|

Stocks ended the week touching the 200-day moving average and pulling back from it. Just above, in the $202-$204 area lies a big gap down from the first trading day of this year. This are should now act as resistance. SPY moved over 11% off the 52-week lows set in February, so it’s a no-brainer that it is now overbought. An overbought condition within a bigger downtrend is a recipe for a push lower.

CHART OF SPY |

|

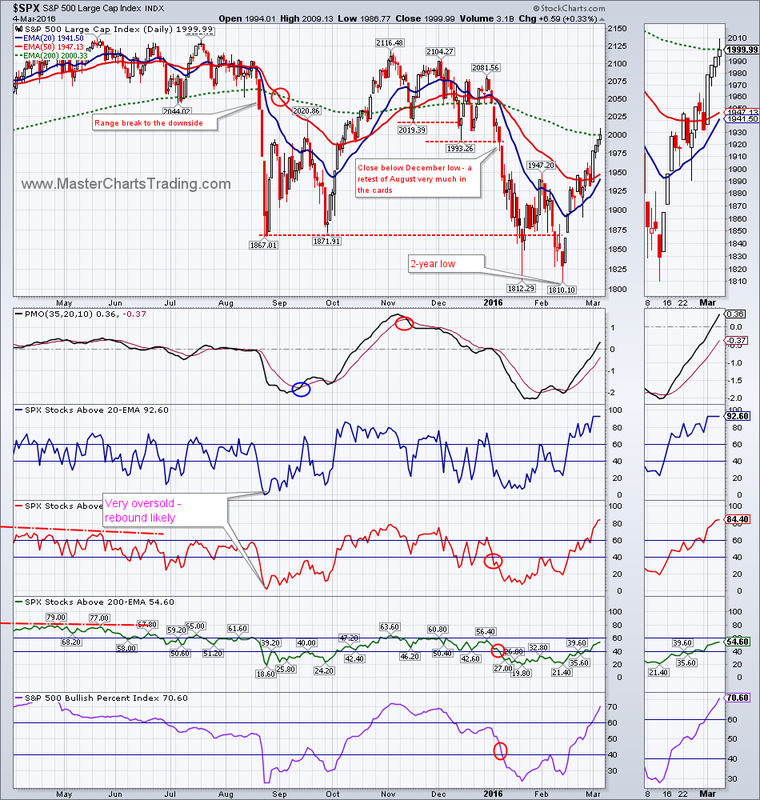

CHART OF $SPX

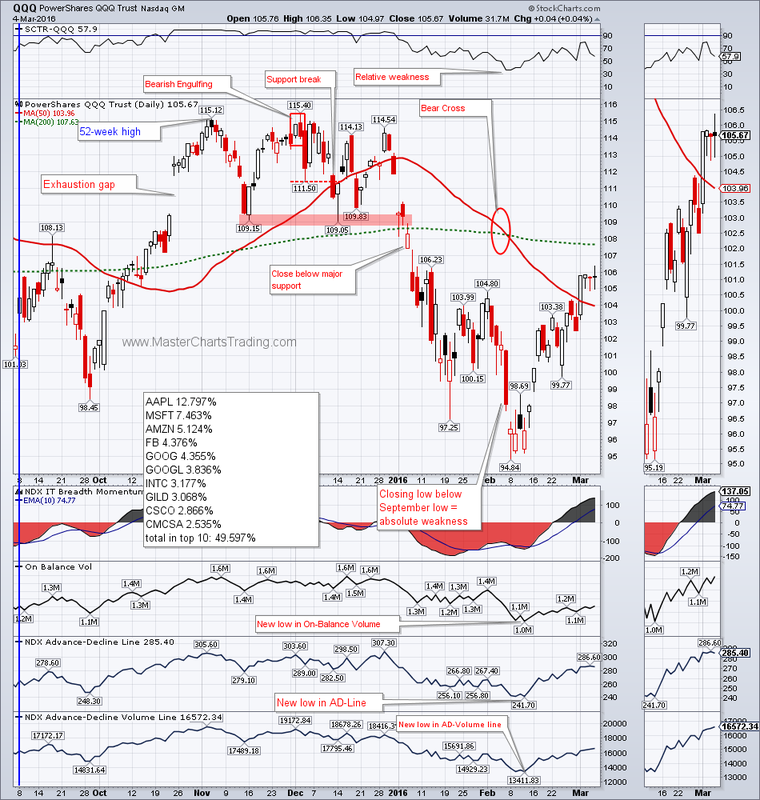

CHART OF QQQ

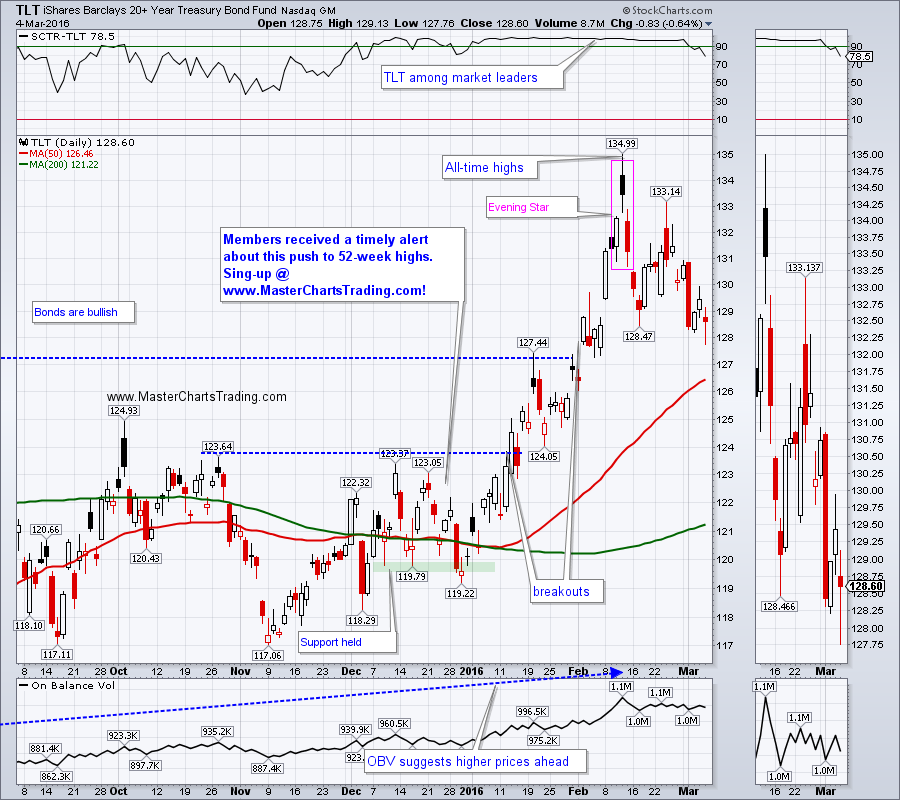

CHART OF TLT

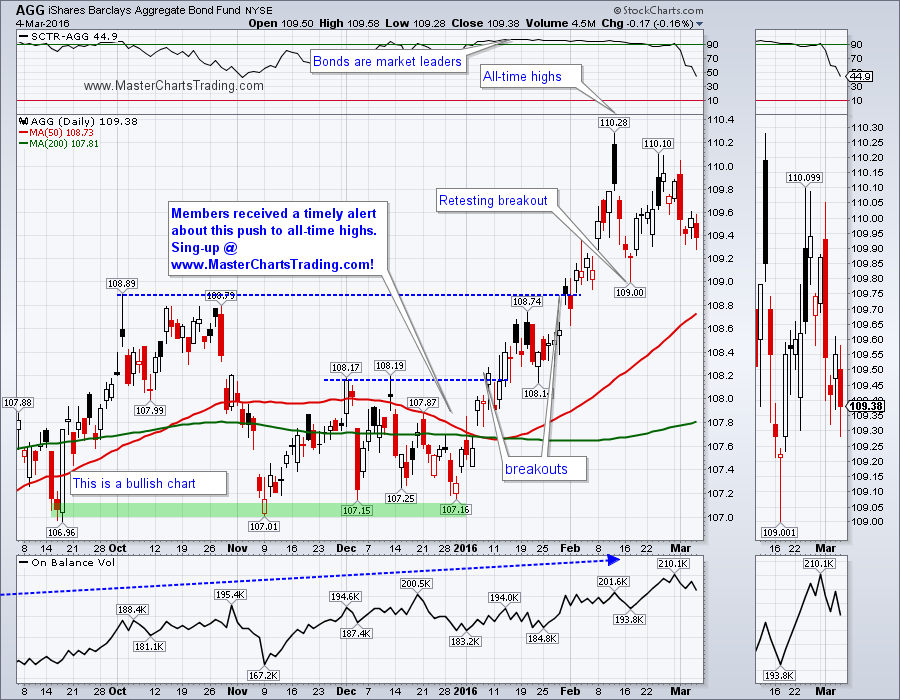

AGG is showing a similar bullish pattern, but looks stronger then TLT. This week, unlike TLT, it did not even come down to the breakout level.

CHART OF AGG

CHART OF MUB

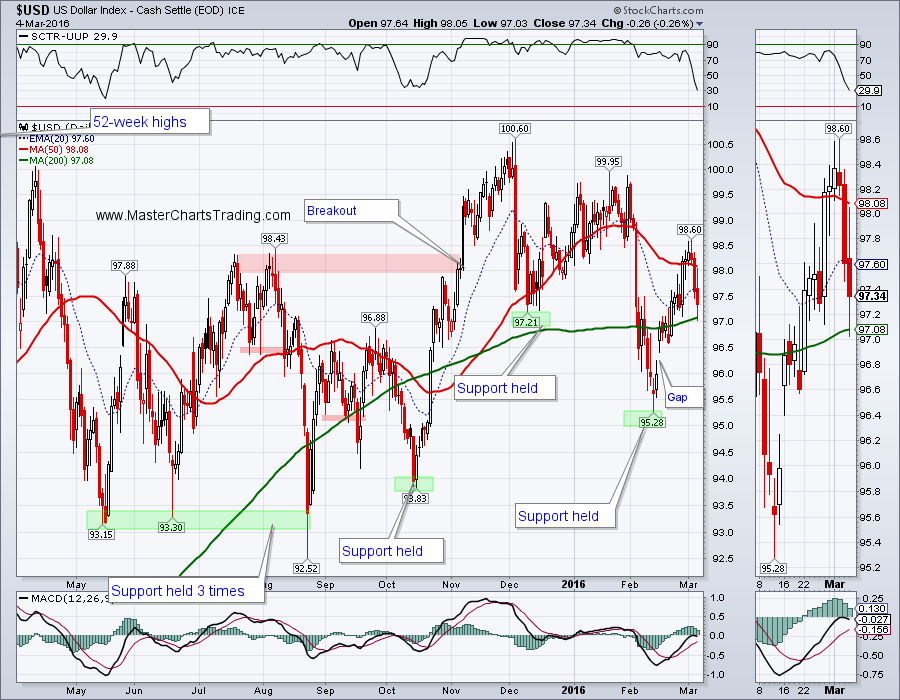

CHART OF $USD

LONG-TERM CHART OF $USD

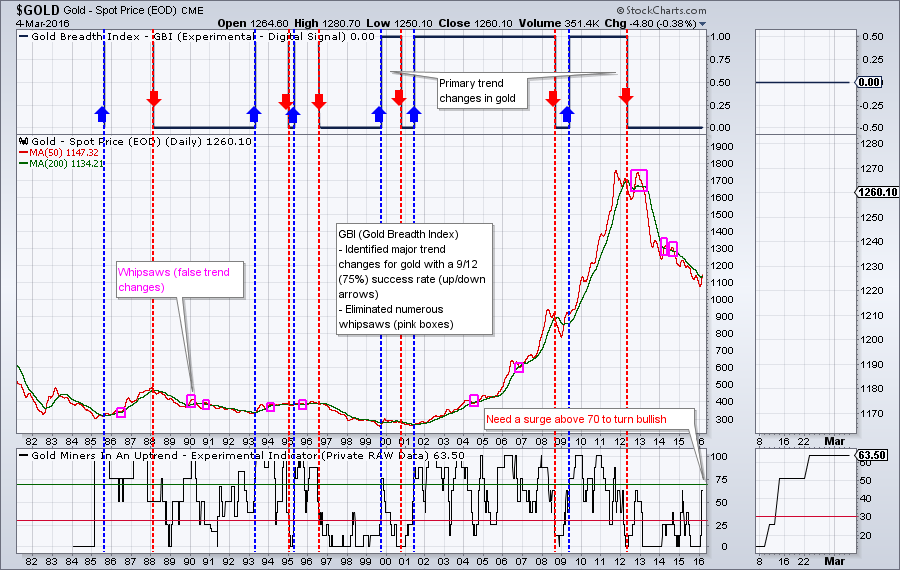

GOLD CHART

One of the more reliable indicators for GDX is a Gold Miners Bullish Percent Index ($BPGDM). $BPGDM has been rising steadily, and now stands at 72.41%. This is an impressive achievement that this indicator hasn’t done since almost the beginning of the bear market in gold back in 2012. We will see if GDX tops out now, or if it continues higher.

CHART OF GDX

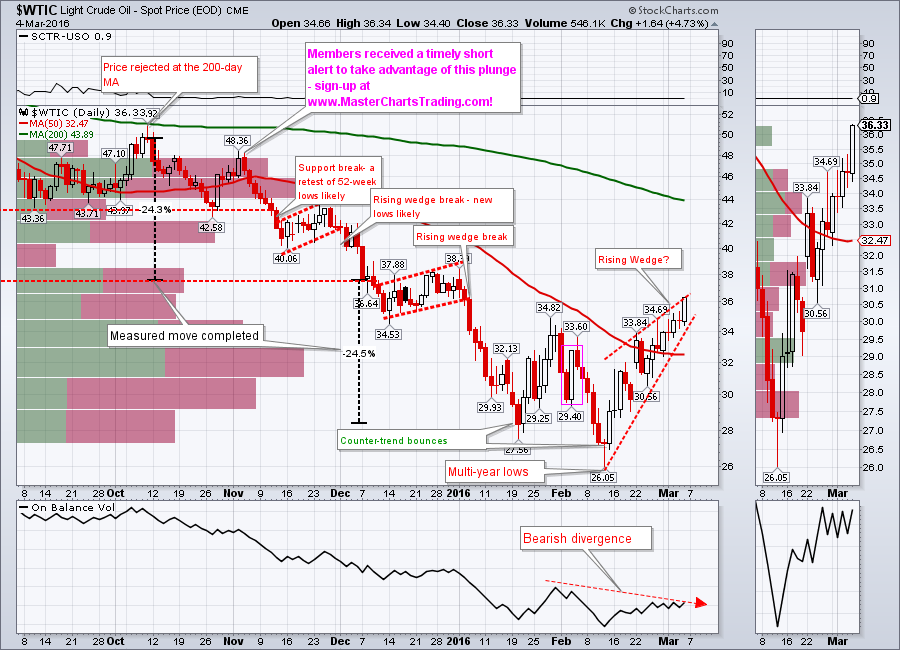

CHART OF $WTIC

CHART OF XLE

There is a slight bullish divergence between the price itself and the On Balance volume indicator. So a bounce now cannot be ruled out as swing traders open long positions. Overall NATGAS is very bearish and I will only be looking at short positions.

CHART OF NATGAS

That’s it for this week’s market recap,

Best Regards and have another great trading week!

Alexander Berger (www.MasterChartsTrading.com)

RSS Feed

RSS Feed