|

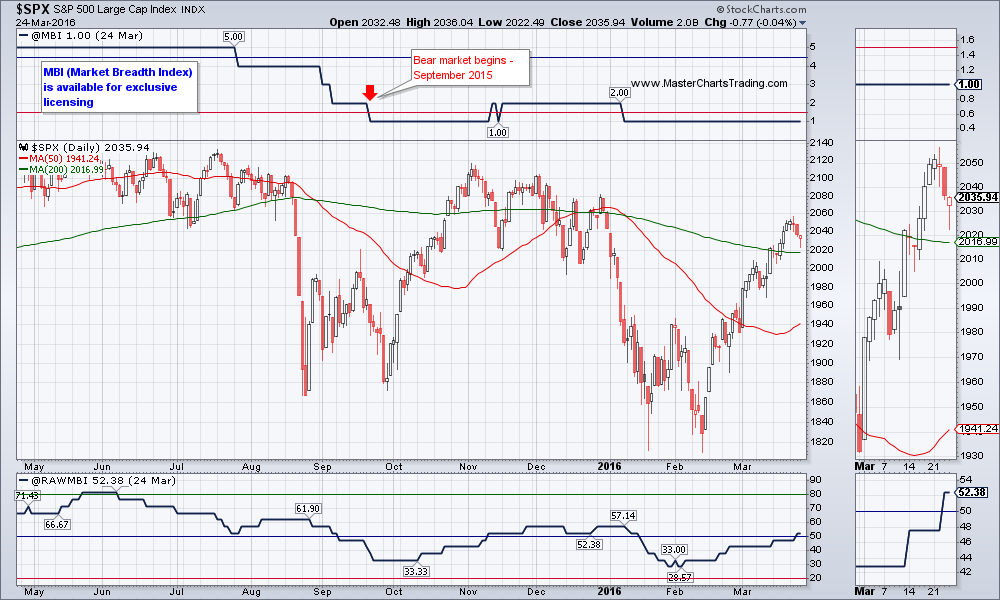

Stocks (SPY) were basically flat for the week, but the resilience of bulls cannot be denied. So far any major attempt by the bears to push the prices lower were met with buyers stepping in. SPY features a giant rising wedge as prices rallied off the 52-week lows in February. The difficulty lies in determining exactly where the trading robots are drawing the invisible lines in the sand we call the trend lines.

|

|

CHART OF SPY

… if we draw using the close-only chart, then the wedge looks like it was broken on Thursday.

CLOSE ONLY CHART OF SPY

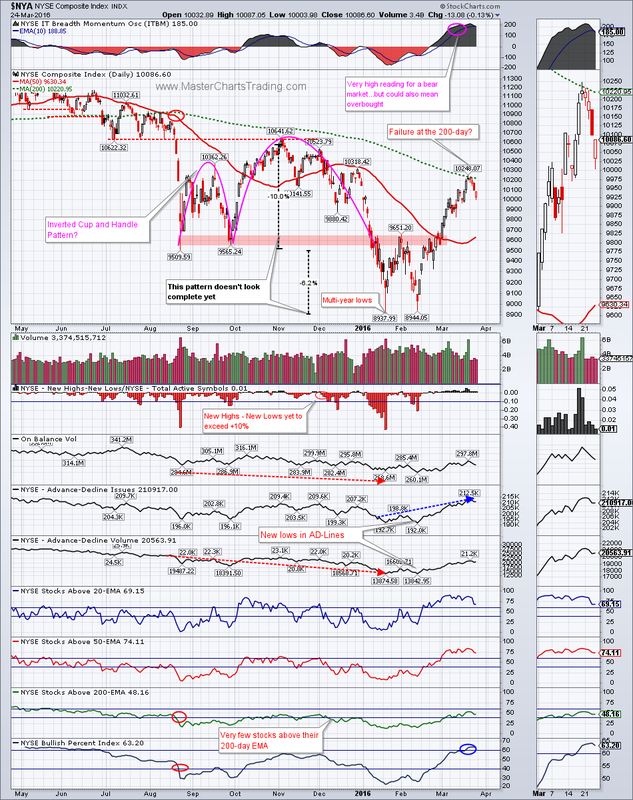

Market breadth did improve significantly from the beginning of the year. Specifically the AD-Line and the Bullish Percent indices for $NYA are now in the bullish territory. But as I have been pointing out, the volume has been lacking on this rally and the percent of stocks above the 200-day exponential moving average for $NYA is still below 50%. This needs to improve further for me to even contemplate a switch in posture from bearish to bullish.

CHART OF $NYA

CHART OF AGG

Long-term AGG is looking rather bullish too. From the chart patterns I can see that AGG could easily move up around 3% or more. Should this come to pass, it would be rather bearish for stocks.

LONG-TERM CHART OF AGG

CHART OF $USD

Long-term $USD needs to break out above 100 or break down below 92 to clarify the picture. A breakout would pressure commodities very strongly, while the breakdown, would help them, gold especially.

LONG-TERM CHART OF $USD

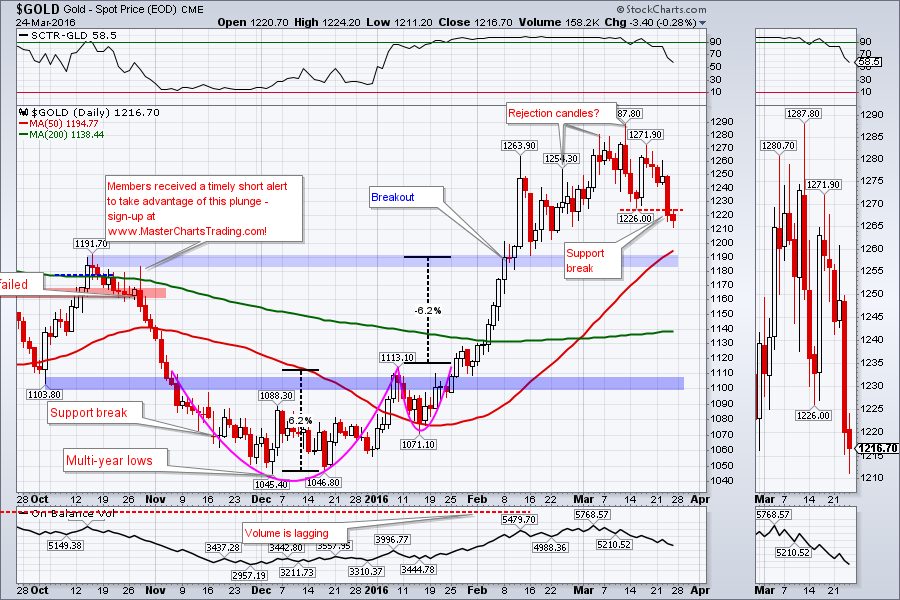

LONG-TERM CHART OF GOLD

This pullback, which is looking like it is going to materialize, is going to be an important test of the validity of this breakout. A failure in the $1800 area, could give way to a trip down to the $1100 area. A failure there may mean that this breakout has failed completely and we would be back to our regularly scheduled bear market in gold.

GOLD CHART

Gold miners are following gold lower over the last two days, but in their usual volatile manner. There are now multiple unfilled gaps on GDX chart. The big question remains which once will get filled first? If gold pulls back, it could be the once down below around $15.5 or even around $13.50. As you can imagine a gap fill in the $13 are would pretty much imply a complete failure of the new bull market in gold.

CHART OF GDX

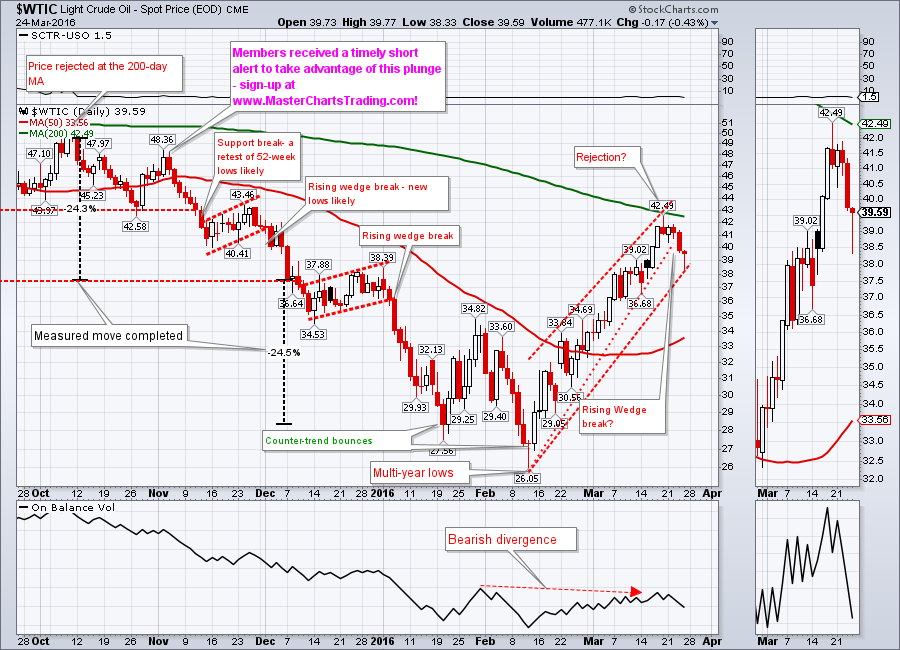

CHART OF $WTIC

CHART OF NATGAS

The 2.50 level is of a particular importance because it is around there that NATGAS failed last September. It is also around 2.50 where the price was rejected in January. Currently there several bullish divergences present on the long-term chart of NATGAS (price made a lower low, but indicators made higher lows).

As of the writing of this blog post, I still consider NATGAS a bearish security and by extension only looking for short setups. Should NATGAS manage to break above 2.50 and hold on a retest my posture would change to a bullish one.

LONG-TERM CHART OF NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed