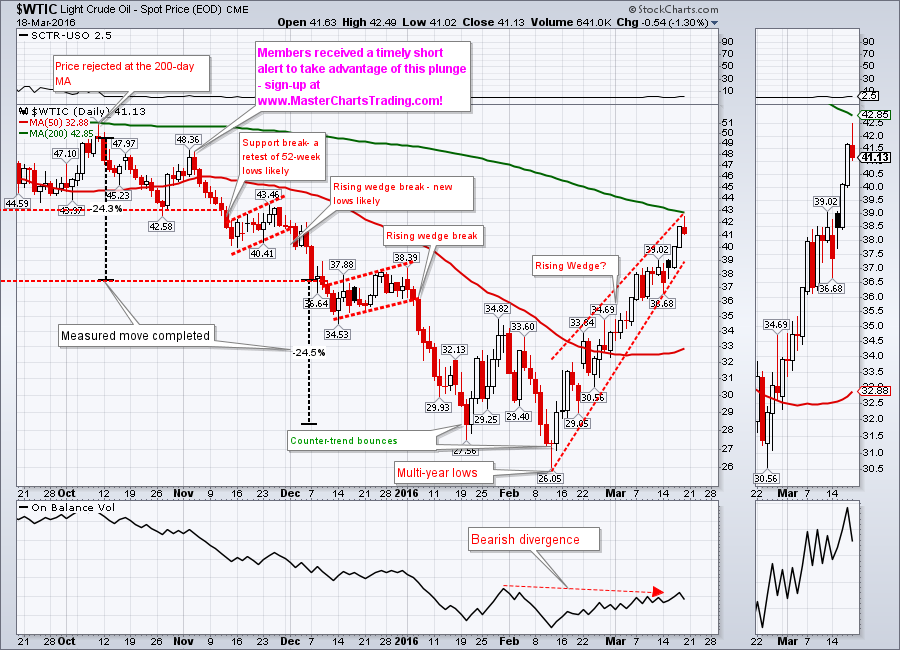

CHART OF $WTIC

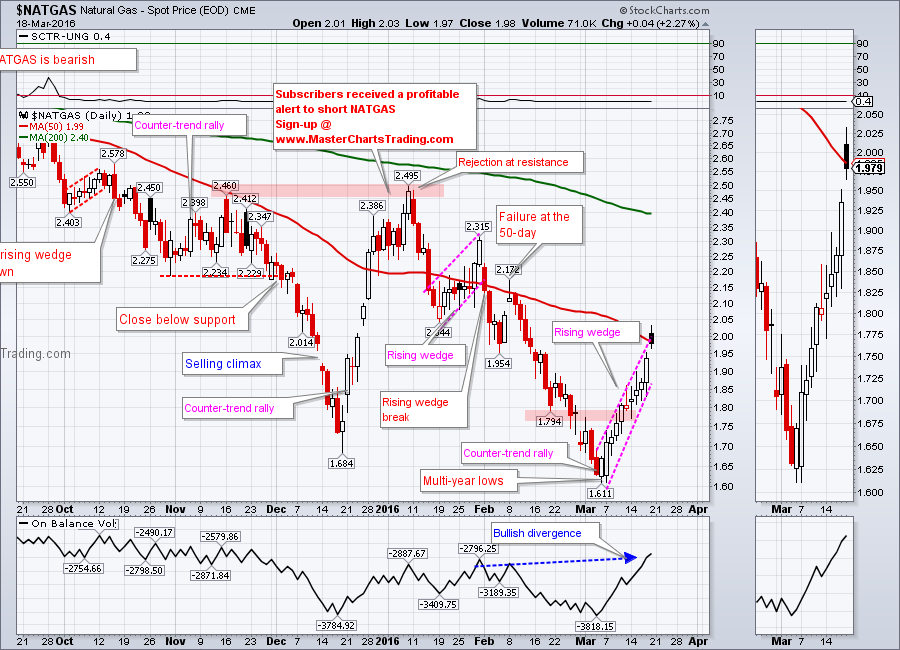

CHART OF NATGAS

CHART OF SUGAR

Trade Alerts Service is now live – please sign-up here!

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed